Bridge Report:(7590)Takasho Fiscal Year Ended January 2025

President Nobuo Takaoka | Takasho Co., Ltd. (7590) |

|

Company Information

Exchange | TSE Standard |

Industry | Retail (Commerce) |

President | Nobuo Takaoka |

HQ Address | Minami Akasaka 20-1, Kainan-shi, Wakayama-ken |

Year-end | January 20 |

Homepage |

Stock Information

Share Price | Share Outstanding (exc. Treasury Stock) | Market Cap. | ROE (Act.) | Trading Unit | |

¥410 | 16,858,453 shares | ¥6,912 million | - | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥5.00 | 1.2% | ¥7.24 | 56.6 x | ¥748.41 | 0.55 x |

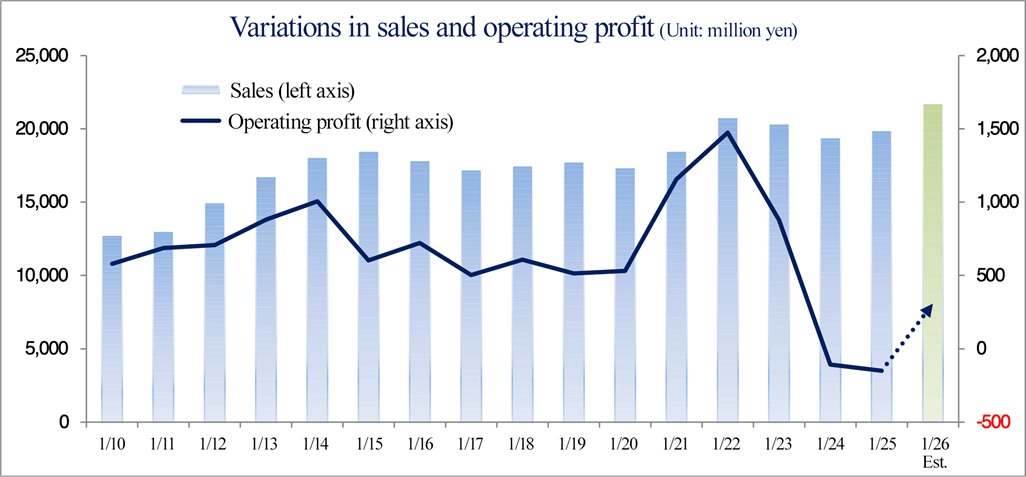

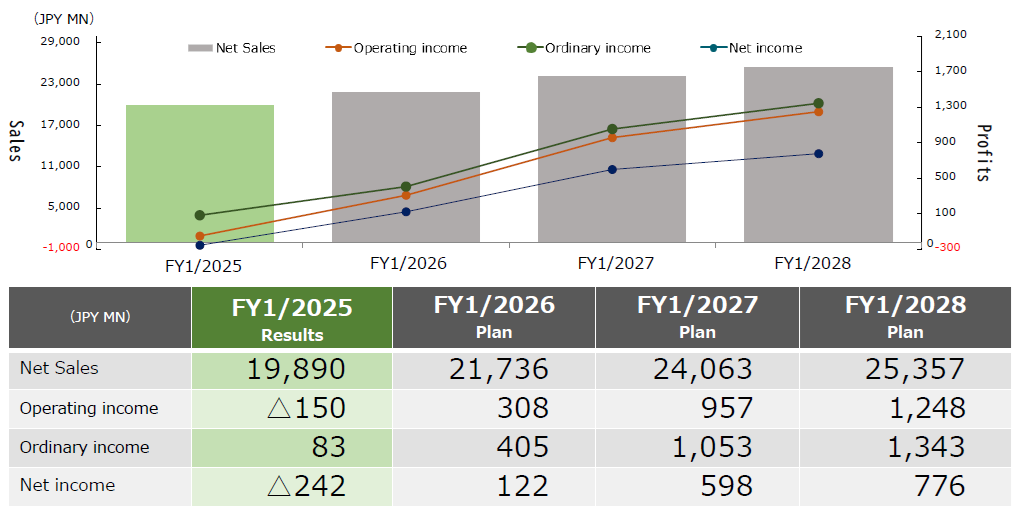

Consolidated Earnings Trends

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS (¥) | DPS (¥) |

January 2022 | 20,781 | 1,474 | 1,530 | 1,001 | 65.00 | 23.00 |

January 2023 | 20,351 | 880 | 982 | 518 | 29.60 | 23.00 |

January 2024 | 19,411 | -108 | 250 | -75 | - | 5.00 |

January 2025 | 19,890 | -150 | 83 | -242 | - | 5.00 |

January 2026 Est. | 21,736 | 308 | 405 | 122 | 7.24 | 5.00 |

We present this Bridge Report along with the earnings results of Takasho Co., Ltd. for fiscal year ended January 2025.

