Bridge Report:(6890)Ferrotec Fiscal Year March 2019

Akira Yamamura, President | Ferrotec Holdings Corporation (6890) |

|

Company Information

Exchange | JASDAQ |

Industry | Electric Equipment (Manufacturing) |

President | Akira Yamamura |

HQ Address | Nihonbashi Plaza Building, Nihonbashi 2-3-4, Chuo-ku, Tokyo |

Year-end | March |

Website |

Stock Information

Share Price | Shares Outstanding | Market Cap. | ROE (Act.) | Trading Unit | |

¥884 | 37,013,134shares | ¥32,720million | 5.7% | 100shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥24.00 | 2.7% | ¥126.98 | 7.0x | ¥ 1,337.33 | 0.7x |

*Share price as of closing on July 9, 2019.

Consolidated Earnings Trends

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS (¥) | DPS (¥) |

March 2016 (Act.) | 69,463 | 4,024 | 3,822 | 2,162 | 70.18 | 10.00 |

March 2017 (Act.) | 73,847 | 5,678 | 5,675 | 3,256 | 105.67 | 18.00 |

March 2018 (Act.) | 90,597 | 8,437 | 7,157 | 2,678 | 77.08 | 24.00 |

March 2019 (Act.) | 89,478 | 8,782 | 8,060 | 2,845 | 76.90 | 24.00 |

March 2020 (Est.) | 92,000 | 8,800 | 8,100 | 4,700 | 126.98 | 24.00 |

* Estimates are those of the Company.

*Unit: million yen.

This Bridge Report reviews overview Ferrotec’s earnings results for the fiscal year March 2019 and earnings estimates for fiscal year March 2020.

Table of Contents

Key Points

1.Company Overview

2.Fiscal Year ended March 2019 Earnings Results

3.Fiscal Year ending March 2020 Earnings Forecasts

4. Medium-Term Management Objectives

5. Conclusions

Reference: Regarding corporate governance

Key Points

- Sales shrank 1.2% year on year while operating income increased 4.1% year on year in fiscal year March 2019. The year-on-year growth of 19.9% in the Semiconductor Equipment Related Business almost completely offset the drop in the Photovoltaic Business from which the Company is scheduled to withdraw. A rise in the ratio of the Semiconductor Equipment Related Business to whole sales improved gross income margin, offsetting the upfront investment and other expenses associated with new businesses.

- For the term ending March 2020, it is projected that sales and operating income will grow 2.8% and 0.2%, respectively, year on year. These earnings estimates are on the premise that investment in semiconductors will be resumed in the second half of the fiscal year, with sales from equipment cleaning services and Substrates for power semiconductor rising and high-volume manufacturing of the eight-inch wafers contributing to revenue. With regard to profit, the Company is expected to achieve operating income on the same level as that of the previous term owing to the effect of withdrawal from the Photovoltaic Business while depreciation burdens due to the mass production of eight-inch wafers will be greater. Sales and operating income will shrink 0.5% and 15.2%, respectively, from the same period of the previous term in the first half of this fiscal year; however, it is forecasted that the Company will see increases in both sales and operating income by 6.2% and 21.2%, respectively, from the same period of the previous term in the second half.

- Ferrotec has cited sales of 125 billion yen and operating income margin of 8 to 13% in fiscal year March 2022 as medium-term goals. It plans to strengthen the subscription-based business (including consumable materials of semiconductor manufacturing equipment and cleaning services of related parts) and automobile fields while committing resources to the steadily thriving semiconductor-related products. Meanwhile, it will focus on sale of consumable materials in the Photovoltaic Business. The Company plans to make capital investment of 71 billion yen in total for the coming three years with the investment reaching its peak in the term ending March 2020. From FY March 2021 onward, the Company will enter the stage of recouping the investment. Planning to reward shareholders with dividends, Ferrotec will consider increasing the dividends to pay.

1. Company Overview

Ferrotec Holdings Corporation conducts business mainly on the basis of the following two segments: the Equipment Related Business, in which it offers parts for semiconductors and fine panel display (FPD) manufacturing equipment, consumable materials and wafers used in the process of manufacturing semiconductors, and semiconductors for equipment offering cleaning services of equipment parts, and the Electronic Device Business that focuses on the thermal element “thermo-electric modules,” with 48 companies serving as Ferrotec’s subsidiaries (41 consolidated subsidiaries and 7 non-consolidated affiliated companies accounted for by the equity method and other related companies).

Ferrotec was born as a company with highly unique technologies including thermo-electric modules with uses in thermal elements and vacuum technologies that respond to magnetic fluids that were born from the NASA space program in the 1980s. Over the course of its 30 years history of operations, the Company has developed a wide range of diverse technologies with applications in the automobile, electronics, next generation energy and other industries. As a transnational company, Ferrotec deploys its businesses in Japan, Europe, the Americas, China, and Asia, and boasts of marketing, development, manufacturing, sales, and management capabilities in various countries and regions. A holding company structure was implemented from April 2017.

1-1.Corporate Philosophy

Bringing Satisfaction to Customers

Caring About the Environment

Providing Dreams and Vitality to the World

From a global perspective, Ferrotec operates in harmony with international and local communities, acting in good faith as a company that provides products and services that contribute to everyday life of people. Ferrotec’s corporate philosophy is to earn satisfaction and trust from the customers, contribute to solving global environmental problems, and be devoted to serving society through manufacturing.

1-2.Business Segments

Ferrotec’s operations can be divided between the Semiconductor Equipment Related Business Segment, where Vacuum Feedthrough, quartz products, and other ceramic products used in semiconductor, FPD, and LED related manufacturing equipment are produced, the Electronic Device Business Segment, where thermo-electric module application products are made, and the Photovoltaic Business Segment, where silicon crystal, PV wafers, and crucibles used in crystal manufacturing devices are produced. In fiscal year March 2019, sales of the Semiconductor Equipment Related, Electronic Device, and Photovoltaic Related Business Segments accounted for 62.5%, 14.4% and 9.0% (FY3/18 = 48.7%, 14.0% and 23.1%) of total sales respectively, while saw blades, equipment part cleaning, machine tool, and other products not included in reported segments accounted for 14.0% (FY3/18 = 14.1%).

