Bridge Report:(7590)Takasho the Fiscal Year January 2020

President Nobuo Takaoka | Takasho Corporation (7590) |

|

Company Information

Exchange | TSE 1st Section |

Industry | Retail (Commerce) |

President | Nobuo Takaoka |

HQ Address | Minami Akasaka 20-1, Kainan-shi, Wakayama-ken |

Year-end | January 20 |

Homepage |

Stock Information

Share Price | Share Outstanding (exc. Treasury Stock) | Market Cap. | ROE (Act.) | Trading Unit | |

¥483 | 14,578,329 shares | ¥7,041 million | 2.4% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥10.00 | 2.1% | ¥20.58 | 23.5 x | ¥590.37 | 0.8 x |

*Stock price as of closing on March 27, 2020. Number of shares issued at the end of the most recent quarter excluding treasury shares.

*ROE and BPS are based on FY January 2020’s results. EPS is the forecast for FY January 2021. The data is rounded off.

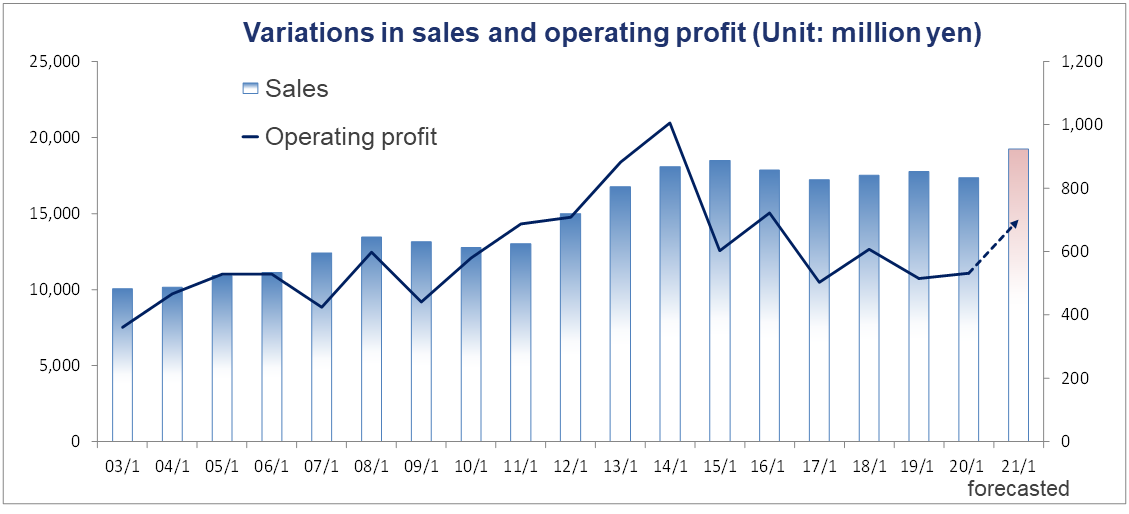

Consolidated Earnings Trends

Fiscal Year | Sales | Operating Profit | Current Profit | Net Profit | EPS (¥) | DPS (¥) |

January 2016 | 17,853 | 722 | 597 | 240 | 19.63 | 17.00 |

January 2017 | 17,223 | 503 | 322 | 152 | 12.39 | 6.00 |

January 2018 | 17,489 | 607 | 571 | 228 | 18.59 | 10.00 |

January 2019 | 17,759 | 514 | 333 | 338 | 25.04 | 10.00 |

January 2020 | 17,357 | 531 | 469 | 203 | 13.93 | 10.00 |

January 2021 Est. | 19,145 | 700 | 578 | 300 | 20.58 | 10.00 |

*Estimates are those of the Company.

*Unit: million yen

We present this Bridge Report along with the earnings results for fiscal year January 2020.

Table of Contents

Key Point

1. Company Overview

2. Business Development

3. Fiscal year January 2020 Earnings Results

4. Fiscal year January 2021 Earnings Forecasts

5. Future Business Development and Medium/Long-Term Plan

6. Conclusion

<Reference: Concerning Corporate Governance>

Key Point

- For the fiscal year January 2020, sales declined 2.3% year on year while current profit augmented 40.6% year on year. In Japan, sales increased in the professional use segment due to the steady sales of large exterior products, while the sales in the home use segment decreased due to the impact of natural disasters, etc. Outside Japan, the home use segment focused on online sales and the professional use segment performed well in conjunction with the home use segment, but restructuring of the sales system in Europe caused sales to drop. With regard to profit, the company established an integrated manufacturing and sales system and increased the ratio of its original products to deal with the increased cost of sales due to exchange rate fluctuations. As for SG&A expenses, liquidation costs of unprofitable subsidiaries dropped. As for non-operating profit, foreign exchange losses were significantly reduced.

- Sales and current profit are expected to rise 10.3% and 23.2% year on year, respectively, in the fiscal year January 2021. In Japan, the company will enhance sales activities and merge manufacturing subsidiaries to expand facilities of the manufacturing division and improve productivity, and strengthen sales of gardening and exterior products further. Outside Japan, the company will release new original products mainly in Europe. As approx. 70% of sales come from the professional use business, which provides products from its own factories in Japan, the impact of the novel coronavirus is expected to be minor. The company’s factories in China resumed operations at 75% of capacity on February 17 and returned to the normal production on March 9.