Table of Contents

Key Points

1.Company Overview

2.Business Development

3.Fiscal Year Ended January 2025 Earnings Results

4.Fiscal Year Ending January 2026 Earnings Forecasts

5.Mid/long-term Plan

6.Conclusion

<Reference: Concerning Corporate Governance>

Key Points

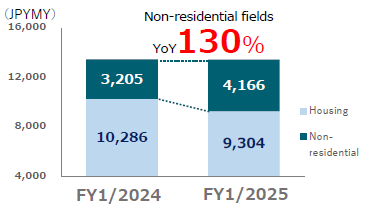

- In the fiscal year ended January 2025, the company achieved a 2.5% year-on-year increase in sales, but experienced a 66.5% decrease in ordinary income. In Japan, the sales of the professional use business expanded, but the home use business struggled. Overseas business demonstrated significant growth. Driven by the expansion of demand from foreign visitors to Japan, capital investment in commercial and accommodation facilities progressed, leading to a 130% year-on-year growth in the non-residential sector. The demand for renovation and remodeling of gardens and exteriors is emerging in the private market. In terms of profit, gross profit margin declined 0.7 points from 42.9% in the previous fiscal year to 42.2% due to discount sales implemented by overseas sales subsidiaries to boost sales and an increase in raw material costs and transportation costs related to procurement. SG&A expenses augmented, resulting in a large operating loss compared to the previous year. Additionally, foreign exchange gain decreased year on year. The company paid a year-end dividend of 5.00 yen per share, like in the previous fiscal year.

- For the fiscal year ending January 2026, the company expects a 9.3% year-on-year increase in sales and a 383.4% year-on-year growth in ordinary income. In the professional use business, the company will expand its proposal-based sales, including DX services, targeting construction companies and contractors to receive orders for new projects. In the lighting business, the company aims for further growth by developing new products and strengthening sales channels. The company will also leverage GLD-LAB. Corporation. further. In the home use business, the company will focus on strengthening sales in the e-commerce sector and promote the development of new products at its factories and the selling of global products across multiple countries. In the overseas business, the company will enhance its sales capability in the United States. In Europe, it aims to expand sales into untapped regions, such as France and Italy, and will introduce new services/products and develop new products. The company plans to pay a year-end dividend of 5.00 yen per share, like in the previous fiscal year.

- Despite the operating loss in the fiscal year ended January 2025, preparations for future business expansion are steadily underway. In the professional use business, contractor-focused products grew significantly, with non-residential sales increasing 30% year on year. The company is achieving success in the food service industry and other sectors. Takasho Digitec's growth is particularly notable, and we believe it demonstrates significant potential for future expansion. The overseas business has also seen a substantial reduction in inventory, paving the way from recovery to growth. We are also closely watching the professional use business initiatives. While the domestic home use business struggled in the fiscal year ended January 2025 due to unfavorable weather, a rebound is anticipated in the fiscal year ending January 2026. Furthermore, e-commerce sales in the home use business are expected to continue increasing both domestically and internationally. If the company achieves the net profit target of 776 million yen in the fiscal year ending January 2028, as outlined in its medium-term plan, EPS will be approximately 50 yen. Considering the anticipated growth from the fiscal year ending January 2026 onward, we believe the current share price, whose PBR is significantly below 1, presents potential for rise.

1. Company Overview

Takasho Co., Ltd. maintains a basic business concept of contributing to the “Creation of comfortable spaces” and handles garden and exterior products. In the aftermath of the Second World War, Takasho changed its business style from sales of gardening materials to a gardening business, and then to a comprehensive lifestyle business, growing as a lifestyle maker that proposes better lifestyles with gardens. Its vision is to create mental and physical health and happy family lifestyles that bring smiles to the people. The corporate philosophy lies in “aim to become a one-of-a-kind global group that grasps changes earlier than anyone else, create new value, and contribute to the development and diffusion of an urban garden culture.”

The Takasho Group manufactures products in Japan and China for sale in Japan, Europe, Asia, Oceania and the United States. The Group’s integrated structure with the ability to plan, manufacture and sell products has allowed it to become the leading company within the “gardening market,” which is growing to become a firmly established market in Japan. The Company listed its shares on the JASDAQ market in September 1998, and after a capital increase in 2012 and 2013, moved its shares to the Second Section of the Tokyo Stock Exchange on October 19, 2017, and to the First Section of the Tokyo Stock Exchange on July 9, 2018. The company chose the Prime Market, in the new market classification of TSE, which became effective on April 4, 2022. On October 20, 2023, the company got listed on the Standard Market.

Company Overview

Date of establishment | August 1980 |

Listing date | September 1998 (JASDAQ) October 2017 Second Section market of the Tokyo Stock Exchange July 2018 First Section market of the Tokyo Stock ExchangeApril 2022 Prime Market of the Tokyo Stock ExchangeOctober 2023 Standard Market of the Tokyo Stock Exchange |

Capital | 3,043 million yen |

Number of employees | 461 employees (including 351 full-time employees) |

Group companies | 7 domestics, 13 overseas |

※Capital stock as of January 20, 2025. Number of employees as of January 20, 2025

Corporate Philosophy

We, the Takasho Group, aim to become a one-of-a-kind global group that grasps changes earlier than anyone else, create new value, and contribute to the development and diffusion of an urban garden culture. | |

| 1. To create an affluent, peaceful garden-centric culture |

2. To aim to satisfy customers more profoundly than they expect with various proposals |

|

| 3. To pursue high-quality products and services by continuing R&D |

4. To respect the life of everything, and conserve the earth environment under the theme of coexistence with nature |

|

| 5. To realize a workplace as a personnel-based enterprise where it grows through the growth of personnel |

6. To conduct transparent corporate activities in accordance with laws, regulations, and fair commercial customs, while recognizing corporate social responsibilities |

|

(Taken from the company’s website)

To comprehensively produce the garden space with five mottoes

The wind rustles trees and flowers, brings seasons, and embraces nature and people. | Light colors the world, weaves dreams, and illuminates people and nature. | Water give life, enriches seasons, and moisturizes people and nature. | Greenery takes root in the earth, covers the earth, and heals people and nature. | We develop comforting gardens while keeping these five mottoes in mind. |

(Taken from the company’s website)

Business

A garden lifestyle maker creating a happy life through a relaxing garden space.

