Bridge Report:(7590)Takasho earnings results for fiscal year January 2021

President Nobuo Takaoka | Takasho Corporation (7590) |

|

Company Information

Exchange | TSE 1st Section |

Industry | Retail (Commerce) |

President | Nobuo Takaoka |

HQ Address | Minami Akasaka 20-1, Kainan-shi, Wakayama-ken |

Year-end | January 20 |

Homepage |

Stock Information

Share Price | Share Outstanding (exc. Treasury Stock) | Market Cap. | ROE (Act.) | Trading Unit | |

¥770 | 14,578,329 shares | ¥11,225 million | 10.6% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥20.00 | 2.6% | ¥61.74 | 12.5 x | ¥646.41 | 1.2x |

*Stock price as of closing on March 25, 2021. Number of shares issued at the end of the most recent quarter excluding treasury shares.

*ROE and BPS are based on FY January 2021’s results. DPS and EPS are the forecast for FY January 2022. The data is rounded off.

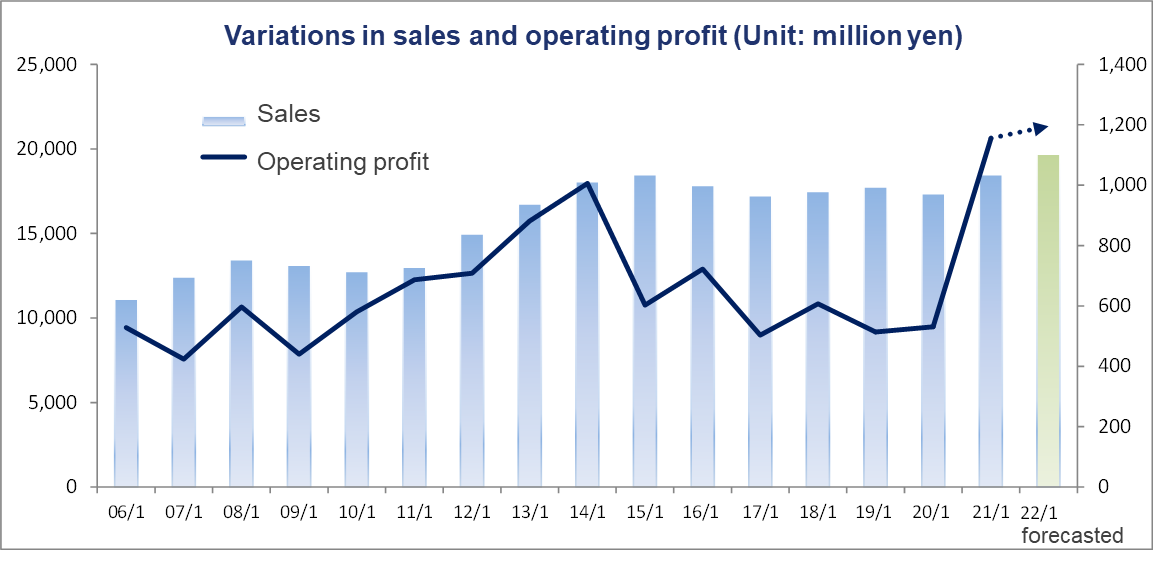

Consolidated Earnings Trends

Fiscal Year | Sales | Operating Profit | Current Profit | Net Profit | EPS (¥) | DPS (¥) |

January 2016 | 17,853 | 722 | 597 | 240 | 19.63 | 17.00 |

January 2017 | 17,223 | 503 | 322 | 152 | 12.39 | 6.00 |

January 2018 | 17,489 | 607 | 571 | 228 | 18.59 | 10.00 |

January 2019 | 17,759 | 514 | 333 | 338 | 25.04 | 10.00 |

January 2020 | 17,357 | 531 | 469 | 203 | 13.93 | 10.00 |

January 2021 | 18,486 | 1,156 | 1,152 | 952 | 65.36 | 20.00 |

January 2022 Est. | 19,680 | 1,195 | 1,190 | 900 | 61.74 | 20.00 |

*Estimates are those of the Company.

*Unit: million yen

We present this Bridge Report along with the earnings results for fiscal year January 2021.

Table of Contents

Key Points

1. Company Overview

2. Business Development

3. Fiscal Year January 2021 Earnings Results

4. Fiscal Year January 2022 Earnings Forecasts

5. Future Business Development and Medium/Long-Term Plan

6. Conclusion

<Reference: Concerning Corporate Governance>

Key Points

- In the fiscal year January 2021, sales and current profit increased 6.5% and 145.7% year on year, respectively. In Japan, the professional use segment was affected by the stagnation of construction work, but the decrease rate of sales was only 1.2%. On the other hand, in the home use segment, sales increased 18.2% because of the growing sales of gardening products at mass retailers and through e-commerce because of people staying home due to the novel coronavirus spread. Demand for gardening also augmented overseas due to the effects of the novel coronavirus, and in particular, sales through e-commerce rose significantly by 28.2% year on year. In terms of profits, gross profit margin improved due to the sales growth of highly profitable e-commerce, resulting in a significant increase in profits. The year-end dividend was 20.0 yen, up 10.0 yen from the previous year.