- The fiscal year January 2020 was also a year of rebuilding through the integration of manufacturing subsidiaries in Japan and the restructuring of the sales system outside Japan. Under such circumstances, the company is also enhancing the production systems inside and outside Japan for future growth. People are more likely to be infected with the novel coronavirus, which is spreading worldwide, in closed rooms. For this reason, the value of the liberal garden “5th ROOM” will be significant. The potential for the company to expand its activities around the world has emerged. If the company achieves its medium-term plan, EPS is expected to be 44 yen in the fiscal year January 2023 and 77 yen in the fiscal year January 2025. The PBR of the company’s stock is well below 1, so there is room to reconsider the stock price. We would also like to pay attention to the garden’s presence in the world in the future.

1. Company Overview

Takasho Corporation maintains a basic business concept of contributing to the “Creation of comfortable spaces” and manufactures and sells artificial and natural wooden fences, garden furniture, greenery materials, and other gardening related products and materials. The company also handles lighting equipment such as LED (Light-emitting diode), water gardens such as ponds, waterfalls and fountains and spot gardens. In the aftermath of the Second World War, Takasho changed its business style from sales of gardening materials to a gardening business, and then to a comprehensive lifestyle business, growing as a lifestyle maker that proposes better lifestyles with gardens. Its vision is to create mental and physical health and happy family lifestyles that bring smiles to the people. Takasho always forecasts future changes to accurately create new value that matches the market’s needs, and pursues its goal of becoming the “only global company” contributing broadly to gardening culture in urban environments. Its mission is “to be a company that provides better lifestyles globally through gardens.” The Takasho Group manufactures products in Japan and China for sale in Japan, Europe, Asia, Oceania and the United States. The Group’s integrated structure with the ability to plan, manufacture and sell products has allowed it to become the leading company within the “gardening market,” which is growing to become a firmly established market in Japan. Takasho maintains 5 domestic and 10 overseas subsidiaries. The Company listed its shares on the JASDAQ market in September 1980, and after a capital increase in 2012 and 2013, moved its shares to the Second Section of the Tokyo Stock Exchange on October 19, 2017, and to the First Section of the Tokyo Stock Exchange on July 9, 2018.

Company Overview

Date of establishment | August 1980 |

Listing date | September 1998 (JASDAQ) October 2017 Second Section market of the Tokyo Stock Exchange July 2018 First Section market of the Tokyo Stock Exchange |

Capital | ¥182,086 million yen |

Domestic consolidated subsidiaries | 5 subsidiaries |

Overseas consolidated subsidiaries | 10 subsidiaries (UK, US, Germany, Australia, India and China)) |

Number of employees | 760 employees(consolidated) |

Corporate Mission

(Taken from the material of the company)

<Business segments>

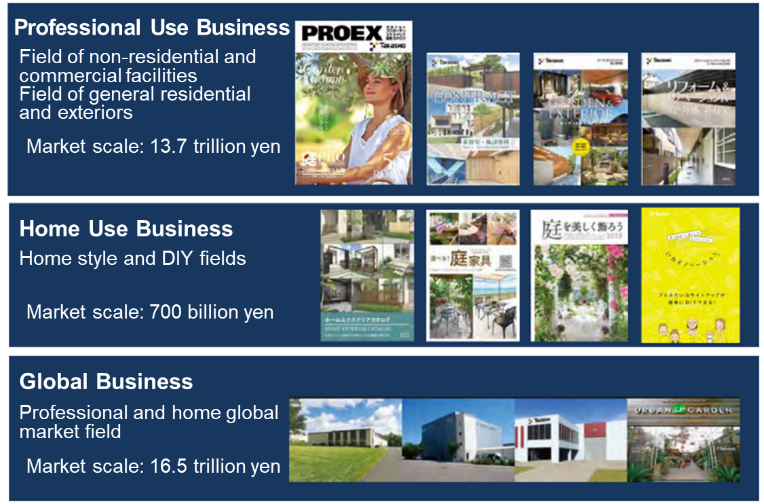

Takasho’s business unit can be divided into three sales routes of “professional use business” products used by home builders and midsized construction companies, “home use business” products sold to home improvement centers on a wholesale basis for use by general consumers and “global business.” Amidst the steady increase in sales, the professional use segment has also seen growth in the past few years. The sales in the professional use business have doubled in the past 10 years.

(Taken from the material of the company)

2. Business development

2-1 Professional use business

“Professional use” products are products sold primarily through Takasho’s “PROEX” catalog, which is the industry’s largest catalog with approximately 250,000 copies printed and distributed by direct mail to gardening and landscaping companies, architects and designers, construction companies specializing in exterior construction, commercial facilities and other users. Pictures of actual gardens using Takasho’s products are included in the catalogs, and customers can fill in diagrams provided within the catalogs to order products they want to use in actual landscapes and facilities they are creating. Customers send these diagrams by fax or email to Takasho. In turn, Takasho will then create image diagrams using CAD and CG technologies to be returned to customers along with estimates within the same day to show what the gardens and landscapes they are creating look like using Takasho products and how much they will cost.