Semiconductor Equipment Related Business

Ferrotec provides total engineering services in the Semiconductor Equipment Related business segment, including the manufacture and sale of Vacuum Feedthrough of equipment parts for solar power, semiconductor, FPD and LED applications, consumable products used in manufacturing of devices, quartz products, ceramic products, CVD-SiC products, silicon wafer processing and equipment cleaning services. The main product of Vacuum Feedthrough boasts of top market share in the world, and is a functional part that insulates the interior of manufacturing equipment from gas and dust contamination while supporting rotating action of the above-mentioned equipment. These Vacuum Feedthrough use magnetic fluids (Fluids that respond to magnetic fields), which has been a core technology of Ferrotec since its founding. Because of instability in these applications arising from their link with corporate capital investments cycles, the Company focuses its marketing efforts upon expanding sales to applications for which demand is more stable, including transportation equipment, precision robots, and general industry usages. In addition, Ferrotec has also focused its efforts upon assuming consigned manufacture of vacuum chambers that use Vacuum Feedthrough and gate valves (Both use vacuum related equipment). At the same time, Quartz, Ceramic, and CVD-SiC products are critical elements in the process of semiconductor manufacturing. Quartz products are able to resist high temperature conditions that exist in the semiconductor manufacturing process, and are a high purity silica glass product that protects semiconductors from undergoing chemical reaction by preventing it from activating with gas. The Company boasts of semiconductor manufacturing equipment manufacturers as their main clients in Japan and overseas who purchase ceramic products, which are Ferrotec’s core material and technology. At the same time, semiconductor inspection tools for machinable ceramics and fine ceramics used in semiconductor manufacturing equipment are two main products in this CVD-SiC.

*CVD-SiC products are the term used to describe SiC products manufactured by "CVD method (Chemical Vapor Deposition method)" (created from compounds of silicon and carbon gas). Currently, semiconductor equipment and structural parts are provided, and research and development for products used in aeronautics and space (Turbine, mirrors), automobile (Power semiconductors), energy (Nuclear power related), information technology (Semiconductor manufacturing equipment parts) and other applications are also being conducted.

Ferrotec is expanding its strengths and capabilities in processing six-inch wafers (diameter) into eight-inch wafers, and has taken the largest share in the equipment part cleaning services market in China.

|

(Source: Ferrotec Hoidings)

Electronic Device Business

Thermal element “thermo-electric modules” are products that can instantly raise or lower temperatures to a highly precise degree and are a core product of this business. Thermo-electric modules are used primarily in heated automobile seats, and also in a wide range of other applications including heated wafers in semiconductor manufacturing equipment, genetic analysis equipment, optical communications, and consumer electronics and Substrates for power semiconductor that Ferrotec itself sells as unitized products. Ferrotec is also working on developing new demand and expanding further applications through cost reduction and quality improvement through development of new products using high performance materials and introduction of automated lines. Earnings of Ferrofluid , including applications currently being developed for use in fishing reels (Water protecting internal seals) and speakers for 4K televisions, are also conducted.

(Source: Ferrotec Hoidings )

Photovoltaic Business

Although Ferrotec had manufactured and sold silicon crystal manufacturing equipment, quartz crucibles, and photovoltaic-use silicon, it is currently making a shift from this segment to the highly value-added semiconductor field to which it can apply the technology cultivated with photovoltaic cells, with the market needs taken into account (structural reform). As part of this approach, It withdrew from the unprofitable structure of selling these products through its own sales channels in the term ended March 2019 and tried decreasing loss by separating specific manufacturing equipment from the manufacturing line in order to focus on an original equipment manufacturer (OEM) business. In FY March 2020, it will finish the structural reform through internal employee transfer and the final disposal of the relevant manufacturing equipment in order to completely withdraw from this business.

2. Fiscal Year ended March 2019 Earnings Results

2-1.Consolidated Earnings

| FY 3/18 | Ratio to sales | FY 3/19 | Ratio to sales | YY Change | Revised Est as of 2Q | Difference |

Sales | 90,597 | 100.0% | 89,478 | 100.0% | -1.2% | 92,000 | -2.7% |

Gross Income | 24,915 | 27.5% | 27,137 | 30.3% | +8.9% | 27,468 | -1.2% |

SG&A | 16,477 | 18.2% | 18,354 | 20.5% | +11.4% | 17,668 | +3.9% |

Operating Income | 8,437 | 9.3% | 8,782 | 9.8% | +4.1% | 9,800 | -10.4% |

Ordinary Income | 7,157 | 7.9% | 8,060 | 9.0% | +12.6% | 8,500 | -5.2% |

Net Income | 2,678 | 3.0% | 2,845 | 3.2% | +6.3% | 5,300 | -46.3% |

*Unit: million yen

Sales shrank 1.2% year on year while operating income increased 4.1% year on year.

Sales shrank 1.2% year on year to 89,478 million yen. Although sales by the Photovoltaic Business from which the Company plans to withdraw plummeted 61.4% year on year, those by the Semiconductor Equipment Related Business jumped 19.9% year on year. Besides, sales by the Electronic Device Business increased 1.5% year on year with sales decreases in Ferrofluid and other products covered with products to which thermo-electric modules are applied.

Operating income rose by 4.1% year on year to 8,782 million yen, Selling, general and administrative (SG&A) expenses, which increased 11.4% year on year due mainly to the experimental research costs of about 1 billion yen in relation to the new business and labor costs, were offset with the gross income margin that was improved by the sales rise and the growing ratio of the Semiconductor Equipment Related Business to sales.