- In the fiscal year January 2022, sales and current profit are expected to increase 6.5% and 3.3% year on year, respectively. The company will continue to take into consideration the impact of the novel coronavirus on economic activities. Under this business environment, the company will strive to improve its brand power in the fiscal year January 2022 by creating lifestyles through gardens based on their concept, the 5th ROOM. In Japan, the company will promote the deployment of hybrid showrooms that combine the in-person and online aspects. Globally, the company will introduce new original products, mainly in Europe. Moreover, to expand sales of exterior products, the company will enhance sales to South Korea, Australia, and Europe, where sales of these products are steadily increasing. Furthermore, in the manufacturing sector in China, the company will increase the production volume by expanding factories to enhance sales activities in Europe, Asia, Oceania, and North America. The term-end dividend is expected to be 20.0 yen/share.

- The fiscal year January 2021 can be considered as a year of significant progress due to the consumption by people staying at home because of the spread of the novel coronavirus. The increase in the e-commerce sales ratio in Japan and overseas has significantly improved profit margin. The establishment of the production and sales systems, which the company has been working on since before the novel coronavirus crisis, has paid off. In particular, we would like to pay attention to the significant sales growth in overseas. Although sales in various parts of the world have increased significantly, it brought in a small amount of money. Thus, there is plenty of room for expansion in the future. Overseas profits are also small. Future sales growth due to the revision of the European sales system and the expansion of e-commerce will significantly contribute to profit growth. Due to the company's good performance, its stock price doubled from the low stock price of last year. Still, PER is as low as 12. Considering the potential for improvement in overseas and the profit level set forth in the mid/long-term plan, it seems to be undervalued.

1. Company Overview

Takasho Corporation maintains a basic business concept of contributing to the “Creation of comfortable spaces” and handles garden exterior products. In the aftermath of the Second World War, Takasho changed its business style from sales of gardening materials to a gardening business, and then to a comprehensive lifestyle business, growing as a lifestyle maker that proposes better lifestyles with gardens. Its vision is to create mental and physical health and happy family lifestyles that bring smiles to the people. Takasho always forecasts future changes to accurately create new value that matches the market’s needs, and pursues its goal of becoming the “only global company” contributing broadly to gardening culture in urban environments. Its mission is “to be a company that provides better lifestyles globally through gardens.” The Takasho Group manufactures products in Japan and China for sale in Japan, Europe, Asia, Oceania and the United States. The Group’s integrated structure with the ability to plan, manufacture and sell products has allowed it to become the leading company within the “gardening market,” which is growing to become a firmly established market in Japan. Takasho has 5 domestics and 10 overseas group companies. The Company listed its shares on the JASDAQ market in September 1980, and after a capital increase in 2012 and 2013, moved its shares to the Second Section of the Tokyo Stock Exchange on October 19, 2017, and to the First Section of the Tokyo Stock Exchange on July 9, 2018.

Company Overview

Date of establishment | August 1980 |

Listing date | September 1998 (JASDAQ) October 2017 Second Section market of the Tokyo Stock Exchange July 2018 First Section market of the Tokyo Stock Exchange |

Capital | ¥1,820 million yen |

Number of employees | 760 employees(consolidated) |

Group companies | 5 domestics, 12 overseas |

Corporate Mission

(Taken from the material of the company)

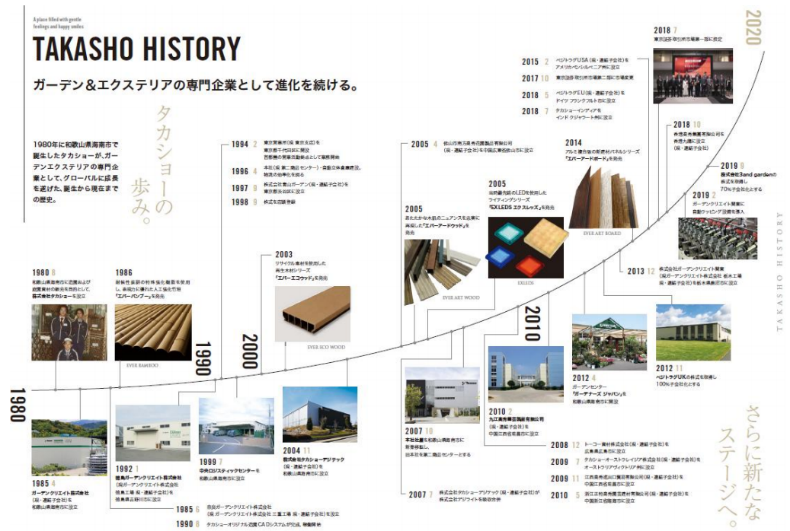

Corporate History

In Japan, the company has operated businesses with different sales routes. One of them is the professional use business for home builders and construction shops that require design and construction. Another one is the home use business for general consumers centered on selling products on a wholesale basis to home improvement centers. In this century, the company has gone into full-scale operations in overseas. In recent years, sales for professional use have increased significantly in Japan. However, with the spread of the novel coronavirus, sales for home use are rapidly expanding in Japan and overseas.