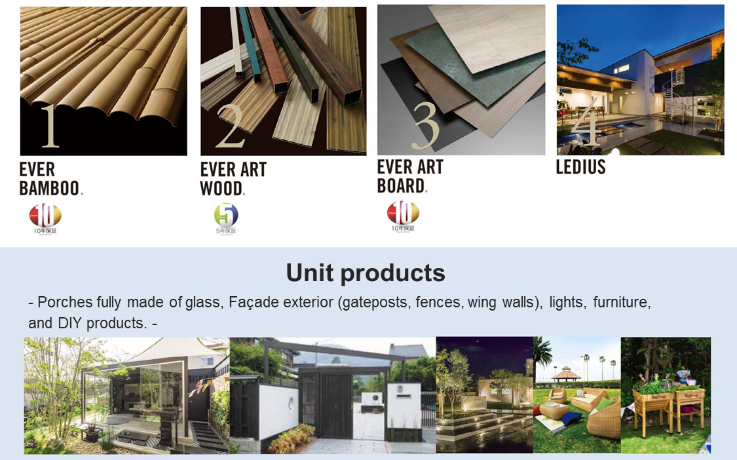

Product Strategy

In its collaborative endeavors with house builders, Takasho’s “Ever Art Wood” has come to be highly regarded and the number of its products listed in major housing manufacturers’ exterior and gardening catalogs is increasing. In addition, the Company proposes the “5th ROOM” concept (a proposal of the garden to play the role as the fifth room in homes in addition to living rooms, dining rooms and bedrooms). Its sales strategy is to provide customers’ life styles through mass (volume sales) and customization (addressing customers’ needs).

(Taken from the materials of the company)

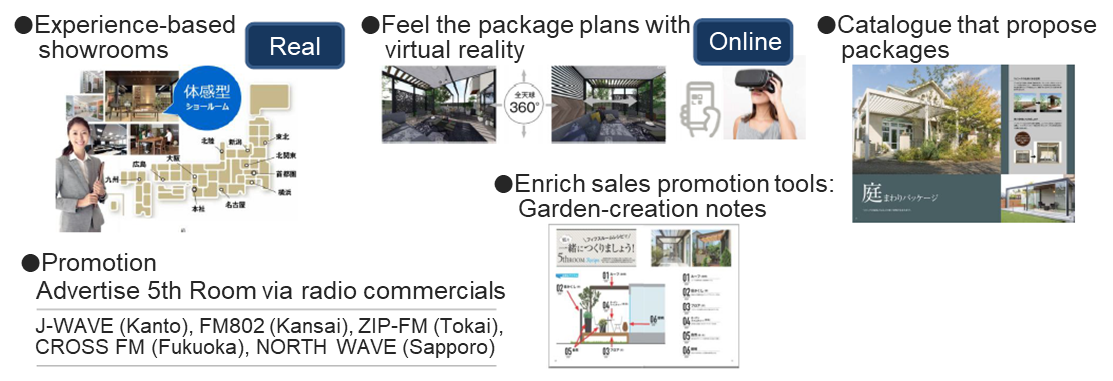

Enhancing the proposal of "5th ROOM" to connect to housing

(Taken from the materials of the company)

The company proposed GEMS (Garden energy management system) as a new initiative. It is a system that makes a garden more comfortable, not only with lighting but also with acoustics, cameras, and air conditioning.

(Taken from the materials of the company)

In addition to the garden, the company will position the exterior and contract as the main axis of the product, and introduce the product to new construction, remodeling, and renovation.

Sales channels that are used simultaneously are real (catalog) and the internet (web tools). Free estimates and other services are provided by using information technology and web services, which also help draw customers to showrooms across the country. There is a new showroom established in Osaka.

The company is focusing on exteriors (new construction), gardens (proposals for living in the garden), and contracts (building materials for the non-residential market, exteriors). Under the unique idea that "a garden is an enclosed paradise. If there is nothing to enclose, a garden cannot be established", the company considers this enclosure to be an exterior, and are promoting product development that emphasizes the uniqueness of Takasho. Moreover, 100% use of LED for outdoor lighting was achieved in October 2014. Furthermore, the awarding of "Takasho Low Voltage Light System" with the "Best Selection Award" in the fourth award event hosted by the HEAD (Study Group on Home Environment and Advanced Design) contributed to an increase in consumer awareness of these products.

The contract (non-residential building materials and exterior siding) realm focuses upon the landscape construction materials business. Takasho is also expected to implement efforts to fortify its "Ever Art Wood" and "Ever Bamboo" product lineup. ("Ever Art Wood" has received certification from the Ministry of Land, Infrastructure, Transportation and Tourism as a fire proof material, and can be used in both exterior and interior applications.) The Company provides total packages comprised of extensive product combinations that appropriately match various garden environments for exteriors and interiors of various facilities, and it boasts of experiences in delivering a multitude of packages across the country.

