| Ferrotec Corporation (6890) |

|

||||||||

Company |

Ferrotec Corporation |

||

Code No. |

6890 |

||

Exchange |

JASDAQ |

||

Industry |

Electric Equipment (Manufacturing) |

||

President |

Akira Yamamura |

||

HQ Address |

Nihonbashi Plaza Building, Nihonbashi 2-3-4, Chuo-ku, Tokyo |

||

Year-end |

March |

||

URL |

|||

* Stock price as of closing on June 8, 2012. Number of shares at the end of the most recent quarter excluding treasury shares.

|

||||||||||||||||||||||||

|

|

* Estimates are those of the Company.

|

|

| Key Points |

|

| Company Overview |

|

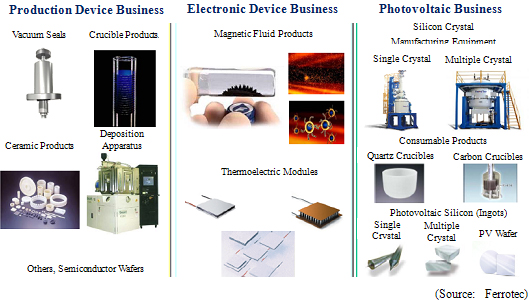

(Business Segments)

Ferrotec' s operations can be divided between the production device business segment where vacuum seals, quartz products, and other ceramics products used in semiconductor, FPD, and LED related manufacturing equipment are manufactured, electronic device business segment where thermoelectric module application products are made, and photovoltaic business segments where silicon single crystal manufacturing equipment and crucibles used in devices are produced. In fiscal year March 2012, these business segments accounted for 41%, 9% and 46% of sales respectively, in addition to the other business segment which accounted for 4% (Saw blades, equipment part cleansing, machine tool, and other products not included in reported segments). Moreover, Ferrotec leverages its knowhow and technologies in vacuum seals, which are a main product of the production device business segment, in its silicon crystal manufacturing equipment.

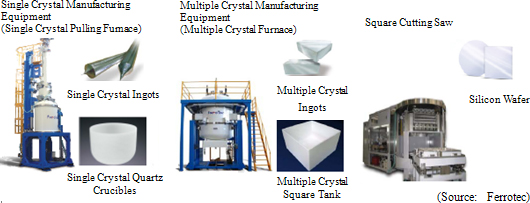

(1) Endeavors in the Photovoltaic Business Segment

During fiscal year March 2012, the production device and photovoltaic business segments got off to a good start, but from the middle of the fiscal year the European sovereign debt crisis and subsequent financial instability there and a sudden slowing in the Chinese economy led to a deterioration in Ferrotec' s business. And while a recovery is anticipated during the second half of the coming fiscal year March 2013, the Company expects "growth in the photovoltaic business to continue for as long as the sun continues to shine." In response to the declines in pricing of flat panels, prices of production devices, crucible products, and the raw materials of silicon crystals have also fallen, but Ferrotec seeks to offset these conditions by promoting efforts to raise its productivity. At the same time, new more productive (30% faster and a 20% improvement in yields) and energy efficient (Consumes 20% less electricity) silicon single crystal manufacturing equipment are being introduced as part of the Company' s strategy of differentiating itself from its competitors.

(2) New Drivers of Growth

With regards to the production device and electronic device business segments, Ferrotec will leverage its vacuum and precision processing technologies and other core technologies to cultivate new drivers of growth.

Production Device Business Segment

While Ferrotec has taken on the processing of wafers for small diameter discrete circuit applications (Cut from ingots and mirror finished) about 10 years ago, it has focused upon the provision of its own branded wafers from three years ago and acquired the approval of manufacturers in Japan, China and Taiwan during fiscal year March 2012. During fiscal year March 2013, Ferrotec expects its branded wafer sales to power semiconductor applications to grow (Currently producing 150,000 per month, but expected to rise to 200,000 during the second quarter). In addition to facilitating service functions that can respond to the increase in the mass production of Ferrotec brand wafers, they expect to also fortify their facilities.

・ Wafers for Small Diameter Discrete Circuits ・ Vacuum Chamber Deposition Equipment

The manufacture of vacuum chambers for MOCVD equipment used in the manufacture of elements used in LED devices are also gaining speed. Specialized manufacturers of chambers (Many chamber manufacturers make applications for water tanks, tank trucks, and boilers) for electronics industry applications are few in number, with even fewer manufacturers capable of making vacuum chambers for MOCVD equipment that can withstand temperatures of over 1,500 degrees centigrade. Ferrotec has been rated highly by its clients for its crystal manufacturing equipment which use high levels of sophisticated vacuum technologies that are highly temperature resistant. In addition, Ferrotec' s United States subsidiary purchased Temescal (Vacuum deposition equipment related business) from Edwards Vacuum Inc. in January 2010 with its backend process for MOCVD using electrode formation technologies to develop new clients in the deposition equipment realm for composite semiconductors, crystal transmitters, and LED applications.