Ordinary income rose by 12.6% year on year because a foreign exchange loss declined (from 640 million yen to 12 million yen) while equity gains of affiliated companies and subsidy income increased (from 328 million yen to 556 million yen, and from 86 million yen to 131 million yen, respectively). Although extraordinary loss grew (from 1,779 million yen to 3,066 million yen) owing partly to an increase in impairment loss (from 243 million yen to 2,429 million yen), net income rose by 6.3% year on year to 2,845 million yen.

The impairment loss consisted chiefly of 2,101 million yen for impairment loss of unutilized fixed assets and photovoltaic (PV) cell equipment for OEM applications, and 305 million yen for impairment loss of the CVD furnace at the Korean subsidiary accompanying the withdrawal from business in the Photovoltaic Business. In the Photovoltaic Business, the Company withdrew from the unprofitable structure of selling these products through its own sales channels in the term ended March 2019 and tried decreasing loss by separating specific manufacturing equipment from the manufacturing line in order to focus on an original equipment manufacturer (OEM) business. (it plans to withdraw from the OEM business as well).

Foreign exchange rates (Average for the FY 2019) of 110.36 yen per United States dollar and 16.64 yen per Chinese yuan (112.04 yen and 16.63 yen respectively in the previous term) were applied.

The Company made capital investment amounting to 35,953 million yen mainly in large-diameter semiconductor wafers.

Capital investment that the Company made was composed of the short-term and intensive investment of 6.5 billion yen in the Semiconductor Equipment Related Business (quartz equipment manufacturing and cleaning), the investment of 1 billion yen in the Substrates for power semiconductor business that the Company plans to develop over a period of two to three years, and the investment of 25.5 billion yen in the large-diameter semiconductor wafer business (pulling up ingots and wafer manufacturing) on which the Company is working from the long-term perspective in order to make it the core business, which totaled up to 35,953 million yen, up 192.3% year on year. Ferrotec recorded depreciation expenses of 5,755 million yen, up 37.4% year on year.

Business Segment Trends

| FY 3/18 | Ratio to sales・Profit margin | FY 3/19 | Ratio to sales・Profit margin | YY Change | Revised Est as of 2Q | Difference | |

Semiconductor Equipment Related | 46,661 | 51.5% | 55,953 | 62.5% | +19.9% | 57,699 | -3.0% | |

Electronic Device | 12,701 | 14.0% | 12,897 | 14.4% | +1.5% | 12,000 | -10.2% | |

Photovoltaic | 20,938 | 23.1% | 8,082 | 9.0% | -61.4% | 9,000 | +7.5% | |

Others | 10,296 | 11.4% | 12,544 | 14.0% | +21.8% | 13,301 | -5.7% | |

Total Sales | 90,597 | 100.0% | 89,478 | 100.0% | -1.2% | 92,000 | -2.7% | |

Semiconductor Equipment Related | 7,497 | 16.1% | 9,186 | 16.4% | +22.5% | - | - | |

Electronic Device | 3,006 | 23.7% | 2,365 | 18.3% | -21.3% | - | - | |

Photovoltaic | -1,592 | - | -1,659 | - | - | - | - | |

Others | -429 | - | -311 | - | - | - | - | |

Adjustments | -44 | - | -798 | - | - | - | - | |

Total Operating Income | 8,437 | 9.3% | 8,782 | 9.8% | 4.1% | - | - | |

*Unit: million yen

2-2.Business Segment Earnings Trends

Semiconductor Equipment Related Business

| FY 3/18 | Ratio to sales | FY 3/19 | Ratio to sales | YY Change | Revised Est as of 2Q | Difference |

Vacuum Feedthroughs | 11,761 | 13.0% | 11,889 | 13.3% | +1.1% | 13,869 | -14.3% |

Quartz Products | 11,524 | 12.7% | 15,590 | 17.4% | +35.3% | 14,900 | +4.6% |

Ceramic Products | 8,729 | 9.6% | 10,221 | 11.4% | +17.1% | 11,100 | -7.9% |

CVD-Sick | 3,039 | 3.4% | 2,800 | 3.1% | -7.9% | 2,900 | -3.4% |

EB guns and LED Deposition Equipment | 3,936 | 4.3% | 4,750 | 5.3% | +20.7% | 4,630 | +2.6% |

Wafer Processing | 5,162 | 5.7% | 7,236 | 8.1% | +40.2% | 6,600 | +9.6% |

Equipment parts cleaning | 2,511 | 2.8% | 3,468 | 3.9% | +38.1% | 3,700 | -6.3% |

Sales | 46,662 | 51.5% | 55,954 | 62.5% | +19.9% | 57,699 | -3.0% |

*Unit: million yen

Due to the difference in the number of digits, the sum of Sales and Profit by Segment and the sum shown above does not match.

Sales growth of Vacuum Feedthrough for organic electroluminescence (EL) and liquid crystal panels had been stagnant since the latter half of the first half of the term, and sales from Vacuum Feedthrough for memories grew weakly in and after the second half of the term due to the delay in capital investment. Demand for consigned manufacturing mainly of Vacuum Feedthrough for photovoltaic cells and semiconductor manufacturing equipment fell in the second half. Quartz products showed a steady sales increase in general on the back of the repeat demand for consumable materials while the investment in semiconductors, which was made on a sound basis in the first half, was slowed down in the second half. Sales from the Si boards and Si parts for high-speed processing were also on the rise. Regarding ceramic products, the Company also increased sales from ceramic products for materials for semiconductor inspection jigs for both abroad and Japan, and the machinable ceramic “photoveel” for medicine-related parts targeting the overseas market. In addition, sales from fine ceramics grew for etching equipment applications abroad. As for CVD-SiC products, materials for semiconductor manufacturing equipment targeted at both the Japanese and overseas markets, which had grown steadily, became sluggish toward the end of the term. On the other hand, sales from high-purity heat-resistant materials for SiC epitaxial deposition equipment increased. The Company manufactured six-inch semiconductor wafers at a high operation rate from the second half onward. With the eight-inch wafer, whose manufacturing was resumed at Shanghai Plant in July, steadily growing in sales, the plant’s manufacturing capacity reached 100,000 units per month in December. Sales from equipment part cleaning services rose thanks to the customers that operated their machines at higher rates. The Company is propelling forward the construction of plants in Tongling City, Anhui province, and Neijiang City, Sichuan province (the second factory), China, planning to begin mass production in the term ending March 2020.