While promoting a “mass/customization” strategy to offer volume sales and meet customer needs, it is also promoting the packages of ready-to-install exterior products

Japanese owned Factory

The professional use products are manufactured in Japan. Garden Create in Kainan city, Wakayama prefecture, introduced an inkjet printer and is planning for expansion in the future. At Garden Create Kanto in Kanuma city, Tochigi prefecture, an automatic wrapping machine was installed.

(Taken from the materials of the company)

Moreover, the "Reform Gardening Club," which aims to become a group of professionals, seeks to increase communication between distributors and construction services providers. Certification systems such as "Exterior and Garden Meister System," "Water Garden Meister System" and "Garden Lighting Meister System" were also established. The number of people certified by the Lighting Meister course exceeded 5,000 in March 2017. The "Garden Therapy Coordinator" certification system was newly established, and a seminar for this certification system was held in November 2017.

Activities for rejuvenating the industry are also going well. Visitors to Takasho's Garden and Exterior Fair, an exhibition aiming at presenting next term's product policies for its clients, is held in July annually and has been successful. Last year, it was held on July 25 and 26. The Company also actively supports its network of construction companies. The number of the Takasho Reform Garden Club member companies exceeded 700.

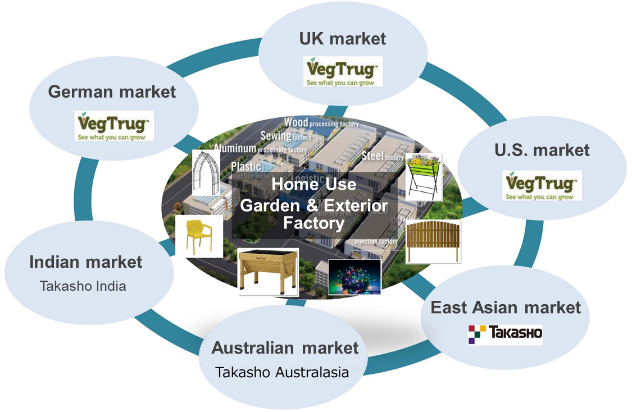

2-2 Home Use Business / Global Business

The business in the home use segment is expanding globally. Products are manufactured in Jiujiang, China, and the Company sell them in Japan and overseas. A new factory of about 16,528 square meter will be set up. As for the sales route, the Company is exploring a brand strategy using both online and traditional retail stores.

Raising the utilization rate of the company’s factories in China is an issue. The company started selling “Bi-WOOD,” which is made of aluminum.

Home Use Business Strategy – Strengthening of products manufactured in the company’s factories

(Taken from the material of the company)

Sales are expanding across a wide geographic region. Efforts have been made to fortify sales within the United States market, along with the establishment of "VegTrug USA" in February 2015, which has been fully funded by its wholly owned sales subsidiary (VegTrug) in the United Kingdom. At the same time, a new showroom was established in Vietnam in May 2016. It also established a subsidiary in India where a promising market exists. In addition to these regions, the Company also conducts business in Germany, Australia and Korea. In order to pursue its worldwide business expansion, it is said that Takasho needs to establish sales subsidiaries in countries with large markets like the United Kingdom, where gardening is estimated to amount to ¥4 trillion (compared with the Japanese market at only ¥600.0 billion).

The operation of a global site called "VegTrug.com" has been started.

(Taken from the material of the company)

3. Fiscal Year January 2020 Earnings Results

3-1 Consolidated Earnings

| FY Jan. 19 | Ratio to sales | FY Jan. 20 | Ratio to sales | YY Change | Initial Forecast | Divergence |

Sales | 17,759 | 100.0% | 17,357 | 100.0% | -2.3% | 18,634 | -6.8% |

Gross Profit | 7,680 | 43.2% | 7,547 | 43.5% | -1.7% | 7,939 | -4.9% |

SG&A | 7,166 | 40.4% | 7,015 | 40.4% | -2.1% | 7,291 | -3.8% |

Operating Profit | 514 | 2.9% | 531 | 3.1% | +3.3% | 648 | -18.0% |

Current Profit | 333 | 1.9% | 469 | 2.7% | +40.6% | 542 | -13.4% |

Net Profit | 338 | 1.9% | 203 | 1.2% | -40.0% | 372 | -45.4% |

*Unit: million yen

*The figures include figures calculated by Investment Bridge Co., Ltd. as reference values, so they may differ from actual figures (the same shall apply hereinafter).

Sales dropped 2.3% year on year and current profit rose 40.6% year on year.

Sales were 17,357 million yen, down 2.3% year on year.

In Japan, the sales of large exterior products produced from “Ever Art Wood,” an artificial wood made of aluminum, and “Ever Art Board,” a decorative exterior building material that is atmospheric and reproduces natural materials such as wood, stone, painted walls and Japanese style, were steady, resulting in larger sales in the professional use segment. The company also promoted the packaging of “5th ROOM”-type unit products and exteriors to eliminate the labor shortage at worksites through “mass customization,” which allows manufacturing and provision of products in accordance with on-site needs. In addition, it focused on the development of a system that enables the simultaneous provision of proposals for a house and its garden, including exterior and garden designs at the time of architectural drafting. Furthermore, the company enhanced its own manufacturing facilities for “Ever Art Wood,” an artificial wood made of aluminum, and “Ever Art Board,” an aluminum composite board, in an effort to expand sales.

