| Ferrotec Corporation (6890) |

|

||||||||

Company |

Ferrotec Corporation |

||

Code No. |

6890 |

||

Exchange |

JASDAQ |

||

Industry |

Electric Equipment (Manufacturing) |

||

President |

Akira Yamamura |

||

HQ Address |

Nihonbashi Plaza Building, Nihonbashi 2-3-4, Chuo-ku, Tokyo |

||

Year-end |

March |

||

URL |

|||

* Stock price as of closing on November 30, 2012. Number of shares issued at the end of the most recent quarter excluding treasury shares.ROE and BPS are based on the actual term end amounts.

|

||||||||||||||||||||||||

|

|

* Estimates are those of the Company.

|

|

| Key Points |

|

| Company Overview |

|

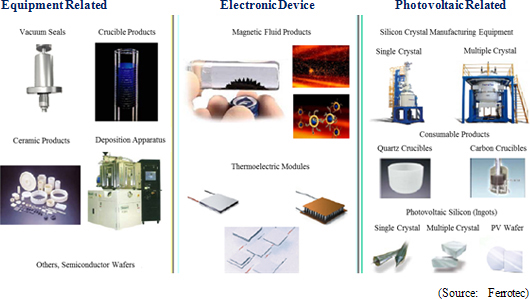

(Business Segments)

Ferrotec' s operations can be divided between the equipment related business segment where vacuum seals, quarts, and other ceramics products used in semiconductor, FPD, and LED related manufacturing equipment are manufactured, electronic device business segment where thermoelectric module application products are made, and photovoltaic business segments where silicon single crystal manufacturing equipment and crucibles used in devices are produced. In fiscal year March 2012, these business segments accounted for 41%, 9% and 46% of total sales respectively (Saw blades, equipment part cleaning service, machine tool, and other products not included in reported segments). Moreover, Ferrotec leverages its knowhow and technologies for vacuum seals, which are a main product of the equipment related business segment, in its silicon crystal manufacturing equipment.

|

| Business Structure Reforms |

However, reductions in the scale of the photovoltaic diffusion support measures and the European sovereign debt crisis led to rapid decline in demand in Europe during the second half of 2011. Further deterioration in market conditions in 2012 caused many Chinese photovoltaic panel manufacturers to encounter financial difficulties. Along with the rapid decline in demand for equipment and consumable products and drops in silicon product pricing, Ferrotec saw a rapid deterioration in its photovoltaic related business from the second half of fiscal year March 2012. And while market conditions were expected to bottom during fiscal year March 2013, conditions and earnings continued to worsen. Given the outlook for a continuation of the severe business conditions for the foreseeable future, Ferrotec has taken the decision to create and implement a "business restructuring plan" that calls for the retreat from manufacturing and sales of its own brand of silicon products, in addition to reductions in the manufacturing and sales of silicon crystal manufacturing equipment and quartz crucibles (Shift towards a low risk business model that conducts outsourced manufacturing of silicon ingots). In addition to the implementation of the "business restructuring plan," losses arising from impairment and retirement losses on some facilities and rationalization of personnel are expected to inevitably contribute to large net losses during fiscal year 2013. However the disappearance of these losses and success of these measures are expected to contribute to improvements in profitability of the photovoltaic related business, steadfast earnings contribution from products with high shares in niche markets including equipment related and electronic devices could contribute to a "V" shaped recovery in earnings during fiscal year March 2014. (Business Restructuring Plan Overview)

In addition to downsizing of the unprofitable photovoltaic related business, reductions in labor costs including cuts in personnel and compensation to directors are expected to be implemented.

(1) Reduction in Photovoltaic Related Business

Ferrotec will scale down production of silicon crystal manufacturing equipment and some consumable products, cease manufacture and sales of wafer cells, and retreat from manufacture and sales of silicon ingots and other Ferrotec branded products along with a shift to a low risk business model where consigned manufacture of products is conducted.

① Silicon Crystal Manufacturing Equipment:

While demand to replace older products including the main products of single crystal pulling equipment, multiple crystal manufacturing equipment, and block cutting wire saw equipment with newer products is anticipated, uncertainty surrounding the ability to recover payments from many customers due to deterioration in their cash flows has led Ferrotec to restrain its marketing activities for these products currently. Therefore, the Company is required to reduce production by large margins and to incur valuation and retirement losses on inventories. Despite these conditions, Ferrotec will continue to invest in research and development for energy conservation and other high value added functions over the intermediate term.