Electronic Device Business

| FY 3/ 18 | Ratio to sales | FY 3/ 19 | Ratio to sales | YY Change | Revised Est as of 2Q | Difference |

Thermo-electric Modules | 11,633 | 12.8% | 11,930 | 13.3% | +2.6% | 11,050 | +8.0% |

Magnetic Fluids, Others | 1,068 | 1.2% | 967 | 1.1% | -9.5% | 950 | +1.8% |

Sales | 12,701 | 14.0% | 12,897 | 14.4% | +1.5% | 12,000 | +7.5% |

*Unit: million yen

While sales from thermo-electric modules designed for automated automobile seat heating applications were on the decline, those for semiconductor manufacturing equipment and consumer products showed steady sales growth. Sales from power semiconductor substrates increased 38% year on year thanks to a rise in production volume attributed to the new bases. In this business segment, the ratio of each application sales to whole sales is as follows: 19% by automobiles, 18% by power semiconductor substrates, 17% by semiconductors, 15% by consumer products, 10% by products for biomedical applications, 8% by communication equipment, 4% by optical communication applications, and 4% by chemicals-related applications.

Photovoltaic Business

| FY 3/ 18 | Ratio to sales | FY 3/ 19 | Ratio to sales | YY Change | Revised Est as of 2Q | Difference |

Quartz Crucibles | 1,851 | 2.0% | 1,072 | 1.2% | -42.1% | 1,404 | -23.6% |

Photovoltaic Use Silicon | 13,066 | 14.4% | 3,620 | 4.0% | -72.3% | 4,371 | -17.2% |

Silicon Crystal Manufacturing Equipment | 157 | 0.2% | 116 | 0.1% | -26.1% | 125 | -7.2% |

Cells, Others | 5,865 | 6.5% | 3,275 | 3.7% | -44.2% | 3,100 | +5.6% |

Sales | 20,939 | 23.1% | 8,083 | 9.0% | -61.4% | 9,000 | -10.2% |

*Unit: million yen. Due to the difference in the number of digits, the sum of Sales and Profit by Segment and the sum shown above does not match.

Ferrotec strengthened sale of quartz crucibles for semiconductors that have high added value and focused only on part of large-diameter quartz crucibles for photovoltaics. As a result, quartz crucibles designed for semiconductors made up about 70% of the total sales. Of quartz crucibles for semiconductors, large-sized crucibles for eight-inch wafers showed a sales rise on a steady basis. The prices of the photovoltaic-use silicone and cells for photovoltaics remained at a low level. The Company improved profitability by withdrawing from sales activities through its own sales channels for both of the products and focusing on the OEM business of them.

2-3.Financial Condition and Cash Flow

Balance Sheet Summary

| FY 3/ 18 | FY 3/ 19 |

| FY 3/ 18 | FY 3/ 19 |

Cash | 23,648 | 31,555 | Payables | 18,419 | 20,887 |

Receivables | 20,700 | 21,460 | ST Interest-Bearing Liabilities (Lease obligations) | 11,664(145) | 20,475(129) |

Inventories | 16,773 | 16,276 | Current liabilities | 43,477 | 60,180 |

Current Assets | 66,826 | 77,271 | LT Interest-Bearing Liabilities (Lease obligations) | 14,329(433) | 41,032(301) |

Tangible Assets | 43,541 | 76,133 | Noncurrent liabilities | 23,167 | 53,069 |

Intangible Assets | 2,922 | 3,557 | Net Assets | 51,812 | 49,848 |

Investments and Others | 5,166 | 6,136 | Total Liabilities and Net Assets | 118,457 | 163,098 |

Noncurrent Assets | 51,631 | 85,827 | Total Interest-Bearing Liabilities (Lease obligations) | 25,994(579) | 61,507(431) |

*Unit: million yen

Total assets at the end of the term stood at 163,098 million yen, up 44,640 million yen from the end of the previous term. Under debit, cash and equivalents grew owing to the debts and issuance of corporate bonds. In addition, construction in progress account increased mainly for processing of large-diameter wafers. Under credit, interest-bearing liabilities grew due to the debts and issuance of corporate bonds for making capital investment in China. The foreign exchange rate at the end of the term was 111.0 yen for the U.S. Dollar (which was 113.0 yen in FY March 2018) and 16.16 yen for the Chinese Yuan (which was 17.29 yen in FY March 2018).

Capital adequacy ratio was 30.3% (which was 43.3% at the end of the previous term).

Cash Flow

| FY 3/ 18 | FY 3/ 19 | YoY | |

Operating cash flow(A) | 9,946 | 11,466 | +1,519 | +15.3% |

Investing cash flow (B) | -12,388 | -37,063 | -24,674 | - |

Free Cash Flow (A + B) | -2,441 | -25,597 | -23,155 | - |

Financing cash flow | 10,830 | 34,507 | +23,676 | +218.6% |

Cash and Equivalents at the end of term | 23,648 | 31,555 | +7,906 | +33.4% |

*Unit: million yen

Operating Cash Flow went up 15.3% year on year to 11,466 million yen owing in part to income before tax of 5,642 million yen and depreciation cost of 5,755 million yen. The deficit of Investing Cash Flow widened further to 37,063 million yen due to the acquisition of tangible and intangible fixed assets, which were broken down primarily into large-diameter wafer-related investment in Hangzhou City of 12,561 million yen, investment associated with processing of large-diameter wafers in Yinchuan City of 6,002 million yen, and investment in cleaning equipment in Tongling City of 1,502 million yen.