(Taken from the material of the company)

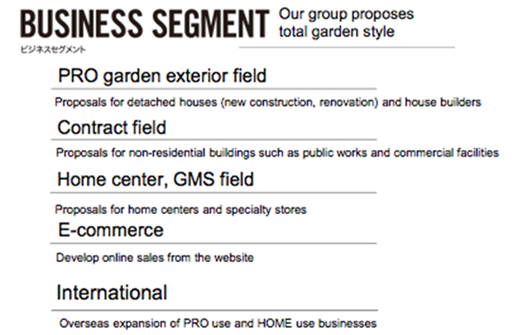

Business Segment

The company has subdivided its business segments as the consumption by people staying at home has increased. The business segments are subdivided into (1) the professional garden and exterior segment for detached houses (new construction and remodeling) and home builders, (2) the contract segment for non-residential projects such as public projects and commercial facilities, (3) the home improvement and GMS segment for home improvement centers and specialty stores, (4) the e-commerce segment that sells products online, and (5) the global segment that handles professional use and home use product businesses overseas.

|

|

(Taken from the material of the company)

Market

The size of the domestic professional market and the DIY market, which the company focuses on, is 700 billion yen each. The size of the domestic contract market and the rapidly growing overseas market is over 10 trillion yen. Thus, there is a great potential.

(Taken from the material of the company)

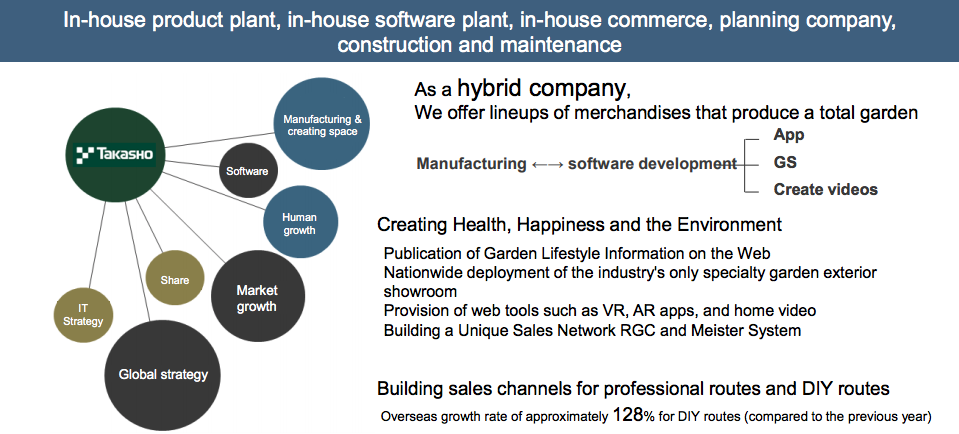

2. Business Development

Business Operations

The company has invested 4.5 billion yen over the past five years in its original product factories. As for original software factories, Takasho GLD-LAB.Soft-Factory Tottori is scheduled to open in April.

(Taken from the material of the company)

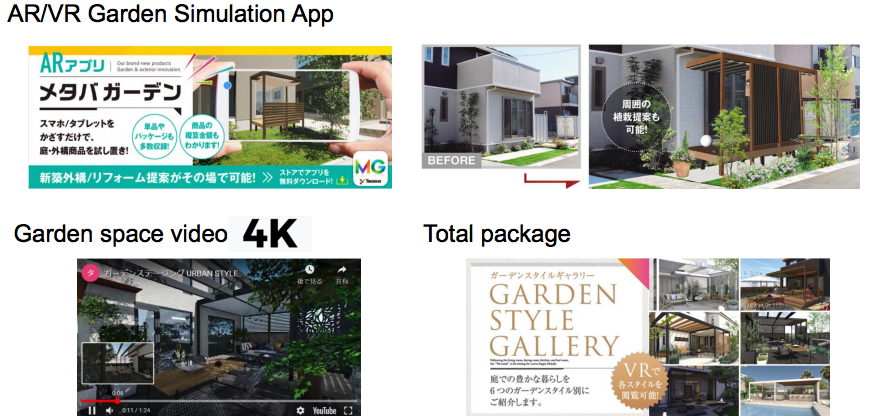

DX (Digital Transformation)

The company is actively working on DX. Especially since the spread of the novel coronavirus has led to an increase in the number of people refraining from going out, the company has started to make the most of its DX initiatives.

(Taken from the material of the company)