Reduction in Production of Some Products ② Consumable Products:

Demand for the main products of quartz crucibles, hot-zones, and other consumable products used in crystal ingot pulling equipment is stagnating due to adjustment of production activities by customers. Therefore, Ferrotec will incur impairment and other losses due to its retreat from the manufacturing of crucibles in the United States (Plant closure), where major photovoltaic panel manufacturers have gone bankrupt, and to reductions in crucible manufacturing equipment at the manufacturing plant in China.

Reduction in Production of Some Products ③ Photovoltaic Silicon:

Continued declines in pricing of major products including silicon ingots and silicon wafers and cells have left costs uncovered and resulted in losses. Therefore, Ferrotec will retreat from the manufacture and sales of its own branded products and implement a shift to a business model where silicon ingot production is done on a consigned basis.Retreat from Ferrotec Branded Products (2) Reductions in Personnel, Director Compensation, and Other Fixed Costs

(Future Business Policies)

Ferrotec will endeavor to make the photovoltaic related business profitable through reductions in silicon crystal manufacturing equipment and consumable product production, and conversion of the photovoltaic use silicon business model. In addition, the continued profit generation from products that have high shares of niche markets in the equipment related device and electronic device business segments is expected to allow a return to profitability from fiscal year March 2014 and to put the Company back on a renewed growth path from fiscal year March 2015.

Equipment Related Business Segment

Electronic Device Business Segment

Ferrotec is expected to aggressively introduce new versions of its main thermoelectric modules using high performance materials. The Company will also increase automated manufacturing lines to ensure stability of supplies and to reduce costs. Moreover, Ferrtoec will fortify its direct sales structure (Sales distributors have been used until now) in order to cultivate demand from communications, medical, biotechnology and other industry applications that call for high performance products, in addition to its traditional customers in the automobile industry, which accounts for over half of all product demand in the North American market. Furthermore, as part of efforts to increase product quality and production efficiency of Direct Copper Bonded (DCB) circuit boards used in power semiconductors, for which demand is strong, sales will be expanded in the main markets of Europe and Japan. At the same time, DCB circuit boards have superior heat resistance due to their ability to bond copper circuits directly to ceramic circuit boards using DCB methods to create heat insulating circuit boards (An example of how Ferrotec leverages its technologies in the realm of thermoelectric modules).

Photovoltaic Related Business Segment

Ferrotec will focus its product development efforts upon energy conserving products that reduce running costs and products with recharge functions in the realm of silicon crystal pulling devices, for which demand is declining. At the same time, the Company will retreat from the in-house branded silicon products business, and will specialize in manufacture of silicon ingots on a consigned basis. Moreover, manufacture of consumable products like quartz crucibles will be continued for photovoltaic products and semiconductor applications.

Other Business Segment (Non-Reported Segment)

Ferrotec has been able to fortify its earnings structure by aggregating in China the consigned manufacturing of processing equipment, surface treatments (Plating, parts cleaning service), saw blades and other products, which are relatively unaffected by fluctuations in the economy. Furthermore, smartphone glass processing and polishing equipment, and core drill and polishing equipment using sapphires are being prepared as new products to be introduced during the next term (Both products leverage knowhow in the realms of internalized NC rooters and NC lathes for consigned processing). In addition, sapphire furnace development for LED circuit boards that leverage crystal furnace technologies developed in the silicon crystal manufacturing equipment process.