Reference: Trends of ROE

| FY 3/ 15 | FY 3/ 16 | FY 3/ 17 | FY 3/ 18 | FY 3/ 19 |

ROE | -5.59% | 5.58% | 8.36% | 5.92% | 5.65% |

Net income margin | -3.61% | 3.11% | 4.41% | 2.96% | 3.18% |

Total asset turnover [times] | 0.77 | 0.88 | 0.86 | 0.86 | 0.64 |

Leverage [times] | 2.02 x | 2.04 x | 2.19 x | 2.33 x | 2.79 x |

*ROE = Net Income rate × Total Asset Net over × Leverage

*The total assets and equity capital used for the calculation are the average value of the balances.

The decline in extraordinary loss is projected to improve ROE for the term ending March 2020 to 9.2%. ROE in the term ending March 2021 is expected to fell to 8.7% following large-scale capital investment mainly in large-diameter wafers, but afterward, profitability will improve because it is forecasted that the business will get on track and various improvement measures will be implemented, resulting in an estimate that ROE for the term ending March 2022 will exceed 10% and reach 10.8%.

3. Fiscal Year ending March 2020 Earnings Forecasts

3-1.Consolidated Earnings

| FY 3/19 Act. | Ratio to sales | FY 3/20 Est. | Ratio to sales | YoY |

Sales | 89,478 | 100.0% | 92,000 | 100.0% | +2.8% |

Gross profit | 27,137 | 30.3% | 28,062 | 30.5% | +3.4% |

SG&A | 18,354 | 20.5% | 19,262 | 20.9% | +4.9% |

Operating Income | 8,782 | 9.8% | 8,800 | 9.6% | +0.2% |

Ordinary Income | 8,060 | 9.0% | 8,100 | 8.8% | +0.5% |

Net Income | 2,845 | 3.2% | 4,700 | 5.1% | +65.2% |

*Unit: million yen

Sales and operating income are estimated to grow 2.8% and 0.2%, respectively, year on year.

Ferrotec estimates that sales will go up 2.8% year on year to 92 billion yen. This forecast is on the premise that investment in semiconductors will be resumed in the second half of the year, and sales growth related to semiconductors are projected to be sluggish in general; however, Equipment parts cleaning services to which the new bases will make contributions, power semiconductor substrates for which production capacity has been enhanced, six-inch wafers that continue to be manufactured at a high rate, and eight-inch wafers of which mass production has gotten on track will contribute to sales increases. By segment, rises in sales in the Equipment Related Business and the Electronic Device Business will cover declining sales in the Photovoltaic Business.

It is forecasted that operating income will grow 0.2% year on year to 8.8 billion yen. While the high-volume manufacturing of eight-inch wafers will create heavier depreciation burdens, the withdrawal from the Photovoltaic Business will improve gross income margin by 0.2 points to 30.5%. An increase in SG&A expenses, including variable costs, will be offset, which is expected to result in a slight rise in operating income. Net income is estimated at 4.7 billion yen, up 65.2% year on year, owing in part to a drop of extraordinary loss.

Capital investment will go up 33.5% year on year to 48 billion yen, and depreciation expenses will grow 39.0% year on year to 8 billion yen. The foreign exchange rate (average during the term) is 110.00 yen for the U. S. Dollar (which was 110.36 yen in fiscal year March 2019) and 16.00 yen for the Chinese Yuan (which was 16.64 yen in the same period). When the exchange rate of Japanese Yen (against the U.S. Dollar) fluctuates by 1 yen per year, sales and operating income will be affected by about 1 billion yen and about 65 million yen, respectively.

3-2.Business Segment Earnings Trends

Equipment Related Business

| FY 3/ 19 Act. | Ratio to sales | FY 3/ 20 Est. | Ratio to sales | YoY |

Vacuum Feedthroughs | 11,889 | 13.3% | 8,500 | 9.2% | -28.5% |

Quartz Products | 15,590 | 17.4% | 16,800 | 18.3% | +7.8% |

Ceramic Products | 10,221 | 11.4% | 10,200 | 11.1% | -0.2% |

CVD-SiC | 2,800 | 3.1% | 2,600 | 2.8% | -7.1% |

EB guns and LED Deposition Equipment | 4,750 | 5.3% | 3,800 | 4.1% | -20.0% |

Wafer Processing | 7,236 | 8.1% | 10,500 | 11.4% | +45.1% |

manufacturing equipment cleaning | 3,468 | 3.9% | 6,600 | 7.2% | +90.3% |

Quartz crucibles | - | - | 1,800 | 2.0% | - |

Total | 55,954 | 62.5% | 60,800 | 66.1% | +8.7% |

*Unit: million yen

* Sales of quartz crucibles are included in the semiconductor and related equipment business from FY 3/20.

Regarding vacuum seals, Ferrotec is expected to fully resume investment in memory-related vacuum seals at the end of 2019, and sales from vacuum seals for organic EL and liquid crystal panels are projected to rebound slowly from the second half of the term onward. The Company will strive to maintain the operating ratio for consigned manufacturing by taking in demand for applications other than semiconductor manufacturing equipment whose growth is expected to slow down. Furthermore, the Company will continue joint development projects with manufacturers of semiconductor manufacturing equipment, and make capital investment in large-sized manufacturing equipment on a continuous basis.