Takasho aspires to create a garden space that melts into the lifestyles of people, based on the concept of “Living Garden” which unifies the garden and home. Furthermore, they are proactively engaging in DX promotion, realizing proposals of an even more concrete and attractive garden or exterior space and creating new value for clients through DX.

Business domains

Engaging in the planning, development, manufacturing and sale of products in three domains, Takasho offers services useful for the business of their clients.

(Taken from the material of the company)

Business fields

Professional Use Business [Targets] Public projects, commercial facilities, detached houses, home builders | Manufacturing based in Japan. Targets professional clients involved in design and construction, such as departments in charge of the planning and layout, design and construction for public projects, commercial facilities and detached houses. Provides comprehensive support for proposals for scenery, outdoor living and exterior space from the viewpoint of a manufacturer. Utilizes various tools to facilitate the proposal for a concrete plan, striving for the enhancement of proposal capability fusing real and digital aspects. |

Home Use Business [Targets] Home improvement centers, mass retailers, e-commerce | Supports garden creation based on DIY, proposing scenarios tailored for a particular garden and offering a versatile product line-up. Makes proposals for a relaxing lifestyle unifying the house and garden rooted in the concept of Living Garden. |

Overseas Business [Targets] Housing, construction, DIY | With the manufacturing base in China, global sales span over Europe, the U.S., Australia and Asian countries. |

DX Business/Other | Space proposals based on DX tools, posting and spreading information through social media, etc. |

Business Overview

(Taken from the material of the company)

2. Business Development

Future growth strategies

Expansion of hybrid management combining real and digital space

Manufacturing factories Garden Create Takasho Digitec | × | Software factories GLD-LAB. The Philippines and Vietnam |

The production system of Garden Create consisting of the three factories in Kanuma, Tokushima and Wakayama will be launched on a full scale in the upcoming fiscal year. The company expects that it will contribute to the improvement in productivity.

Wakayama Factory, which was expanded, has been in operation since February 2025.

The new factory of Digitec (approx. 9,900 m2) for manufacturing LED lighting and signboards started operation in February 2024.

The subsidiary “GLD-LAB. Corporation.,” which is responsible for 4D space design and XR simulation business, was founded in July 2022.

Professional use |

① Proactive promotion of an approach to the non-residential market, such as hotels, restaurants and facilities, which is expanding due to demand from foreign visitors

(Taken from the material of the company)

② Living Garden and expansion to Exterior

Development of products for facilitating an even better garden life in the field of professional use, such as Ever Art Wood, Ever Art Board and Ever Bamboo. Takasho has come up with a relatable concept of the 5th Room (a fifth room that connects the house and the garden), following 1. living room, 2. dining room, 3. kitchen and 4. bedroom.

③ Materials

Artificial wood, boards and bamboo superior to the real thing. Dry construction, original manufacturing methods, simplified construction work.

High-quality and stylish building materials. Atmospheric veneer boards usable outdoors. Products for the field of professional use enhanced by extending domestic factories and installing equipment.

④ Remodeling and renovation

Enhanced as a market with the greatest potential for future development. Also making proposals for expanding the interior, bringing the “5th Room” into the house.

(Taken from the material of the company)

⑤ DX solutions

Regarding software factories, “GLD-LAB. Soft-Factory Tottori” was established. In full operation since April 2021. It possesses technologies and know-how for 4D space design and XR simulation. DX tools will be developed in cooperation with the Philippines and Vietnam.

The company produces high-definition perspective drawings using EXVIZ, ultra-high-definition CG perspective drawings. These high-definition perspective drawings, which express subtle textures and light, enable the making of proposals that “convey the image” more clearly than before.

Furthermore, a package plan site has been opened as a service for searching plans. Refined design can be easily found just by selecting the image and requirements. Business discussions based on the price and the downloading of 3D perspective drawings are possible from the initial proposal.

https://pac.takasho.jp

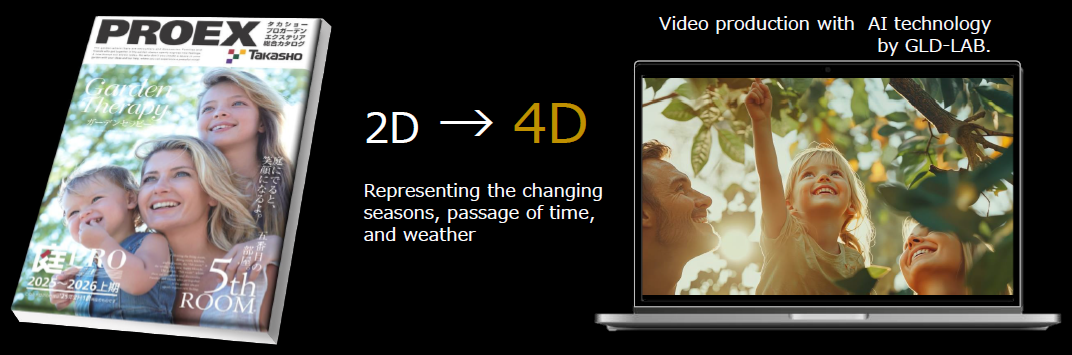

PROEX CONCEPT

The concept page in the company catalog was updated from 2D to 4D using AI and digital technologies which are outstanding in the industry, expressing the changing of seasons, passage of time and weather through a video.