|

| First Half Fiscal Year March 2013 Earnings Results |

Sales Decline by 43.9% Year-Over-Year, Ordinary Loss of ¥2.711 Billion Incurred

Sales declined by 43.9% year-over-year to ¥20.048 billion during the first half of the fiscal year. Weakness in the semiconductor related and photovoltaic industries contributed to large declines in the sales of all three business segments including equipment related, photovoltaic related, and electronic device businesses. Consequently an operating loss of ¥2.153 billion was incurred (Compared with an operating income of ¥3.564 billion in the previous first half). Deterioration in profitability of all segments was recorded, with a particularly large operating loss of ¥2.393 billion seen in the photovoltaic related business segment alone (Compared with an operating income of ¥984 million in the previous first half). An analysis of the consolidated income statement shows how valuation losses on inventories of silicon crystal manufacturing equipment materials (Review of parts and materials inventories was conducted along with the downsizing of this business) of ¥827 million, and on materials due to pricing declines (Polysilicon) of ¥438 million contributed to a 10% point increase in cost of sales margin to 81.9% (Aside from these special factors, cost of sales would have risen by a smaller margin of 3.6% points to 75.5%). Efforts to reduce expenses contributed to a decline in variable costs and allowed selling, general and administrative expenses to decline by 10.7% year-over-year to ¥5.788 billion despite ¥681 million in provisions to doubtful account reserves due to the potential inability to recover some accounts receivables. Despite the large operating loss, a large portion of this loss can be attributed to valuation losses and other expenses which were not accompanied by payments. Therefore cash flow remained relatively healthy with a small margin of net outflow of ¥157 million in operating cash flow (Compared with a net inflow of ¥2.460 billion in the previous first half). Net loss of ¥6.157 billion was recorded during the first half. Commission payments declined from ¥121 to ¥8 million due to the disappearance of fees arising from the public offering last term. At the same time increases in interest payments from ¥275 to ¥322 million and foreign exchange translation losses from ¥80 to ¥183 million contributed to deterioration in non-operating income. Sales of affiliated company shares amounted to ¥75 million in profit and contributed to extraordinary income of ¥79 million. At the same time, business restructuring expenses (Liquidation of the United States crucible manufacturing plant, and raw materials related expenses associated with the photovoltaic business segment) and valuation losses on marketable securities amounted to ¥2.684 billion and ¥166 million respectively, and contributed to a extraordinary losses of ¥2.909 billion. Based on the outlook for continuation of a difficult earnings environment, Ferrotec has decided to use consolidated deferred tax assets of ¥586 million. The average exchange rate used during the first half was ¥79.78 per US dollar, and ¥12.65 per Chinese yuan (¥81.78 and ¥12.52 respectively in the previous term).   Equipment related Business Segment

Sales and operating income declined by 35.3% and 92.5% year-over-year to ¥9.509 billion and ¥140 million respectively. Sales over the first half of the current and previous terms of vacuum seals, quartz products, EB guns and LED deposition equipment, ceramics, and wafer processing declined from ¥4.352 to ¥2.427, ¥3.265 to ¥1.743, ¥2.262 to ¥1.283, ¥2.324 to ¥2.148, and ¥2.493 to ¥1.909 billion respectively. However, demand for quartz product and ceramics etc, which are materials used in manufacturing processes, was consistent by investments for scaling down of semiconductors used in smartphones, and electronic beam equipment (Product of the US subsidiary) used in communication control ICs for smartphones remained strong.

Photovoltaic Related Business Segment

Sales declined by 57.8% year-over-year to ¥7.022 billion while an operating loss of ¥2.393 billion (Compared with an operating income of ¥984 million in the same term of the previous year) was incurred. The region from which the largest demand is derived of Europe suffered from reductions in government support measures, and China disrupted the supply and demand balance with its oversupply of products, contributing to a weakening in demand for manufacturing equipment and consumable products and in pricing for silicon products. Provisions to doubtful account reserves to cover accounts receivables extended to some clients who may have difficulty in paying for products and subsequent valuation losses on equipment and silicon materials due to restraint in sales contributed to an expansion in losses.

Electronic Device Business Segment

Sales and operating income declined by 31.8% and 78.1% year-over-year to ¥2.195 billion and ¥115 million respectively. The bulk of this segment's sales are in thermoelectric module related applications products. Declines in sales to semiconductor manufacturing equipment applications contributed to declines in both sales and profits. And aside from weakness seen in sales to seasonal products in consumer related applications, earnings of this segment were basically in line with expectations. The main application of automobile seat automated heating applications grew on the back of an increase in the number of new contracts for luxury cars.

|

| Fiscal Year March 2013 Earnings Estimates |

Sales of ¥18.951 Billion and Net Loss of ¥2.142 Billion Expected in Second Half

Sales during the second half of the current term are expected to decline by 22.2% year-over-year to ¥18.951 billion. Sales of thermoelectric modules for automated seat heaters and other products of the electronic devices business are expected to grow. However, sales of the photovoltaic related business segment are expected to decline by a large margin and sales of the production equipment business are also expected to contract based on the outlook for continued weakness in the semiconductor market.

Full Year Sales to Decline by 35.1% Year-Over-Year to ¥39.0 Billion,

First half earnings fell short of initial estimates, and second half and full year earnings estimates have been revised down to reflect the "business restructuring plan". Assumptions for foreign exchange rates are ¥78 per US dollar (¥79.6 per US dollar in the previous term) and ¥12.8 per Chinese yuan (¥12.3 per yuan in the previous term). A dividend of ¥5 per share is expected to be paid at the term end. Because Ferrotec's subsidiaries end their fiscal year in December, the positive impact of the "business restructuring plan" upon profitability of the photovoltaic related business segment is expected to be seen from fiscal year March 2014.

Net Loss of ¥8.3 Billion (Net Income of ¥1.715 Billion in FY3/12)  |

| Conclusions |

|

Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2012 Investment Bridge Co., Ltd. All Rights Reserved. |