While investment in memory-related quartz products continues to be adjusted, sales from 200-mm products for power devices for on-board and electric vehicle (EV) applications, Si boards for the high-temperature process shrink, and Si parts for vacuum etchers will be on the rise. Ferrotec also plans to increase the production capacity at the two bases newly opened in the previous term in China (Changshan and Dongtai), and a development base in Yamagata prefecture in an effort to take in the demand accompanying the full-fledged operation of customers in and after the second half of the term. The new factories in China (Changshan and Dongtai) which are the leading OEMs already in operation is scheduled for full operation in the second half of the term. The Company will step up its efforts at development projects for the next and subsequent generations as well (in May 2019, it began operating the development and manufacturing base in Yamagata prefecture in Japan).

As for ceramic products, the Company took into account the steady growth of the machinable ceramic “photoveel” for general machines, the recovery of the products for semiconductor inspection jigs in Japan that is in the phase of adjustment at the present moment, and a rise in sales from the products for new types of inspection jigs resulting from process shrink. While sales from fine ceramics for deposition equipment parts overseas will shrank, those in Japan will show growth.

Concerning CVD-SiC products, sales from materials for semiconductor manufacturing equipment are expected to remain sluggish around September because of the capital investment put off and inventory adjustment despite an increase in sales from high-purity heat-resistant materials for SiC epitaxial deposition equipment (sales recovery after October is taken into account). The Company will expand sale of materials for semiconductor manufacturing equipment, develop the production system, and even enhance the development and policy enforcement structure for the SiC semiconductor field.

Ferrotec will continue to manufacture wafers at a high rate on the basis of six-inch wafers produced in 400,000 units per month. As for eight-inch wafers, it will expand sale by keeping manufacturing 100,000 units per month throughout the year and focus on setting up a new factory in Hangzhou, China. It plans to develop a capacity to manufacture 450,000 units per month combined with those produced in Shanghai, China, within fiscal year 2020.

Sales from equipment parts cleaning services will grow thanks to the two newly established bases. In addition, examining the demand trends in semiconductor and FPD customers in China carefully, the Company will consider further boosting production as necessary.

Quartz crucibles are included in this segment starting in the term ending March 2020 because sales from those for semiconductors have accounted for 70% of the total sales. Operation of a factory dedicated to semiconductor crucibles (the process of cleaning up and post-automation process) will be started. Furthermore, adopting a 32-inch large melting furnace, the Company will begin manufacturing in the second half of fiscal year 2019.

Electronic Device Business

| FY 3/ 19 Act. | Ratio to sales | FY 3/ 20 Est. | Ratio to sales | YoY |

Thermo-electric Modules | 11,930 | 13.3% | 13,700 | 14.9% | +14.8% |

Magnetic Fluids, Others | 967 | 1.1% | 1,200 | 1.3% | +24.1% |

Sales | 12,897 | 14.4% | 14,900 | 16.2% | +15.5% |

*Unit: million yen

While thermo-electric modules for automated automobile seat heating applications are expected to show a sales decline, sales from those for communication devices, such as ones for the 5G communication system, will increase. Sales from power semiconductor substrates for which the Company will continue enhancing production capacity will also be on the rise. The Company will focus on trial manufacturing and development of thermo-electric modules designed for automated heating applications in next-generation vehicles. Regarding power semiconductor substrates, the Company will step up development of such new materials as silicon nitride and aluminum nitride.

Photovoltaic Business

| FY 3/ 19Act. | Ratio to sales | FY 3/20 Est. | Ratio to sales | YoY |

Quartz Crucibles | 1,072 | 1.2% | - | - | - |

Photovoltaic Use Silicon | 3,620 | 4.0% | 3,400 | 3.7% | -6.1% |

Silicon Crystal Manufacturing Equipment | 116 | 0.1% | 0 | 0.0% | -100.0% |

Cells, Others | 3,275 | 3.7% | 1,500 | 1.6% | -54.2% |

Sales | 8,083 | 9.0% | 4,900 | 5.3% | -39.4% |

*Unit: million yen. Sales of quartz crucibles are included in the semiconductor and related equipment business from FY 3/20.

Concerning photovoltaic-use silicon, the Company will focus only on monocrystal wafers and polycrystal ingots for OEM applications and deal with the inventory and idle equipment. Although the Company estimates sales from OEM photovoltaic cells at approximately 1.5 billion yen, it plans to withdraw even from the OEM business in the future. It will continue OEM-based production for the time being while considering when to withdraw.

4. Medium-Term Management Objectives

4-1.Main Points

Results | The sales in the final fiscal year are set to exceed 120 billion yen ・With increasing profitability, the Company is set to reach the next stage as a billion-dollar company |

Product Strategy | Improvement of the business portfolio ・Specializing in the sale of consumable goods in the Photovoltaic Business ・Devoting resources into semiconductor-related products of which performance is healthy, while strengthening the subscription-based business and the automobile sector |

Capital Investment | Capital investment peaked in FY 3/20 ・Total capital investment in 3 years is expected to be 71 billion yen. From FY 3/21, the company will recoup the investment. |

Shareholder Returns | Following the improvement in results, a dividend increase will be considered. |

4-2. Strategy Products and Services

The Company plans to focus on 3 products and 1 service: semiconductor materials (quartz products, silicon parts, ceramic products, CVD-SiC), wafers, power semiconductor circuit boards, and equipment parts cleaning services. It is estimated that the sales of semiconductor materials will increase from 28.6 billion yen in FY 3/19 to 38.1 billion yen in FY 3/22 (up 33.2%), the sales of wafers will increase from 7.2 billion yen in FY 3/19 to 28.2 billion yen in FY 3/22 (up 291.6%), the sales of power semiconductor circuit boards will increase from 2 billion yen in FY 3/19 to 7 billion yen in FY 3/22 (up 250.0%) and the sales of equipment parts cleaning services will increase from 3.5 billion yen in FY 3/19 to 8.5 billion yen in FY 3/22 (up 142.9%).