(Taken from the material of the company)

Outdoor lighting and signboards |

To enhance product development and manufacturing capacity to expand the market share through global business operation, etc.

① Expansion of in-house product ratio

Digitec New China Factory (Guangzhou, China) in operation since March

② Enhancement of production capacity and building of a supply chain

The company’s policy lies in enhancing production capacity to raise the ratio of sales to clients outside the group from the current 52% to 70% (4.5 billion yen).

Keeping an eye on global business operation, they intend to boost sales, which stood at 3.24 billion yen in the fiscal year ended January 2025, to 6.5 billion yen by the fiscal year ending January 2028.

③ Expansion of products for the construction domain

Provided to Azabudai Hills, Skytree Tokyo Solamachi, Kabukicho Tower, etc.

(Taken from the material of the company)

Home use |

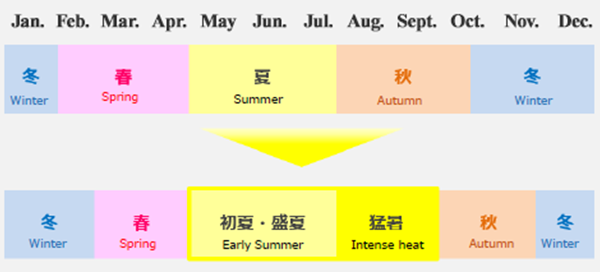

① Sale policy 2025

To change sale periods from four seasons to five seasons, and extend the summertime sale period from three months to five months, with the intention to capitalize on seasonality.

(Taken from the material of the company)

② Enhancement of online business

To promote the transformation of Aoyama Garden into a specialized store.

③ Product policy 2025

To expand the line-up to match the five seasons.

Moreover, the company will pursue alliances with overseas manufactures, such as GARDENA, a world-class quality German manufacturer, or Bestway, which offers commodities for casual enjoyment of authentic outdoor leisure.

Overseas |

To aim for the No. 1 manufacturer in the global garden category through brand development and the expansion of sales channels.

① Development of new products

To enrich the offer of high-end products which are sold for a long period of the year. To propose a package combining pergolas or gazebos and vegetable garden planters.

② Expansion of sales channels such as major chain stores and e-commerce

Sale at The Home Depot, Costco, Amazon, etc.

The company headhunted a department chief for new business development on the U.S. market. They will increase the number of major DIY stores which sell their products.

③ Development of the professional market

They will strive for expanding the sale of products for housing and construction with a high demand and high profit margin on the U.S. market, having launched initiatives with leading distributors and construction shops.

3. Fiscal Year Ended January 2025 Earnings Results

(1) Consolidated Earnings

| FY 1/24 | Ratio to sales | FY 1/25 | Ratio to sales | YoY | Company’s forecasts | Ratio to forecasts |

Sales | 19,411 | 100.0% | 19,890 | 100.0% | +2.5% | 20,750 | -4.1% |

Gross Profit | 8,335 | 42.9% | 8,389 | 42.2% | +0.6% | - | - |

SG&A | 8,444 | 43.5% | 8,539 | 42.9% | +1.1% | - | - |

Operating Income | -108 | -% | -150 | - | - | 150 | - |

Ordinary Income | 250 | 1.3% | 83 | 0.4% | -66.5% | 350 | -76.1% |

Net Income Attributable to Owners of the Parent | -75 | -% | -242 | - | - | 85 | - |

*Unit: million yen. The company’s forecasts are those as of the announcement date in August 2024.

*The figures include figures calculated by Investment Bridge Co., Ltd. as reference values, so they may differ from actual figures (the same shall apply hereinafter).

Sales increased 2.5%, and ordinary income decreased 66.5% year on year.

Sales increased 2.5% year on year to 19,890 million yen.

In Japan, the sales of the professional use business grew, but the home use business struggled. The overseas business saw significant growth. The garden and exterior industry continued to face challenging conditions due to rising raw material prices and a decrease in new housing starts. On the other hand, driven by the expansion of demand from foreign visitors to Japan, capital investment in commercial and accommodation facilities progressed, leading to a 130% year-on-year growth in the non-residential sector. Additionally, demand for the renovation and remodeling of gardens and exteriors is emerging in the private sector. In sales promotion, GLD-LAB. enhanced its proposal capability by using 3D renderings and VR and launched the industry's first BIM content on "BIMobject" and high-definition architectural CG rendering service "EXVIZ." In the manufacturing division, a new factory in China was completed in March 2024, establishing a global production system. Furthermore, the company's LED lighting technology was highly recognized, leading to a technical partnership with Drone Show Japan Inc. to strengthen sales. Additionally, the company worked to improve productivity domestically through the streamlining of its production systems.

Ordinary income decreased 66.5% year-on-year to 83 million yen. In terms of profit, gross profit margin declined 0.7 points from 42.9% in the previous fiscal year to 42.2% due to discount sales implemented by overseas sales subsidiaries to boost sales and an increase in raw material costs and transportation costs related to procurement. SG&A expenses augmented due to factors such as increased production costs associated with the development of DX tools to expand sales, higher shipping costs at overseas sales subsidiaries due to increased sales on the Amazon Marketplace, and continued efforts in capital investment and talent acquisition. As a result, operating loss amounted to 150 million yen (an operating loss of 108 million yen in the previous year). A decrease in recorded foreign exchange gain from the previous year led to a decline in ordinary income. Furthermore, an increased tax burden, partly due to the strong performance of Takasho Digitec, resulted in a net loss attributable to owners of the parent company of 242 million yen (a net loss of 75 million yen in the previous year).