In the home use segment, the sales of gardening-related products were sluggish due to the impact of natural disasters such as typhoons and heavy rainfalls, despite a spike in demand before the consumption tax hike. Also, some products were sold directly to domestic customers by Jiangxi Gaoxiu Import-Export Trade Co., Ltd., a Chinese company of the Group, which caused sales to decline.

Outside Japan, in the home use segment, the company’s sales subsidiaries focused on online sales by providing garden-living and VegTrug gardening products. As for the professional use segment, sales were steady due to the linkage with the home use segment. However, sales decreased due to a delay in the transfer process associated with the restructuring of the sales system in Europe and a slowdown in sales in the U.S

Operating profit increased 3.3% year on year to 531 million yen.

With regard to profit, the company established a system integrating planning, manufacturing and sales at global companies to increase the ratio of its own products to deal with the increased costs of sales resulting from exchange rate fluctuations. Furthermore, the gross profit margin of overseas subsidiaries stabilized, which helped curtail costs. SG&A expenses rose due to the hiring of human resources for enhancement of sales capacity and production volume, higher freight charges, system replacement owing to aging servers, etc., but operating profit grew as costs for liquidation of unprofitable subsidiaries decreased. In non-operating expenses, foreign exchange losses declined significantly from the previous term due to exchange rate fluctuations, which caused current profit to augment 40.6% year on year to 469 million yen. Profit attributable to owners of parent dropped 40.0% year on year to 203 million yen due to the liquidation of subsidiaries and reversal of deferred tax assets.

In the domestic gardening industry, the number of new houses under construction has been recovering slowly but declined from the previous year, despite the support of various policies. While the recovery from natural disasters such as typhoons and heavy rainfalls is coming to an end, the demand and supply of construction materials and labor remain uncertain.

Under these circumstances, the Group expanded the range of new products, such as “SMART LIVING GARDEN,” which focuses on safety and energy and electricity conservation in the garden, and “GARDEN THERAPY,” which focuses on gardens that make families smile and healthy, based on the concept of “5th ROOM,” where a garden is the 5th room in the house, to allow people to live in a comfortable garden where they can enjoy nature and the seasons.

In addition, the company enhanced the production system as it merged three domestic manufacturing subsidiaries (Garden Create Co., Ltd., Tokushima Garden Create Co., Ltd., and Garden Create Kanto Corporation) on July 21 and expanded Tochigi Factory for a stable supply of products while newly building Wakayama Factory and increasing manufacturing facilities.

In the global business, the company expanded the factories (new factory are 18,000 m2; total factory are 88,000 m2) of the Chinese subsidiary Jiujiang Gaoxiu Gardening Product Co., Ltd. to increase sales from its wholly-owned global sales subsidiaries, and started the full-scale production of new products. Through the expansion and strengthening of these supply systems, it became possible to provide a stable supply to the world while maintaining the quality of Japanese products, allowing VegTrug Limited, whose headquarter is located in the United Kingdom, and other overseas sales subsidiaries to expand sales of gardening materials based on garden-living products, VegTrug gardening products, etc. to home improvement stores and garden centers in Europe, the U.S., and Australia.

3-2 Trend by Segment

Sales by Segment

| FY Jan. 19 | Ratio to sales | FY Jan. 20 | Ratio to sales | YY Change |

Japan | 15,410 | 86.8% | 15,495 | 89.3% | +0.6% |

Europe | 864 | 4.9% | 438 | 2.5% | -49.3% |

China | 866 | 4.9% | 894 | 5.2% | +3.2% |

Korea | 98 | 0.6% | 120 | 0.7% | +23.0% |

US | 348 | 2.0% | 268 | 1.5% | -22.9% |

Others | 170 | 1.0% | 139 | 0.8% | -18.1% |

Total Consolidated Sales | 17,759 | 100.0% | 17,357 | 100.0% | -2.3% |

Japan | 508 | 117.8% | 569 | 149.8% | +11.8% |

Europe | -244 | - | -329 | - | - |

China | 192 | 44.6% | 188 | 49.6% | -2.1% |

Korea | -33 | - | -22 | - | - |

US | 1 | 0.3% | -14 | - | - |

Others | 7 | 1.7% | -11 | - | - |

Consolidated Adjustments | 82 | - | 151 | - | - |

Consolidated Operating Profit | 514 | 100.0% | 531 | 100.0% | +3.3% |

*Unit: million yen

Japan

Sales rose 0.6% year on year to 15,495 million yen and segment profit increased 11.8% year on year to 569 million yen. New products were released to increase sales in the home use segment. However, sales declined as the company shifted to direct transactions between overseas subsidiaries and clients with the aim to reduce the foreign exchange risk. On the other hand, the sales of new products including “Ever Art Wood” and “Ever Art Board” were steady, while the sales in the professional use segment grew due to the use of “Ever Art Wood” as a building material. Profit also grew as the company was able to control the rise in costs of sales due to exchange rate fluctuations and reduce SG&A expenses significantly from the previous term.