Proposal for Packages

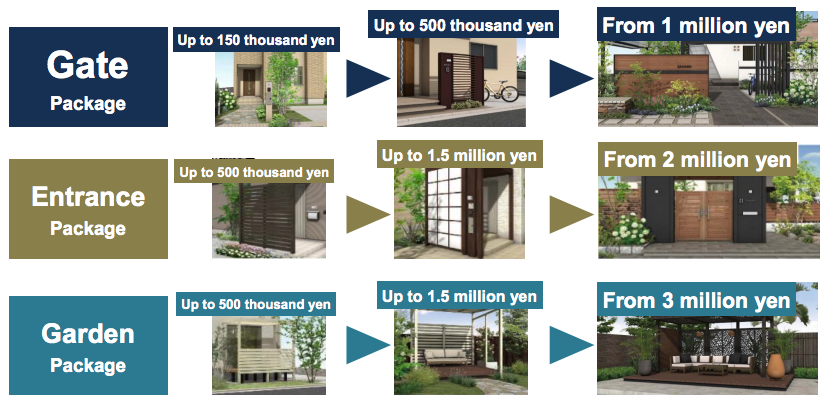

It is considered that there are 53.66 million housing units in total and 8.76 million vacant houses in Japan. The company proposes a garden package, aiming for a market of 1% of the total number of houses multiplied by gardens (300,000 yen), which is about 160 billion yen. Houses are changing with the spread of the novel coronavirus. The company anticipates that demand in the DIY lifestyle market will grow as people want homes to be more personal, fun, and relaxing.

The company proposes packages suited for various ages, various sense of worth, values, regions, and hobbies.

(Taken from the material of the company)

Features of Home Use

The business in the home use segment is expanding globally. Products are manufactured in Jiujiang, China, and the Company sell them in Japan and overseas. In addition to the existing 66,115 square meter factory, a new factory of about 16,528 square meter will be set up. As for the sales route, the Company is exploring a brand strategy using both online and traditional retail stores.

(Taken from the material of the company)

Home Use Initiatives

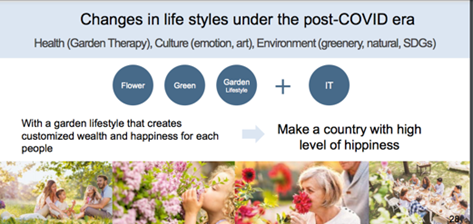

As more people are staying home, the demand for having gardens is rising. The value of flowers, greenery, having a garden, kitchen gardens, and lifestyles have changed.

(Taken from the material of the company)

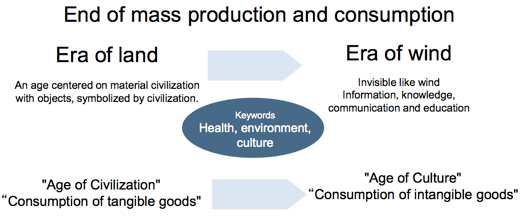

Major Changes Over Time and The Value Takasho Provides

The times have changed drastically from the "earth era" centered on the material civilization of things, to the "wind era" where invisible information, knowledge, transmission, and education are focused. In other words, the times have shifted from the era of civilization to the era of culture, and consumption has changed from the consumption of goods to the consumption of services. Therefore, the main themes will be health, environment, and culture. Takasho provides health through garden therapy, culture through atmosphere and art, and environment through greenery, nature, and SDGs.

Major Changes Over Time

(Source: Takasho) | The Value that Takasho Provides

(Source: Takasho) |

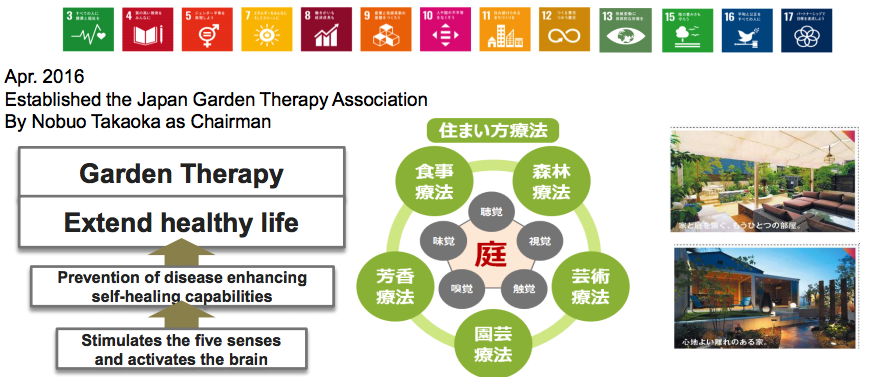

SDGs Initiatives

Takasho contributes to society through the sustainable development goals based on the principle of always anticipating change, creating new value, and contributing widely to the creation of urban environment garden culture.

(Taken from the material of the company)

3. Fiscal Year January 2021 Earnings Results

3-1 Consolidated Earnings

| FY Jan. 20 | Ratio to sales | FY Jan. 21 | Ratio to sales | YY Change | Forecast | Divergence |

Sales | 17,357 | 100.0% | 18,486 | 100.0% | +6.5% | 18,400 | +0.5% |

Gross Profit | 7,547 | 43.5% | 8,259 | 44.7% | +9.4% | - |

|

SG&A | 7,015 | 40.4% | 7,103 | 38.4% | +1.3% | - |

|

Operating Profit | 531 | 3.1% | 1,156 | 6.3% | +117.7% | 1,010 | +14.5% |

Current Profit | 469 | 2.7% | 1,152 | 6.2% | +145.7% | 910 | +26.6% |

Net Profit | 203 | 1.2% | 952 | 5.2% | +369.2% | 640 | +48.9% |

*Unit: million yen

*The figures include figures calculated by Investment Bridge Co., Ltd. as reference values, so they may differ from actual figures (the same shall apply hereinafter).