・ Sapphire Furnaces

Similarly, growth furnaces (Sapphire furnace) are being developed for single crystal sapphire (Used as a substrate to grow crystals for LEDs) in the realm of LED related applications with sample shipments of two varieties including 35 kilogram and 70 kilogram units being started in March 2012. The quality of single crystal sapphire used influences the quality of LEDs, and while the cost competitive nature of LEDs can be strengthened by reducing the cost of the sapphires, there are only a few manufacturers making sapphire furnaces in Russia, Ukraine, and the United States. Ferrotec has been successful in its joint development efforts with a research institution sponsored by the Chinese Government.Furthermore, the Chinese Government is considering eliminating highly energy inefficient incandescent light bulbs currently used in China by 2016 and a roadmap for this plan was released by the National Development and Reform Commission last autumn. According to this roadmap, the sale and import of incandescent light bulbs of over 100 watts and 60watts will be prohibited from October 1, 2012 and October 1, 2014 respectively, and incandescent light bulbs of over 15 watts will be halted from October 1, 2016. Furthermore, production, sales, and imports of halogen light bulbs that fall below energy conservation standards will also be prohibited. The Chinese Government also announced that it will begin awarding subsidies to LED related manufacturers as part of its strategy to grow the LED lighting market by 2016. Ferrotec seeks to contribute growth in the Chinese LED market by providing vacuum chambers and sapphire furnaces to customers in that market (Ferrotec is expected to expand its offering of LED related products). Electronic Device Business Segment

・ Power Device Circuit Board

Insulated Gate Bipolar Transistor (IGBT) is seeing an expansion in demand due to its crucial need in inverter applications (Power circuits that enable direct current to be converted to alternating current combined with control devices to reduce power consumption), and Ferrotec has successfully developed IGBT circuit boards which can be combined with a cooling thermo-module. The market for this product is estimated to be worth ¥10.0 billion and products are expected to begin being provided to domestic manufacturers from fiscal year March 2013 (The synergy of this application with the small diameter wafers for power semiconductor applications in the production device business segment is high). In addition, the development of new materials has contributed to an improvement in the yields of thermoelectric modules from the traditional levels of 30% to 92%. Collaborative efforts with its consolidated subsidiary Ferrotec Nord Corporation have allowed Ferrotec to successfully develop the world' s highest performance thermoelectric module, and it is the only company to boast of an automated production line for thermoelectric modules. The Company will leverage the high functional effectiveness and cost performance of its thermoelectric modules to increase its market share of the biotechnology and optical communications market. |

| Fiscal Year March 2012 Earnings |

Sales Rise by 3.8%, Ordinary Income Fall by 47.7%

Sales rose by 3.8% year-over-year to ¥60.0 billion. The production device and the electronic device business segments saw declines in sales, while steady processing of order backlog contributed to increased sales of crystal manufacturing equipment and consumables, allowing photovoltaic business segment sales to rise by a large margin. Operating income declined by 40.5% year-over-year to ¥4.12 billion. Lower sales of the production device and electronic device business segments caused marginal profitability of these segments to decline, and profits of the photovoltaic business segment declined by two thirds due to declines in product pricing and valuation losses on raw materials inventories. Non-operating income deteriorated on the back of increases in financial expenses (Rose from ¥457 to ¥581 million) and commissions accompanying the establishment of a commitment line (¥190 million). Extraordinary income declined (Disappearance of revised earnings adjustments and reversals of insurance redemptions) and contributed to a 61.7% year-over-year fall in net income.Capital investments and depreciation increased to ¥7.87 and ¥2.82 billion from ¥5.03 and ¥2.65 billion in the previous term respectively. The Yen to United States Dollar exchange rate strengthened by ¥4.2 to ¥79.6 compared with ¥83.8 in the previous year. At the same time the Yen to Chinese Yuan exchange rate also strengthened by ¥0.2 from ¥12.5 in the previous term to ¥12.3 in the current term.  Production Device Segment

Sales and operating income declined by 10.1% and 19.3% year-over-year to ¥24.88 and ¥2.49 billion respectively. By product, sales of ceramics rose, however sales of vacuum seals used in semiconductor, FPD, and LED manufacturing equipment and quartz crucibles used as consumables in the manufacture of semiconductors fell by large margins. At the same time, silicon wafer processing sales also declined. Moreover, sales of machinable ceramic "photoveel" (Used as a guide board for probe pins in top down probe cards) used in logic IC and flash memory, which are growing along with the expansion in the smart phone market, grew.