Europe

Sales were 438 million yen, down 49.3% year on year, and segment loss amounted to 329 million yen (a loss of 244 million yen in the previous term). Sales decreased owing to the impact of the commencement of liquidation proceedings for a sales subsidiary in Germany, Brexit, market confusion caused by the consolidation of major home improvement stores, etc. On the profit front, sales declined, investments were made in facilities (expansion of offices and warehouses) to increase sales of the sales subsidiary in the U.K., and there was a temporary expense for the liquidation of the German sales subsidiary.

China

Sales were 894 million yen, up 3.2% year on year. Segment profit dropped 2.1% year on year to 188 million yen. The transfer of trade areas from the parent company and the increase of the ratio of the company’s own products increased sales. Despite the increase in sales, profit declined slightly due as depreciation rose as a result of new investments in production facilities.

Korea

Sales rose 23.0% year on year to 120 million yen, while segment loss amounted to 22 million yen (a loss of 33 million yen in the previous term). Sales increased as a larger number of items were introduced to home improvement stores and the sales of exterior related products to the regional builder were steady. On the profit front, the company’s loss shrank thanks to the increases in sales, etc.

United States

Sales were 268 million yen, down 22.9% year on year, and segment loss was 14 million yen (a profit of one million yen in the previous term). Despite efforts to open new accounts with large home improvement stores and expand transactions with mail-order companies, sales dropped due to the impact of trade friction between the U.S. and China. The business fell into the red as sales declined.

Others

Sales dropped 18.1% year on year to 139 million yen and segment loss was 11 million yen (a profit of 7 million yen in the previous term). The sluggish market environment and the lack of sales growth of newly established sales subsidiaries resulted in decreased sales. As for profit, the company posted a loss due to sluggish sales and higher expenses for strengthening human resources and expanding warehouses for the future sales growth.

3-3 Financial Conditions and Cash Flow

Balance Sheet Summary

| Jan. 19 | Jan. 20 |

| Jan. 19 | Jan. 20 |

Cash, Equivalents | 3,210 | 2,790 | Payables | 3,049 | 2,872 |

Receivables | 3,187 | 2,868 | Short Term Interest Bearing Liabilities | 5,326 | 5,167 |

Inventories | 4,877 | 4,778 | Current Liabilities | 9,720 | 9,282 |

Current Assets | 11,999 | 11,099 | Long Term Interest Bearing Liabilities | 379 | 437 |

Tangible Assets | 5,127 | 5,683 | Noncurrent Liabilities | 557 | 657 |

Intangible Assets | 335 | 331 | Net Assets | 8,581 | 8,693 |

Securities, Other Investments | 1,398 | 1,519 | Total Liabilities, Net Assets | 18,859 | 18,634 |

Noncurrent Assets | 6,860 | 7,534 | Total Interest Bearing Liabilities | 5,706 | 5,605 |

*Unit: million yen

*Interest Bearing Liabilities = Debt + Bonds + Leases

The current assets at the end of the fiscal year January 2020 were 11,099 million yen, down 899 million from the end of the previous term. The main factors included cash and deposits of 2,790 million yen (down 420 million from the end of the previous term), notes and accounts receivable of 2,299 million yen (down 323 million yen from the end of the previous term), and inventory assets of 3,279 million yen (down 230 million yen from the end of the previous term).

Noncurrent assets rose 673 million yen from the end of the previous term to 7,534 million yen. The main factors included building and structures of 3,178 million yen (up 196 million yen from the end of the previous term) that increased due to the expansion of factories in Japan, and lease assets of 428 million yen (up 294 million yen from the end of the previous term) which increased through the adoption of new accounting standards.

As a result, total assets dropped 225 million yen from the end of the previous term to 18,634 million yen.

Current liabilities were 9,282 million yen, down 437 million yen from the end of the previous term. The main factors included accounts payable of 2,872 million yen (down 176 million yen from the end of the previous term) and short-term borrowings of 4,891 million yen (down 172 million yen from the end of the previous term). Noncurrent liabilities rose 100 million yen from the end of the previous term to 657 million yen. The main factors included long-term borrowings of 62 million yen (down 170 million yen from the end of the previous term), which decreased due to the shift of working capital from long-term borrowings to short-term borrowings, and lease obligations of 374 million yen (up 228 million yen from the end of the previous term), which increased through the adoption of new accounting standards.

As a result, total liabilities declined 339 million yen from the end of the previous term to 9,940 million yen.

Total net assets were 8,693 million yen, up 112 million yen from the end of the previous term. The main factors included retained earnings of 4,620 million yen (up 57 million yen from the end of the previous term).