Sales rose 6.5%, and current profit rose 145.7% year on year.

Sales were 18,486 million yen, up 6.5% year on year.

Sales in the domestic professional use segment decreased 1.2% from the previous fiscal year. The company conducted a variety of customer support to expand the sales of its core product, All Glass Porch, and its peripheral items based on the 5th Room concept, which is an intermediate space connecting the house and the garden. Through customer support, the company also aimed to improve the design of the façade exterior in new exterior construction. This led to stagnation at the construction sites, but the company was able to curb the decline in sales. Home use segment sales increased 18.2% year on year. The demand for gardening grew due to refraining from going out because of the spread of the novel coronavirus. This led to an increase in sales at mass retailers, which are the company's sales destination, and in sales of gardening products through e-commerce, resulting in improved home use segment sales.

In overseas, demand for gardening also increased due to the impact of the novel coronavirus, and sales of gardening products, primarily through e-commerce, rose significantly by 28.2% year on year.

Furthermore, the website platform Garden Story, which is operated by a subsidiary and specializes in information on the garden and exterior industry, reached a record high in page views and unique user numbers in May 2020. This was attributable to the overlapping of the peak of the gardening season and people staying home due to the spread of the novel coronavirus. Access to articles related to kitchen gardens and seasonal plants has remained strong since then. The search influx continued to be up 900% or higher from the previous fiscal year, demonstrating the stability of a lifestyle with gardening and kitchen gardens. The company took advantage of this opportunity to accelerate its efforts on DX (digital transformation) and opened a website showroom on June 15. Furthermore, on October 22 and 23, the company held its own exhibition, Takasho Garden & Exterior Fair 2020. The exhibition was a hybrid type that combined the in-person and online aspects. Through this exhibition, the company made proposals related to future new lifestyles and video software package proposals using VR and AR to strengthen its sales activities.

Operating profit increased by 117.7% year on year to 1,156 million yen.

In terms of profits, gross profit margin expanded from 43.5% in the previous fiscal year to 44.7% due to an increase in the sales composition ratio of the company's original products and the enhancement in productivity. Ratio of SG&A went down from 40.4% in the previous fiscal year to 38.4% because of the decline in operating expenses due to changes in sales style because of social distancing measures in sales activities and the decrease in advertising and marketing fees by reviewing sales promotion expenses. Current profit grew 145.7% year on year to 1,152 million yen due to a reduction in foreign exchange losses and a decrease in interest expenses. As the liquidation procedures of Takasho Europe GmbH and Tianjin Gaoxiu International Industry Trade Co., Ltd. have been completed, the company recorded a gain of 74 million yen on the reversal of the foreign currency translation adjustment as extraordinary income, and the parent net profit increased 369.2% to 952 million yen, year on year.

The year-end dividend (same amount as the annual dividend) was 20.0 yen, up 10.0 yen from the end of the previous fiscal year.

SG&A |

|

|

|

| (Unit: million yen) |

| FY Jan. 20 | Ratio to sales | FY Jan. 21 | Ratio to sales | YY Change |

Labor Cost | 2,812 | 16.2% | 2,924 | 15.8% | +4.0% |

Shipping Cost | 1,108 | 6.4% | 1,176 | 6.4% | +6.1% |

Promotion・Advertisement | 621 | 3.6% | 555 | 3.0% | -10.6% |

Payment Fee | 518 | 3.0% | 513 | 2.8% | -1.0% |

Travel Expenses | 228 | 1.3% | 105 | 0.6% | -54.0% |

Total | 7,015 | 40.4% | 7,103 | 38.4% | +1.3% |

Sales by Segment |

|

| (Unit: million yen) | ||

| FY Jan. 20 | Ratio to sales | FY Jan. 21 | Ratio to sales | YY Change |

Japan | 15,495 | 89.3% | 15,857 | 85.8% | +2.3% |

Europe | 438 | 2.5% | 753 | 4.1% | +71.9% |

China | 894 | 5.2% | 1,058 | 5.7% | +18.3% |

Korea | 120 | 0.7% | 154 | 0.8% | +27.8% |

US | 268 | 1.5% | 402 | 2.2% | +49.8% |

Others | 139 | 0.8% | 259 | 1.4% | +85.6% |

Total Consolidated Sales | 17,357 | 100.0% | 18,486 | 100.0% | +6.5% |

Japan | 569 | 149.8% | 809 | 76.6% | +42.3% |

Europe | -329 | - | -99 | - | - |

China | 188 | 49.6% | 314 | 29.8% | +66.9% |

Korea | -22 | - | -9 | - | - |

US | -14 | - | 23 | 2.2% | - |

Others | -11 | - | 17 | 1.7% | - |

Consolidated Adjustments | 151 | - | 100 | - | - |

Consolidated Operating Profit | 531 | 100.0% | 1,156 | 100.0% | +117.7% |

3-2 Financial Conditions and Cash Flow

Balance Sheet Summary

| Jan. 20 | Jan. 21 |

| Jan. 20 | Jan. 21 |

Cash, Equivalents | 2,790 | 3,942 | Payables | 2,872 | 3,001 |

Receivables | 2,868 | 3,212 | Short Term Interest Bearing Liabilities | 5,167 | 4,416 |