Semiconductor materials

(From the company website)

Semiconductor materials are classified into manufactured products, which are proportional to capital investment, and consumable products, which are proportional to the operation of semiconductor manufacturing equipment. The Company covers both manufactured products and consumable products. For this reason, a stable revenue is guaranteed and it is possible to offer one stop products even during the transitional season of capital investment. Although capital investments in semiconductors etc., currently, are undergoing adjustment, consumable products such as semiconductor materials are steadily expanding and initiatives will be taken to increase the production capacity through the extension of the product line.

The production capacity of quartz products is expected to be increased in 2 footholds in China (Changshan, Dongtai), which were constructed during the previous term, as well as in a development foothold in Yamagata, and the Company will make efforts to meet the demand following the full-scale operation starting from the second half of the fiscal year.

| FY 3/18 Act. | FY 3/19 Act. | FY 3/20 Est. | FY 3/21 Forecast | FY 3/22 Forecast |

quartz products | 10,851 | 13,727 | 14,200 | 15,800 | 20,600 |

silicon parts | 673 | 1,863 | 2,600 | 2,700 | 3,000 |

ceramic products | 8,729 | 10,221 | 10,200 | 11,000 | 11,500 |

CVD-SiC | 3,039 | 2,800 | 2,600 | 2,700 | 3,000 |

*Unit: million yen

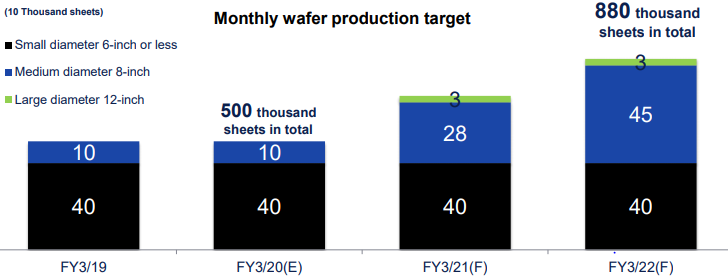

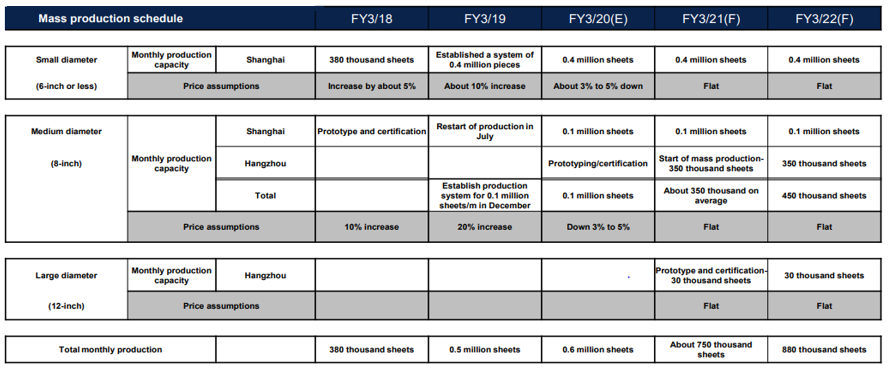

Wafers

In China, the manufacturing system of the 8-inch medium diameter wafers is under maintenance, and one of those, the Shanghai Factory, has started mass production and the sale of wafers at a rate of 100,000 units per month. In the Hangzhou Factory, the construction of the building is in progress and is expected to be completed within this term, and the Company will start mass production by FY 3/21. Focusing on middle and long-term needs, capital investment of approximately 43.6 billion yen is being planned, including investment in 12-inch large diameter wafers. The Company wants to establish an overall monthly output of 880,000 units of large, medium and small diameter wafers by FY 3/22.

Expecting to Move into the Black within the Next 3 Years

The earnings from the wafer business move in conjunction with global unit prices. The Company aggressively constructed new factories from the previous year, but the latest unit prices are showing a downward trend. Thus, the aim is to have the 8-inch model move into the black by FY 3/22 and the 12-inch model move into the black by FY 3/24. The Company will make efforts to move into the black at an early stage after the increase in unit price due to the improvement in product quality as well as cost reduction.

| FY 3/18 | FY 3/19 | FY 3/20 Est. | FY 3/21 Forecast | FY 3/22 Forecast |

Small Diameter (6 inches or smaller) | 5,162 | 6,404 | 6,700 | 6,700 | 6,700 |

Medium Diameter (8 inches) | 0 | 832 | 3,800 | 15,100 | 18,700 |

Large Diameter (12 inches) | 0 | 0 | 0 | 2,000 | 2,800 |

*Unit: million yen

* It is assumed that the mass production and sale of the medium diameter version (8 inches) at the new foothold in Hangzhou will begin in Q1 of FY 3/21 or later.

* It is assumed that the mass production and sale of the large diameter version (12 inches) from the trial manufacturing line in Hangzhou will start in the second half of FY 3/21 or later.

(According to company data)

Equipment Parts Cleaning

Factories were built in Tongling City, Anhui Province and Neijiang City, Sichuan Province (line no. 2) in China, and now the Company has 5 footholds and 6 factories. As it is a central business among the subscription-based businesses, a further increase of footholds is being considered focusing on the middle and long-term demand in the cleaning business.

| FY 3/18 | FY 3/19 | FY 3/20 Est. | FY 3/21 Forecast | FY 3/22 Forecast |

Equipment part cleaning services Sales | 2,511 | 3,468 | 6,600 | 7,000 | 8,500 |

*Unit: million yen

Power Semiconductor Circuit Boards

According to a research agency, the global semiconductor market, which was worth 2.4 trillion yen in 2016, will grow by more than 30% to 3.1 trillion yen by 2025, and the demand within the machine tools and automobile sectors, which are a strength of the Company, is also expected to increase. Following Shanghai, the new factory for manufacturing power semiconductor circuit boards in Dongtai City, Jiangsu Province was completed in FY 3/19. A significant growth in sales is expected in FY 3/20 due to the increase in production capacity.