Cash Flow

| FY Jan. 19 | FY Jan. 20 | YY Change | |

Operating Cash Flow | 433 | 987 | +553 | +127.8% |

Investing Cash Flow | -801 | -783 | +17 | - |

Free Cash Flow | -367 | 203 | +571 | - |

Financing Cash Flow | 1,043 | -606 | -1,649 | - |

Cash and Equivalents at First Term End | 3,210 | 2,790 | -420 | -13.1% |

*Unit: million yen

The balance of cash and cash equivalents at the end of the fiscal year January 2020 was 2,790 million yen, down 420 million yen from the end of the previous term.

Net cash inflow from operating activities was 987 million yen (an inflow of 433 million yen in the previous term). The main factors included net income before income taxes of 467 million yen (328 million yen in the previous term) and an increase of accounts receivables by 298 million yen (a decrease of 264 million yen in the previous term).

Net cash outflow from investing activities was 783 million yen (an outflow of 801 million yen in the previous term). The main factors included purchase of property, plant and equipment of 621 million yen (713 million yen in the previous term), and purchase of intangible assets of 85 million yen (91 million yen in the previous term).

Net cash outflow from financing activities was 606 million yen (an inflow of 1,043 million in the previous term). The main factors included a net expenditure of 151 million yen (a net revenue of 500 million yen in the previous term) for short-term borrowings and a revenue of 1,014 million yen from the issuance of new shares in the same period of the previous year.

4. Fiscal Year January 2021 Earnings Forecasts

Consolidated Earnings

| FY Jan.20 | Ratio to sales | FY Jan. 21 (Est.) | Ratio to sales | YY Change |

Sales | 17,357 | 100.0% | 19,145 | 100.0% | +10.3% |

Gross Profit | 531 | 3.1% | 700 | 3.7% | +31.7% |

Current Profit | 469 | 2.7% | 578 | 3.0% | +23.2% |

Parent Net Profit | 203 | 1.2% | 300 | 1.6% | +47.7% |

*Unit: million yen

Sales and current profit are expected to increase 10.3% and 23.5% year on year, respectively.

For the fiscal year January 2021, it is estimated that sales will be 19,145 million yen, up 10.3% year on year, and current profit will be 578 million yen, up 23.2% year on year.

The business environment is expected to remain uncertain with risks of unpredictability of the impact of international trade issues and voluntary restraint from going out due to the novel coronavirus, and also because of the frequent occurrence of natural disasters in Japan. Under such circumstances, the company will continue to improve its brand power as a garden lifestyle maker in the fiscal year January 2021 by broadcasting online video commercials and commercials on FM radio, based on the “5th ROOM” concept of the garden as the fifth room in the house. In Japan, the company will further strengthen the sales of gardening and exterior products by enhancing sales activities and merging manufacturing subsidiaries to expand manufacturing facilities and improve production efficiency. Further, it will promote the use of IoT in the garden based on GEMS (Garden Energy Management System) through enhancement of the low-voltage series. As for SG&A expenses, efforts will be made in reducing costs by promoting the operation of Ai, Ai-OCR and RPA (Robotics Process Automation) in order to improve work efficiency and productivity. In the global market, the company will release new original products mainly in Europe, and expand sales of exterior products including “Ever Art Wood” in Europe by operating the company’s EU branch, in the same way as in Korea and Australia, where the sales of these products have been steady. Furthermore, the company aims to strengthen sales activities in Europe, Asia, Oceania and North America through expansion of production volume in the manufacturing division by building additional factories in China.

(For reference) Regarding the impact of the novel coronavirus

The impact of the novel coronavirus seems mild, as approx. 70% of the company’s total sales are from the professional use segment, which provide products manufactured in the company’s own factories in Japan.

The company’s factories in China resumed operations at 75% of capacity on February 17 and returned to the normal production on March 9. Although the implementation of the sales plan for February will be postponed until March or later, the sales plan for the first half will be unaffected. Also, almost no order cancellation has been made.

5. Future Business Development and Medium/Long-Term Plan

Business development

No.1 in growing Exteriors and Garden fields From Only one to No.1 General G&EX Manufacturer |

◇ Manufacturing factories Further improvement in utilization rate

◇ Software factories Proposal for space Establishment of a new team specializing in designing virtual spaces of AR and VR

● Operation of GEMS Utilization of IoT in gardens and linkage of low-voltage lights, cameras and sound with the application

●GARDEN STORY Over 2,000 published articles and 12 million PVs

(Taken from the materials of the company)

Medium/Long-Term Plan

In the medium-term plan, the company aims to achieve sales of 21 billion yen and a current profit of 980 million yen in the fiscal year January 2022. Further, it plans to achieve sales of 27.1 billion yen and a current profit of 1,980 million yen in the fiscal year January 2025.

| FY Jan. 20 | FY Jan. 21(Plan) | FY Jan .22 (Plan) | FY Jan. 23 (Plan) | FY Jan. 24 (Plan) | FY Jan. 25 (Plan) |