Inventories | 4,778 | 4,354 | Current Liabilities | 9,282 | 8,823 |

Current Assets | 11,099 | 12,187 | Long Term Interest Bearing Liabilities | 437 | 1,129 |

Tangible Assets | 5,683 | 5,556 | Noncurrent Liabilities | 657 | 1,350 |

Intangible Assets | 331 | 414 | Net Assets | 8,693 | 9,516 |

Securities, Other Investments | 1,519 | 1,533 | Total Liabilities, Net Assets | 18,634 | 19,691 |

Noncurrent Assets | 7,534 | 7,503 | Total Interest Bearing Liabilities | 5,605 | 5,546 |

*Unit: million yen

*Interest Bearing Liabilities = Debt + Bonds + Leases

Total assets at the end of the fiscal year January 2021 stood at 19,691 million yen, up 1,056 million yen from the end of the previous fiscal year. Current assets increased 1,087 million yen to 12,187 million yen. This was due to the recording of cash and equivalents of 3,942 million yen (up 1,152 million yen from the end of the previous fiscal year), notes and accounts receivable of 2,640 million yen (up 328 million yen from the end of the previous fiscal year), and goods and products of 2,826 million yen (down 453 million yen from the end of the previous fiscal year). Noncurrent assets declined 30 million yen from the end of the previous fiscal year to 7,503 million yen. This was attributable to the recording of tangible assets of 5,556 million yen (down 127 million yen from the end of the previous fiscal year) and intangible assets of 414 million yen (down 83 million yen from the end of the previous fiscal year).

Total liabilities rose 233 million yen year on year to 10,174 million yen. Current liabilities decreased 458 million yen from the end of the previous fiscal year to 8,823 million yen. This was attributable to the recording of notes and accounts payable of 3,001 million yen (up 128 million yen from the end of the previous fiscal year), current portion of long term debt of 356 million yen (up 190 million yen from the previous fiscal year), consumption tax payable of 220 million yen (up 118 million yen from the previous fiscal year), and short-term debt of 3,943 million yen (down 948 million yen from the previous fiscal year). Noncurrent liabilities increased 692 million yen from the end of the previous fiscal year to 1,350 million yen. The main reason for this was that long-term debt increased 771 million yen (up 709 million yen from the previous fiscal year) due to capital enhancement in consideration of the impact of the novel coronavirus on business performance.

Total net assets grew 822 million yen from the end of the previous fiscal year to 9,516 million yen, mostly due to retained earnings increasing to 5,427 million yen (up 807 million yen from the end of the previous fiscal year).

Equity ratio was 47.9% (46.2% at the end of the previous fiscal year).

The company raised 1 billion yen as an emergency measure fund for the novel coronavirus crisis.

The real loan balance has declined 1,055 million yen from the end of the previous fiscal year.

Debts |

| (Unit: million yen) | |||||

| FY Jan. 20 | FY Jan. 21 | YY Change | FY Jan. 22 Est. | |||

Working Capital | 4,948 | 4,896(3,896) | -52 | 4,511 | |||

Equipment Funds | 76 | 126 | 50 | 147 | |||

Investments and Acquisitions | 97 | 48 | -49 | 3 | |||

Loans | 5 | - | -5 | - | |||

Total | 5,126 | 5,071(4,071) | -55 | 4,661 | |||

*() is the real balance excluding the loans considering the impact of the novel coronavirus

Cash Flow |

|

| (Unit: million yen) | |

| FY Jan. 19 | FY Jan. 20 | YY Change | |

Operating Cash Flow | 987 | 1,899 | +912 | +92.4% |

Investing Cash Flow | -783 | -438 | +345 | - |

Free Cash Flow | 203 | 1,461 | +1,257 | +617.5% |

Financing Cash Flow | -606 | -307 | +299 | - |

Cash and Equivalents at First Term End | 2,790 | 3,942 | +1,152 | +41.3% |

Cash and equivalents at the end of the fiscal year January 2021 stood at 3,942 million yen, up 1,152 million yen from the end of the previous fiscal year.

Operating CF had a surplus of 1,899 million yen (a surplus of 987 million yen in the previous fiscal year). The main factors behind that were the recording of income before taxes and adjustments of 1,218 million yen (467 million yen in the previous fiscal year) and a decrease in receivables of 320 million yen (an increase of 298 million yen in the previous fiscal year).

Investing CF was negative 438 million yen (a deficit of 783 million yen in the previous fiscal year). This was mainly attributable to a tangible asset expenditure of 268 million yen (621 million yen in the previous fiscal year) and the expenditure for acquiring intangible assets of 170 million yen (85 million yen in the previous fiscal year).

Financing CF was an outflow of 307 million yen (an outflow of 606 million yen in the previous fiscal year). This was mainly due to net revenue of 899 million yen (net expenditure of 213 million yen in the previous fiscal year) from long-term loans due to the expansion of funds in consideration of the impact of the novel coronavirus on business performance and net expenditure from short term loans of 941 million yen (net expenditure of 151 million yen in the previous fiscal year).