Both sales and all kinds of profits fell short of the company's forecast.

Sales status by business

| FY 1/24 | Ratio to sales | FY 1/25 | Ratio to sales | YoY |

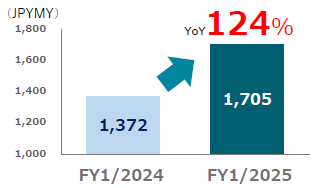

Professional use business

| 13,490 | 69.5% | 13,838 | 69.6% | +2.6% |

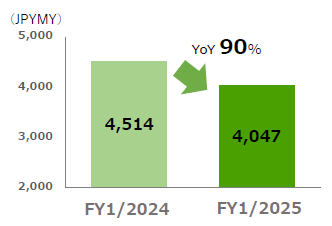

Home use business | 4,514 | 23.3% | 4,047 | 20.3% | -10.3% |

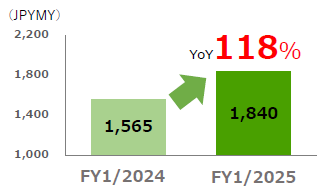

Overseas business

| 1,358 | 7.0% | 1,943 | 9.8% | +43.1% |

Consolidated sales | 19,411 | 100.0% | 19,890 | 100.0% | +2.5% |

*Unit: million yen

*Since the company recorded a small amount of sales outside of the above three businesses, total sales do not match the net sales of the three businesses.

*The figures in each business segment in the fiscal year ended January 2024 reflect the segment change.

Professional Use Business

Sales increased 2.6% year on year to 13,838 million yen.

The market environment became increasingly challenging in 2024 as new housing starts dipped below 800,000 units. However, leveraging the strengths of its domestic factories and offering a wide range of color options and customization to meet customer preferences, the company contributed to enhanced on-site value and improved productivity by providing products tailored to the specific needs of each project. Moreover, the company's new sales model, which integrates hardware and software and utilizes GLD-LAB.'s photorealistic digital tools (CG renderings, VR, and video production) to visualize on-site concepts with photorealistic accuracy, is gaining traction. The company also researched and developed digital technologies to promote DX across the organization. In the non-residential sector, which experienced a robust 30% year-on-year growth, the company benefited from its centrally located showroom near Shinagawa Station (opened in July 2024, just a 4-minute walk away) by hosting exhibitions and workshops to generate new business opportunities.

At Takasho Digitec, the company's focused sales efforts and collaboration with the parent company's landscape materials division continue to drive growth in the non-residential sector (public and commercial facilities). This has resulted in a strong 24% year-on-year increase in sales. Takasho Digitec is also developing innovative lighting designs, forging alliances to broaden the horizons of lighting design and presentation, and introducing new products from globally recognized lighting brands. The company is dedicated to contributing to a sustainable society and generating new value through contribution to local communities, technological advancements, and design promotion.

Home Use Business

Sales declined 10.3% year on year to 4,047 million yen.

Unfavorable weather and the impact of abnormal climate conditions dampened demand for seasonal products such as shades and greenhouses. Amid this, cost-push inflation and the rising prices of goods procured overseas due to the weak yen led to consumers curbing their spending. Changes in consumer purchasing behavior were observed in the home improvement center market, with a significant year-on-year decrease in the number of visitors to mass retailers. Despite efforts to strengthen online advertising and revise sales prices for mass retailers, sales declined.

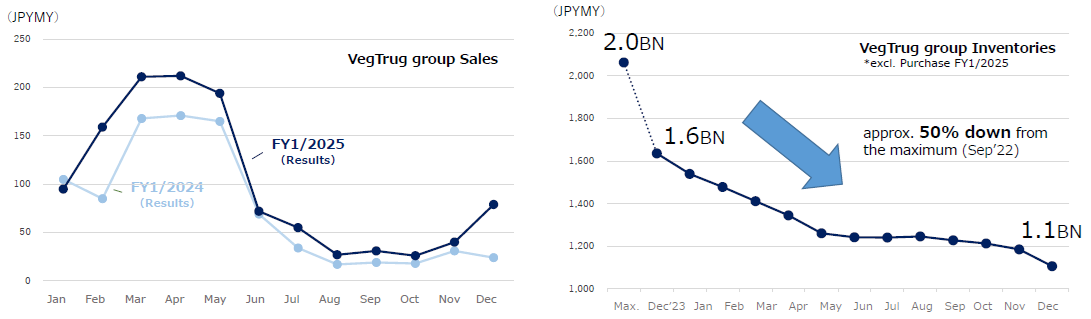

Overseas Business

Sales increased 43.1% year on year to 1,943 million yen.

In the United States, the number of visitors to garden centers and home improvement centers is recovering, and the excessive inventory at the company's business partners' stores has been reduced. In Europe, however, cautious consumer spending continues due to high energy prices and rising costs of essential goods. Despite this, the company achieved a double-digit increase in revenue through implementing price revisions, expanding the demand in key categories, and strengthening sales channels. Furthermore, in the United States, the growing demand for residential outdoor landscaping resulted in a rise in the average household expenditure on gardening activities. This growth of home gardening, driven by heightened health awareness and the desire for self-sufficiency in fruits and vegetables, is expanding the importance of landscaping. Additionally, in the overseas professional use business, orders received in the United States have increased significantly, up 97% year on year.