Sales | 17,357 | 19,145 | 21,000 | 22,500 | 25,000 | 27,100 |

Operating Profit | 531 | 700 | 950 | 1,100 | 1,650 | 1,820 |

Current Profit | 469 | 578 | 980 | 1,130 | 1,680 | 1,980 |

Parent Net Profit | 203 | 300 | 555 | 645 | 960 | 1,130 |

*Unit: million yen

6. Conclusion

Sales decreased due to the impact of lack of sunlight at the beginning of summer, typhoons and heavy rainfalls in autumn in Japan, and liquidation of a sales subsidiary in Germany. The fiscal year January 2020 was also a year of rebuilding through the integration of manufacturing subsidiaries in Japan and the restructuring of the sales system outside Japan. Under these circumstances, the company is further strengthening the production systems in Japan and building additional factories in China in preparation for future growth. Although uncertainties remain, the novel coronavirus, which is spreading around the world, is more likely to be transmitted in closed rooms. Hence, the value of the liberal garden, “5th ROOM” will be significant. The potential for the company to expand its activities around the world has emerged. For this reason, the company’s decision in the fiscal year January 2020 to strengthen its production system is likely to play an important role. The path to achieving the ambitious medium-term plan seems to be in sight.

If the company achieves its medium-term plan, EPS is expected to be 44 yen in the fiscal year January 2023 and 77 yen in the fiscal year January 2025.

With the novel coronavirus causing the stock market turbulence, the company’s share price has fallen and its PBR has also fallen well below 1. There is a lot of room for reconsideration of the stock price, considering the level of profit in the medium-term plan. We would also like to pay attention to the garden’s presence in the world in the future.

<Reference: Concerning Corporate Governance>

◎ Organizational structure and composition of directors and corporate auditors

Organizational structure | Company with audit and supervisory board |

Directors | 6, out of which 2 are outside directors. |

Corporate auditors | 3, out of which 2 are outside directors. |

◎ Corporate Governance Report

Last updated: April 19, 2019

<Basic policy>

Takasho recognizes that the establishment of corporate governance that is sound and highly transparent and secures the efficiency of management decision-making to respond promptly and appropriately to changes in the business environment is an important matter and is working on it.

< Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts) >

Principles | Reasons for not implementing the principles |

【Supplementary principle 1-2-4】 | Our company has not decided to install the electronic platform for exercising voting rights and prepare the English translation of the convocation notice, because the ratio of institutional investors and overseas investors is relatively low. In the future, we will consider these matters in accordance with changes in the shareholder composition, etc. |

【Supplementary principle 3-1-2】 | Our company has not adopted information disclosure in English, because the ratio of overseas investors is relatively low in light of cost effectiveness from the personnel and cost perspectives. In the future, we will consider the matter in accordance with changes in the shareholder composition, etc. |

【Supplementary principle 4-8-1】 | At present, there are no regular meetings, etc. consisting of independent external directors only, but our outside directors exchange views with other directors and corporate auditors, and they actively participate in the Board of Directors and make remakes. Therefore, we believe that our external directors are fulfilling their roles and responsibilities. |

< Disclosure Based on the Principles of the Corporate Governance Code (Excerpts) >

Principles | Reasons |

【Principle 1-4 Strategically held shares】 | (1) Policy on strategic shareholding Our company will hold shares strategically after comprehensively judging whether they will lead to the maintenance and strengthening of business relationships or whether they will lead to an improvement in our medium- to long-term corporate value through smooth promotion of business activities, etc. For the major ones, we will examine the effects of strategic shareholding from the perspective of maintaining medium- to long-term economic rationality and maintaining and strengthening the overall relationship with our business partners and report the results to the Board of Directors. The company will reduce the number of shares that are considered not worth holding. (2) Criteria for exercising voting rights pertaining to strategic shareholding We will review the contents of the shareholder meeting agenda of the investee company based on the prospect of sustainable development and medium- to long-term corporate value enhancement for both investee company and our company and exercise the voting rights. |

【Principle 2-6 Functioning as an asset owner for corporate pensions】 | The company has a defined benefit corporate pension system and has entered into agreements with an asset management organization that has expressed acceptance of stewardship activities with respect to the administration and management of corporate pensions. A person from the General Affairs and Human Resources Department is assigned to receive regular reports from the entrusted organization on the soundness of the management, and the relevant departments conduct monitoring as appropriate. |

【Principle 4-8 Effective utilization of independent directors】 | Our company appoints two outside directors. They are the independent outside directors to keep an independent and neutral position in the discussions at the Board of Directors. We will continue to select candidates so that multiple independent outside directors with high expertise and rich experience can be appointed. |

【Supplementary Principle 4-11-1 General idea on the balance of knowledge, experience and capabilities, diversity and size of the Board of Directors】 | In order to respond appropriately and swiftly to changes in the business environment, the company appoints human resources with diverse backgrounds to its Board of Directors, taking into account the balance of knowledge, experience and capabilities. Outside directors, in particular, are selected based on their knowledge of the industry, experience in management, and professional abilities in their respective fields to ensure balance and diversity. In addition, considering the size of the company and other factors, the company’s articles of incorporation limits the number of directors to be not more than 15, and there are currently six directors (including two outside directors). |

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2020 Investment Bridge Co.,Ltd. All Rights Reserved. |

To view back numbers of Bridge Reports on Takasho Corporation (7590) and other companies and to see IR related seminars of Bridge Salon, please go to our website at the following URL: www.bridge-salon.jp/