4. Fiscal Year January 2022 Earnings Forecasts

Consolidated Earnings

| FY Jan.21 | Ratio to sales | FY Jan. 22(Est.) | Ratio to sales | YY Change |

Sales | 18,486 | 100.0% | 19,680 | 100.0% | +6.5% |

Gross Profit | 8,259 | 44.7% | 8,770 | 44.6% | +6.2% |

SG&A | 7,103 | 38.4% | 7,575 | 38.5% | +6.6% |

Operating Profit | 1,156 | 6.3% | 1,195 | 6.1% | +3.3% |

Current Profit | 1,152 | 6.2% | 1,190 | 6.0% | +3.3% |

Net Profit | 952 | 5.2% | 900 | 4.6% | -5.6% |

*Unit: million yen

Sales and current profit are expected to increase 6.5% and 3.3% year on year, respectively.

In the fiscal year January 2022, sales are planned to increase 6.5% year on year to 19,680 million yen, and current profit to grow 3.3% year on year to 1,190 million yen. As no effective means against the novel coronavirus infection have been established, there is a concern that its impact on economic activities will be prolonged. Although there are some positive signs as vaccination has started in some overseas countries, if the vaccines are not effective, economic activity may stagnate for a long time. Therefore, the business environment surrounding the company will continue to be unpredictable.

Under such business environment, the company will strive to improve its brand power in the fiscal year January 2022 by creating lifestyles through gardens based on their concept, the 5th ROOM. In Japan, as the novel coronavirus crisis continues, the company will promote digitization by proposing images after construction using website showrooms, VR showrooms, and the AR application Metaba Garden. Also, the company will deploy hybrid showrooms that combine the in-person and online aspects. Furthermore, the company will enhance sales activities by establishing Takasho GLD-LAB. Soft-Factory Tottori (scheduled to open in April) to operate as a software factory centered on the production of garden simulation apps and garden space package videos for garden spaces and Takasho Garden Life Design Lab Phil. Corp. (scheduled to be established in August).

As for SG&A expenses, efforts will be made in reducing costs by promoting the operation of AI, AI-OCR and RPA in order to improve work efficiency and productivity. In the global market, the company will release new original products mainly in Europe, and expand sales of exterior products including “Ever Art Wood,” which is company’s main product, in Korea, Australia, and Europe, where the sales of these products have been steady. Furthermore, the company aims to strengthen sales activities in Europe, Asia, Oceania and North America through expansion of production volume in the manufacturing division by building additional factories in China.

The year-end dividend is expected to be 20.0 yen/share.

5. Future Business Development and Medium/Long-Term Plan

Business development

No.1 in growing Exteriors and Garden fields From Only one to No.1 General G&EX Manufacturer |

Manufacturing factories Further improvement in utilization rateSoftware factories Proposal for space Establishment of a new team specializing in designing virtual spaces of AR and VR

● Experience-based showroom newly established in Nagoya installed in Tokyo, Nagoya, Osaka, Tohoku, and Hiroshima

● Operation of GEMS Utilization of IoT in gardens and linkage of low-voltage lights, cameras and sound with the application

● Garden service network

●GARDEN STORY Over 2,600 published articles and 37 million PVs

(Taken from the material of the company)

(Taken from the material of the company)

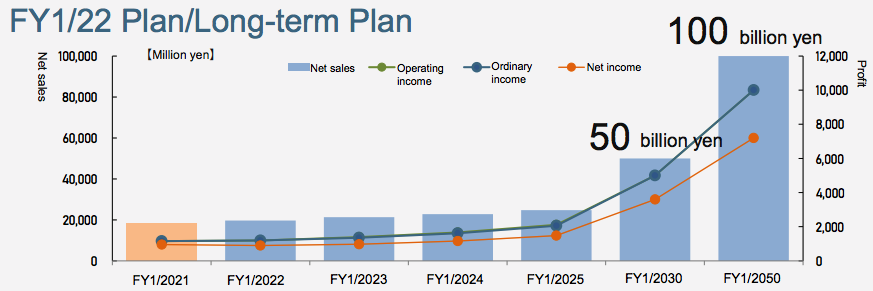

Mid/long-term Plan

The mid/long-term plan is to achieve sales of 24.7 billion yen and a current profit of 2,050 million yen in the fiscal year January 2025. The company aspires to reach sales of 50 billion yen in the fiscal year January 2030 and 100 billion yen in the fiscal year January 2050. Profit is also expected to grow in proportion to the rise in sales.

(Taken from the material of the company)

| FY Jan. 21 | FY Jan. 22 (Plan) | FY Jan .23 (Plan) | FY Jan. 24 (Plan) | FY Jan.25 (Plan) |

Sales | 18,486 | 19,680 | 21,310 | 22,800 | 24,700 |

Operating Profit | 1,156 | 1,195 | 1,391 | 1,660 | 2,110 |

Current Profit | 1,152 | 1,190 | 1,350 | 1,610 | 2,050 |

Parent Net Profit | 952 | 900 | 972 | 1,159 | 1,476 |

*Unit: million yen

* FY Jan. 21 includes 66 million yen of the special loss. Including that loss, the parent net profit would be 886 million yen.