Sales by Segment |

|

|

| ||

| FY 1/24 | Ratio to sales | FY 1/25 | Ratio to sales | YoY |

Japan | 17,259 | 88.9% | 17,285 | 86.9% | +0.1% |

Europe | 432 | 2.2% | 666 | 3.4% | +54.3% |

China | 872 | 4.5% | 943 | 4.7% | +8.1% |

Korea | 214 | 1.1% | 198 | 1.0% | -7.8% |

US | 387 | 2.0% | 537 | 2.7% | +38.7% |

Others | 244 | 1.3% | 258 | 1.3% | +6.1% |

Total Consolidated Sales | 19,411 | 100.0% | 19,890 | 100.0% | +2.5% |

Japan | 502 | 2.9% | 549 | 3.2% | +9.3% |

Europe | -476 | - | -322 | - | - |

China | 56 | 6.4% | -137 | - | - |

Korea | -23 | - | -57 | - | - |

US | -231 | - | -253 | - | - |

Others | -47 | - | -44 | - | - |

Consolidated Adjustments | 111 | - | 116 | - | - |

Consolidated Operating Income | -108 | - | -150 | - | - |

*Unit: million yen

* Composition of operating income is on a consolidated basis before consolidation adjustments

(2) Financial Conditions and Cash Flow

Financial Conditions

| Jan. 24 | Jan. 25 |

| Jan. 24 | Jan. 25 |

Cash, Equivalents | 3,796 | 3,649 | Payables | 3,598 | 3,667 |

Receivables | 3,136 | 3,494 | Short Term Interest Bearing Liabilities | 4,020 | 4,700 |

Inventories | 6,994 | 7,023 | Current Liabilities | 9,505 | 9,810 |

Current Assets | 14,676 | 15,125 | Long Term Interest Bearing Liabilities | 389 | 589 |

Tangible Assets | 6,395 | 6,452 | Noncurrent Liabilities | 1,129 | 1,248 |

Intangible Assets | 566 | 518 | Net Assets | 12,499 | 12,756 |

Investments, Other Assets | 1,496 | 1,718 | Total Liabilities, Net Assets | 23,134 | 23,814 |

Noncurrent Assets | 8,458 | 8,688 | Total Interest Bearing Liabilities | 4,409 | 5,289 |

*Unit: million yen

*Interest Bearing Liabilities = Debt

At the end of the fiscal year ended January 2025, total assets stood at 23,814 million yen, up 680 million yen year on year, primarily due to an increase in current assets, such as accounts receivable.

Current liabilities increased 305 million yen year on year to 9,810 million yen, mainly due to a rise in interest-bearing debt.

Net assets increased 256 million yen year on year to 12,756 million yen, primarily due to the rise in foreign currency translation adjustment account.

Equity ratio stood at 53.0% (compared to 53.5% at the end of the previous fiscal year).

(3) Topics

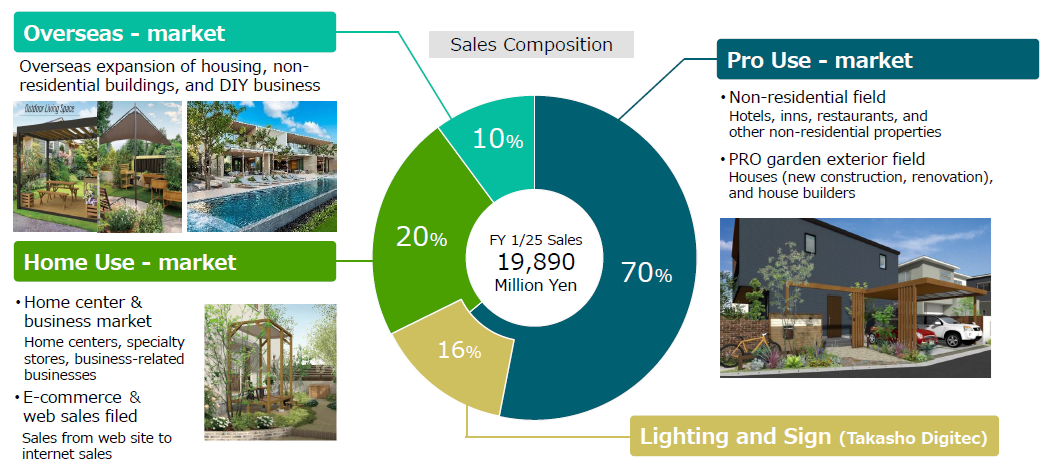

Professional Use

The professional use business, representing 70% of the company's sales composition ratio, saw a 30% year-on-year increase in non-residential sales, driven by a 24% year-on-year expansion in Takasho Digitec's revenue.

Sales growth in the non-residential fields  | Sales growth of Takasho Digitec  |

(Taken from the material of the company)

Home use

While the home use business, which accounts for 20% of sales composition ratio, struggled with a 10% year-on-year decrease, e-commerce sales within this business saw an 18% year-on-year increase.

Sales trend in home use - market  | Sales growth in e-commerce

|

(Taken from the material of the company)

Overseas

In the overseas business, which constitutes 9.8% of the company's sales composition ratio, sales significantly recovered with a 43% year-on-year increase. Furthermore, inventory, which was a challenge, has been reduced to approximately 50% of its peak.