Electronic Device Segment

Sales and operating income declined by 22.8% and 52.4% year-over-year to ¥5.33 and ¥0.55 billion respectively. Thermoelectric module products for medical and biotechnology devices, semiconductor, and optical applications trended strongly, while automobile seat automatic heating applications fell as model changes at some customers led to inventory adjustments, and consumer product applications deteriorated due to order decreases resulting from termination of the eco-points system, the floods in Thailand and others.

Photovoltaic Segment

Sales grew by 29.3% year-over-year to ¥27.35 billion, while operating income declined by 68.7% year-over-year to ¥0.77 billion. The processing of order backlog allowed manufacturing equipment (Crystal manufacturing and square cut wire saws) to rise, and increases in market share in Japan, China and Korea allowed quartz crucibles sales to grow. A sudden deterioration in market conditions (40% year-over-year decline in prices) led to production adjustments during the second half, but sales of photovoltaic silicon still managed to rise. With regards to profits, an overall decline in product prices, valuation losses on polysilicon used as raw materials in photovoltaic silicon (¥0.3 and ¥0.26 billion in the first and second halves of the fiscal year) and ¥1.4 billion in related devices development expenses contributed to weaker profits.Furthermore, new orders declined by a large margin during the second half along with the sudden deterioration in manufacturing equipment market conditions. And while consumable products such as quartz crucibles for single crystal silicon trended strongly, multiple crystal silicon square tanks suffered from weak demand. Solar cell silicon market conditions deteriorated a step further, and processed products including wafers saw large declines in prices (Fell by 40% year-over-year).

|

||||||||||||||||||||||

| Fiscal Year March 2013 Earnings Estimates |

Sales, Ordinary Income Expected to Decline by 16.8% and 75.7% Year-Over-Year

Sales are expected to fall by 16.8% year-over-year to ¥50.0 billion in fiscal year March 2013. Production device segment is expected to see a gradual recovery beginning in the second half of the fiscal year, but difficulties are anticipated in the photovoltaic business due to continued weakness in pricing and the sudden decline in orders for manufacturing equipment. Furthermore, the electronic device segment is expected to see growth in volume of thermoelectric modules for automated seat heaters, which comprise the bulk of this segment, but weak pricing trends are expected to remain in place.Operating income is expected to decline by 70.9% year-over-year to ¥1.2 billion in fiscal year March 2013. In addition to a decline in marginal profitability resulting from the lower sales, valuation losses on inventories (Polysilicon used as raw materials in silicon solar cells) of ¥0.6 billion have also factored into cost of goods sold estimates. The improvement in non-operating income is attributed to the disappearance of commissions from the commitment line established in the current term and the assumption of no foreign exchange losses. Capital investments of ¥1.8 billion (¥7.87 billion in FY3/12) and depreciation of ¥3.1 billion (¥2.82 billion in FY3/12) are anticipated. An exchange rate of ¥78.0 to the United States Dollar and ¥12.8 to the Chinese Yuan are expected (¥79.6 per USD and ¥12.3 per Yuan in FY3/12).  Production Device Segment

Vacuum seals and quartz products are expected to encounter continued difficult conditions, but Ferrotec branded products are expected to grow and contribute to a recovery in wafer processing along with strength in ceramic products due to an expansion in the smart phone market. Subsequent to these trends, sales are expected to decline by 5.4% year-over-year to ¥23.53 billion.

Outlook for Main Products

Electronic Device Segment

A decline in thermoelectric module sales to ¥4.55 billion in fiscal year March 2013 from ¥4.93 billion in the previous term is expected to reduce electronic device segment sales by 7.3% year-over-year to ¥4.95 billion. While the volume thermoelectric modules provided is expected to remain firm on the back of strong demand from automated heated seat applications in the automobile industry, with applications for one new model expected to be seen in both the first and second halves of the fiscal year, as well as from consumer products, biotechnology equipment, semiconductor, and optical industry applications, weaker unit pricing is expected to contribute to declines in the value of sales. The launch of power device circuit board applications of thermoelectric modules, and large improvements in yields resulting from the development of new materials used in new products is expected to increase market share in the optical communications market. At the same time, efforts to implement higher levels of automation in production lines will also be promoted.

Photovoltaic Segment

Sales of quartz crucibles are expected to rise by 17.0% year-over-year on the back of the increase in the total number of units of manufacturing equipment in operation. However the rapid decline in orders during the second half of the current fiscal year is expected to contribute to a 61.4% year-over-year decline in manufacturing equipment. Furthermore weaker demand and pricing are expected to lead to a 27.2% year-over-year decline in sales of solar cell use silicon.

Outlook for Main Products

|

| Conclusions |

|

Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2012 Investment Bridge Co., Ltd. All Rights Reserved. To view back numbers of Bridge Reports on Ferrotec Corporation (6890) and other companies and to see IR related seminars of Bridge Salon, please go to our website at the following url: www.bridge-salon.jp/ |