6. Conclusion

The fiscal year January 2021 is considered as a year of significant progress due to the consumption by people staying home because of the spread of the novel coronavirus. Profit margin improved significantly due to the increase in the e-commerce sales ratio in Japan and overseas. The establishment of the production and sales system, which the company has been working on since before the novel coronavirus crisis, has paid off. Primarily, we would like to pay attention to the significant growth in overseas. Sales in Europe increased 71.9% year on year to 753 million yen, and sales in the United States rose 49.8% year on year to 402 million yen. Although there was a significant increase in sales, it brought in a small amount of money. Thus, there is a lot of room for expansion in the future, in other areas as well. Furthermore, the company's reducing its losses significantly in Europe contributed to the increase in profits in the fiscal year January 2021, but the amount of profits was small. Future sales growth due to the review of the European sales system and the expansion of e-commerce will play a great role in profit growth. It is disappointing that the company's forecast for the current fiscal year predicts only an increase of 6.5% and 3.3% in sales and current profit, respectively. We believe that if the gardening demand, which is said to be a special demand, becomes well established, it could lead to a double-digit increase in sales and profits.

Due to the company's good performance, the stock price doubled from the low stock price of last year. Yet, the PER is as low as 12. Considering the future improvement capacity in overseas and the profit level set forth in the mid/long-term plan, it seems to be undervalued.

<Reference: Concerning Corporate Governance>

◎ Organizational structure and composition of directors and corporate auditors

Organizational structure | Company with audit and supervisory board |

Directors | 6, out of which 2 are outside directors. |

Corporate auditors | 3, out of which 2 are outside directors. |

◎ Corporate Governance Report

Last updated: April 17, 2020

<Basic policy>

Takasho recognizes that the establishment of corporate governance that is sound and highly transparent and secures the efficiency of management decision-making to respond promptly and appropriately to changes in the business environment is an important matter and is working on it.

< Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts) >

Principles | Reasons for not implementing the principles |

【Supplementary principle 1-2-4】 | Our company has not decided to install the electronic platform for exercising voting rights and prepare the English translation of the convocation notice, because the ratio of institutional investors and overseas investors is relatively low. In the future, we will consider these matters in accordance with changes in the shareholder composition, etc. |

【Supplementary principle 3-1-2】 | Our company has not adopted information disclosure in English, because the ratio of overseas investors is relatively low in light of cost effectiveness from the personnel and cost perspectives. In the future, we will consider the matter in accordance with changes in the shareholder composition, etc. |

【Supplementary principle 4-8-1】 | At present, there are no regular meetings, etc. consisting of independent external directors only, but our outside directors exchange views with other directors and corporate auditors, and they actively participate in the Board of Directors and make remakes. Therefore, we believe that our external directors are fulfilling their roles and responsibilities. |

< Disclosure Based on the Principles of the Corporate Governance Code (Excerpts) >

Principles | Reasons |

【Principle 1-4 Strategically held shares】 | (1) Policy on strategic shareholding Our company will hold shares strategically after comprehensively judging whether they will lead to the maintenance and strengthening of business relationships or whether they will lead to an improvement in our medium- to long-term corporate value through smooth promotion of business activities, etc. For the major ones, we will examine the effects of strategic shareholding from the perspective of maintaining medium- to long-term economic rationality and maintaining and strengthening the overall relationship with our business partners and report the results to the Board of Directors. The company will reduce the number of shares that are considered not worth holding. (2) Criteria for exercising voting rights pertaining to strategic shareholding We will review the contents of the shareholder meeting agenda of the investee company based on the prospect of sustainable development and medium- to long-term corporate value enhancement for both investee company and our company and exercise the voting rights. |

【Principle 2-6 Functioning as an asset owner for corporate pensions】 | The company has a defined benefit corporate pension system and has entered into agreements with an asset management organization that has expressed acceptance of stewardship activities with respect to the administration and management of corporate pensions. A person from the General Affairs and Human Resources Department is assigned to receive regular reports from the entrusted organization on the soundness of the management, and the relevant departments conduct monitoring as appropriate. |

【Principle 4-8 Effective utilization of independent directors】 | Our company appoints two outside directors. They are the independent outside directors to keep an independent and neutral position in the discussions at the Board of Directors. We will continue to select candidates so that multiple independent outside directors with high expertise and rich experience can be appointed. |

【Supplementary Principle 4-11-1 General idea on the balance of knowledge, experience and capabilities, diversity and size of the Board of Directors】 | In order to respond appropriately and swiftly to changes in the business environment, the company appoints human resources with diverse backgrounds to its Board of Directors, taking into account the balance of knowledge, experience and capabilities. Outside directors, in particular, are selected based on their knowledge of the industry, experience in management, and professional abilities in their respective fields to ensure balance and diversity. In addition, considering the size of the company and other factors, the company’s articles of incorporation limit the number of directors to be not more than 15, and there are currently six directors (including two outside directors). |

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) Investment Bridge Co.,Ltd. All Rights Reserved. |

To view back numbers of Bridge Reports on Takasho Corporation (7590) and other companies and to see IR related seminars of Bridge Salon, please go to our website at the following URL: www.bridge-salon.jp/