(Taken from the material of the company)

4. Fiscal Year Ending January 2026 Earnings Forecasts

Consolidated Earnings

| FY 1/25 Act. | Ratio to sales | FY 1/26 Est. | Ratio to sales | YoY |

Sales | 19,890 | 100.0% | 21,736 | 100.0% | +9.3% |

Operating Income | -150 | - | 308 | 1.4% | - |

Ordinary Income | 83 | 0.4% | 405 | 1.9% | +383.4% |

Net Income Attributable to Owners of the Parent | -242 | - | 122 | 0.6% | - |

*Unit: million yen

Sales are expected to increase 9.3%, and ordinary income to increase 383.4% in the fiscal year ending January 2026 from the previous fiscal year.

For the fiscal year ending January 2026, the company forecasts net sales of 21,736 million yen, up 9.3% year on year, an operating income of 308 million yen (an operating loss of 150 million yen in the previous year), an ordinary income of 405 million yen, up 383.4% year on year, and a net income attributable to owners of the parent company of 122 million yen (a net loss of 242 million yen in the previous year). In the professional use business, the company will expand its proposal-based sales, including DX services, targeting construction companies and contractors to secure new projects. Furthermore, the company will strengthen its sales structure in the non-residential sector to expand sales. The company aims for further growth in the lighting business by developing new products and strengthening sales channels. It will leverage GLD-LAB. Corporation. to promote DX-based sales by fusing offline and online channels, such as AR and MR. The company will also enhance its sales and proposal capabilities for the non-residential sector, including major restaurant chains. The company will establish a sales system linking its seven showrooms nationwide with its website to revitalize local communities and realize a sustainable economic society. Takasho Digitec will collaborate technologically with Drone Show Japan Inc. to develop new light productions that integrate the drone technology with the company's lighting expertise.

In the home use business, the company will focus on strengthening sales in the e-commerce sector, promote the development of new products at its factories, and sell global products across several countries. For sales to home improvement centers, the company will proceed with improving its product lineup and work to expand its range of products that are less susceptible to weather conditions.

In the overseas business, the company will enhance its sales capability in the United States, promoting new transactions with major home improvement centers and selling professional use products. In Europe, the company aims to expand sales into untapped regions such as France and Italy, introduce new products/services, and develop new products. In the United Kingdom, leveraging the endorsement of VegTrug's flagship products by the Royal Horticultural Society (RHS), the company will continue to increase brand awareness. In Australia, the company will leverage the increased recognition resulting from the company's Australian subsidiary winning the "Supplier of the Year 2024 Award" to expand sales. In China, the operation of Takasho Digitec China's new factory is expected to increase the production capacity. In addition to producing outdoor lighting equipment, the company plans to mass-produce OEM products, LED signs, and BtoC products to increase exports to Asia, America, and Europe.

The company plans to pay a year-end dividend of 5.00 yen per share, like in the previous fiscal year.

5. Mid/long-term Plan

In the fiscal year ending January 2028, sales are expected to be 25,357 million yen and ordinary income is projected to be 1,343 million yen.

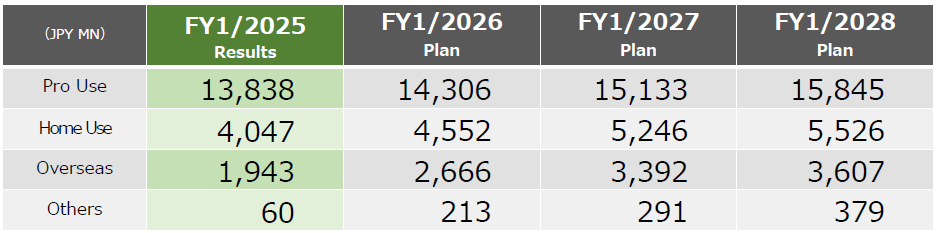

Segment Sales Plan

(Taken from the material of the company)

Policy for improving PBR

They will strive to optimize profitability, the efficiency of use of assets, and the composition of liabilities, and maximize revenues based on their business models and efficient cost management, with the aim of establishing an appropriate capital structure.

●Maximizing the Synergy among Group Companies

●Concentrating Investment in Key Business Areas

●Enriching Stable Shareholder Returns

●Efficiently Utilizing Assets

●Management Focused on Capital Efficiency

●Tightening Corporate Governance

●Investing in Human Capital

Policy for improving ROE

To achieve an ROE of 11.7% in the fiscal year ending January 2028, the company strategy focuses on the following key drivers (ROE = Net Profit Margin × Total Asset Turnover × Financial Leverage)

① Net Profit Margin (Profitability)

●The company will improve the gross profit margin of all businesses to increase operating income margin.

●The company will also strive to reduce the SG&A expense ratio through BPR initiatives.

② Total Asset Turnover (Asset Efficiency)

●The company will review its assets and reduce inventory and fixed assets.

●The company will increase sales.

③ Financial Leverage

While pursuing an optimal capital structure, the company anticipates maintaining the current level.

Furthermore, the company's targets for Return on Assets (ROA) are 0.5% for the fiscal year ending January 2026 and 3.1% for the fiscal year ending January 2028.

6. Conclusion

The sluggish recovery of the domestic home improvement center market resulted in an operating loss for the fiscal year ended January 2025. Nevertheless, preparations for future business expansion are steadily underway. In the professional use business, contractor-focused products grew significantly, with non-residential sales increasing 30% year on year. The company is achieving success in the food service industry and other sectors. Takasho Digitec's growth is particularly notable, and we believe its limited current sales indicate significant potential for future expansion, which will likely drive overall growth. Production capacity has also increased, and higher sales contribution should lead to greater profitability in the future. The overseas business has also seen a substantial reduction in inventory, paving the way from recovery to growth. We are also closely watching the professional use business initiatives. While the domestic home use business struggled in the fiscal year ended January 2025 due to unfavorable weather, a rebound is anticipated in the fiscal year ending January 2026. Furthermore, e-commerce sales in the home use business are expected to continue increasing both domestically and internationally.

If the company achieves the net profit target of 776 million yen in the fiscal year ending January 2028, as outlined in its medium-term plan, EPS will be approximately 50 yen. Considering the anticipated growth from the fiscal year ending January 2026 onward, we believe the current share price, whose PBR is significantly below 1, presents potential for rise.

<Reference: Concerning Corporate Governance>

◎ Organizational structure and composition of directors and corporate auditors

Organizational structure | Company with audit and supervisory board |

Directors | 5, out of which 2 are outside directors. |

Corporate auditors | 3, out of which 2 are outside directors. |

◎ Corporate Governance Report

Last updated: April 17, 2024

<Basic policy>

Takasho recognizes that the establishment of corporate governance that is sound and highly transparent and secures the efficiency of management decision-making to respond promptly and appropriately to changes in the business environment is an important matter and is working on it.

< Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts) >

Principles | Reasons for not implementing the principles |

[Supplementary Principle 2-4-1 Ensuring diversity in the appointment of core personnel, etc.]

| Our company is actively working to ensure diversity, for example, by promoting women to management positions, and has set targets for the percentage of women in management positions and stated them in the action plan based on the Act on the Promotion of Women’s Participation and Advancement in the Workplace. In addition, our company is striving to create an environment that ensures diversity by providing training and implementing various measures related to respecting diversity, etc. We have not formulated any medium/long-term strategies or policies that will serve as the basis for these initiatives, however, we will continue to consider the formulation of such strategies and policies to enhance corporate value. |

[Supplementary principle 4-8-1 Exchange of information and sharing of recognition by independent outside directors from the objective standpoint] | At present, there are no regular meetings, etc. consisting of independent external directors only, but our outside directors exchange views with other directors and corporate auditors, and they actively participate in the Board of Directors and make remakes. Therefore, we believe that our external directors are fulfilling their roles and responsibilities. |

< Disclosure Based on the Principles of the Corporate Governance Code (Excerpts) >

Principles | Reasons |

[Principle 1-4 Strategically held shares] | (1) Policy on strategic shareholding Our company will hold shares strategically after comprehensively judging whether they will lead to the maintenance and strengthening of business relationships or whether they will lead to an improvement in our medium- to long-term corporate value through smooth promotion of business activities, etc.(2) Details of the check of the appropriateness of strategic shareholdingwe will examine the effects of strategic shareholding from the perspective of maintaining medium- to long-term economic rationality and maintaining and strengthening the overall relationship with our business partners and report the results to the Board of Directors. The company will reduce the number of shares that are considered not worth holding. (3) Criteria for exercising voting rights pertaining to strategic shareholdingWe will review the contents of the shareholder meeting agenda of the investee company based on the prospect of sustainable development and medium- to long-term corporate value enhancement for both investee company and our company and exercise the voting rights. |

[Principle 2-6 Functioning as an asset owner for corporate pensions] | The company has a defined benefit corporate pension system and has entered into agreements with an asset management organization that has expressed acceptance of stewardship activities with respect to the administration and management of corporate pensions. A person from the General Affairs and Human Resources Department is assigned to receive regular reports from the entrusted organization on the soundness of the management, and the relevant departments conduct monitoring as appropriate. In addition, we have adopted a corporate defined contribution pension plan to build employees’ assets. At the time of hiring, employees are briefed on the investment period, selection of investment instruments, and asset management. |

[Supplementally Principle 3-1-3 Sustainability Initiatives] | Our group's policies and initiatives regarding sustainability are disclosed in our Annual Securities Report. |

[Supplementary principle 4-1-1 Roles and responsibilities of the Board of Directors] | Our company has established the “Regulations for the Board of Directors,” the “Rules for Approval,” and the “Detailed Rules for Approval” as important decision-making items, in addition to matters stipulated by laws and regulations and the Articles of Incorporation, determining the scope of decision-making by the Board of Directors. In order to enhance the swiftness and flexibility of business execution and increase the vigor of management, the Board of Directors deliberates and makes decisions on business execution other than those matters stipulated by laws and regulations, the Articles of Incorporation, and the “Regulations for the Board of Directors” at the Executive Committee, which is also attended by the Representative Director. |

[Principle 4-8 Effective utilization of independent directors] | Our company appoints two outside directors. They are the independent outside directors to keep an independent and neutral position in the discussions at the Board of Directors. We will continue to select candidates so that multiple independent outside directors with high expertise and rich experience can be appointed. |

[Supplementary Principle 4-11-1 General idea on the balance of knowledge, experience and capabilities, diversity and size of the Board of Directors] | In order to respond appropriately and swiftly to changes in the business environment, the company appoints human resources with diverse backgrounds to its Board of Directors, taking into account the balance of knowledge, experience and capabilities. Outside directors, in particular, are selected based on their knowledge of the industry, experience in management, and professional abilities in their respective fields to ensure balance and diversity. In addition, considering the size of the company and other factors, the company’s articles of incorporation limit the number of directors to be not more than 15, and there are currently five directors (including two outside directors). |

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. |