In the middle term, in addition to the current alumina ceramic circuit boards, silicon nitride and aluminum nitride circuit boards will be mass-produced, expanding 255% from FY 3/19 to 7 billion yen in FY 3/22.

| FY 3/18 | FY 3/19 | FY 3/ 20 Est. | FY 3/ 21 Forecast | FY 3/22 Forecast |

Power Semiconductor Circuit Boards Sales | 1,414 | 1,969 | 4,500 | 5,600 | 7,000 |

*Unit: million yen

4-3.Semiconductor Equipment Related Businesses

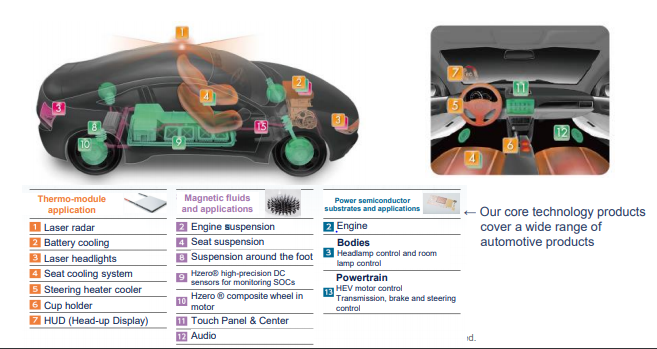

As part of the semiconductor equipment related businesses and Electronic Device Business, the initiatives in the 3 products, 1 service strategy of semiconductor materials (quartz products, silicon parts, ceramic products, CVD-SiC), wafers, power semiconductor circuit boards and equipment parts cleaning were explained, but the semiconductor equipment related businesses does not only manage semiconductor related businesses, but also includes a total of 6 growing fields of automobiles, energy, biomedical, communications and commissioned manufacturing as well. For that purpose, the core technology and products will be utilized in this field to expand products and services.

Semiconductors (discussed above) | ・To keep enlarging the production line of materials for which customers strongly demand the increase in output. ・The pilot line for the 12-inch wafer will be actualized. |

Automobiles | ・Construction of a mass production system of circuit boards for IGBT power semiconductors for use in electric automobiles ・Engaging in the development of applied products which utilize thermo-electric modules, such as sub air-conditioners and head-up displays for electric vehicles, excluding temperature control sheets. |

Energy | ・Developing applied products which utilize thermo-electric modules for controlling lithium ions in electric automobiles. |

Biomedical | ・Strengthening product appeal for the embodiment of DNA amplification equipment and blood separators with thermo-electric modules, application to regenerative medicine, and drug delivery (delivering medical drugs inside the human body) |

Communications | ・Growth anticipated due to the progress in 5G technology Thermo-electric modules are frequently used in telecommunication equipment of mobile communications and in the internal parts of antennas as a countermeasure against heat |

Commissioned Manufacturing | ・Proportional to the growth in the semiconductor market ・Expecting an increase in commissioned manufacturing from semiconductor manufacturing equipment manufacturers by combining vacuum technology and precise metal manufacturing |

Enhancement of the Automobile Industry

The Company owns a wide variety of products with high potential demand in the automobile industry, including thermoelectric modules, ferrofluids and power semiconductor circuit boards. In the in-house project “Automotive Project,” which is already making progress, it is strengthening the marketing in the automotive industry and conducting the proposal-based selling of new technology combined with core technologies, targeting in-vehicle accessories manufacturers.

Examples of the Application of Thermo-electric Modules (Products for EV/ADAS)

・Thermo-electric Module Battery Cooler/Heater

Heat flow through the heat pump. Temperature management (cooling and heating) of lithium ion batteries for electric vehicles with low power consumption.

・Thermal Module ADAS Camera Cooler

Heat radiation in CMOS Image Sensors used in cameras for ADAS (Advanced Driver-Assistance System) (Temperature management to accurately measure distance)

(From the company website)

4-4. Numerical Plan and Initiatives in Equipment Related Business

Sales Plan

| FY 3/ 18 | FY 3/ 19 | FY 3/ 20 Est. | FY 3/ 21 Forecast | FY 3/ 22 Forecast |

Equipment Related Business | 46,662 | 55,954 | 60,800 | 79,600 | 94,200 |

Electronic Device Business | 12,701 | 12,897 | 14,900 | 16,000 | 18,000 |

Photovoltaic Business (*) | 20,939 | 8,083 | 4,900 | 14,400 | 12,800 |

Others | 10,296 | 12,544 | 11,400 | ||

Consolidated Sales | 90,597 | 89,478 | 92,000 | 110,000 | 125,000 |

*Unit: million yen. Transition to other segments from FY 3/21

Equipment Related Business is expected to grow significantly due to the strengthening of semiconductor materials. Under this business, the Company will devote resources to successful semiconductor related products while enhancing subscription-based businesses and the automobile section. Under the Electronic Device Business, it will strengthen the trend of increasing sales from FY 3/20 through development of new applications of thermo-electric modules for automobiles and investment in high added value products with power semiconductor circuit boards. As for the Photovoltaic Business, it will specialize in the sale of consumable products (transition into other segments in FY 3/21 or later).

Profit Margin Plan

| FY 3/ 18 | FY 3/ 19 | FY 3/ 20 Est. | FY 3/ 21 Forecast | FY 3/ 22 Forecast |

Equipment Related Business | 16.1% | 16.4% | Transition in the range of 8 to 13% | ||

Electronic Device Business | 23.7% | 18.3% | Transition in the range of 15 to 20% | ||

Photovoltaic Business (*) | -7.6% | -20.5% | Segment will be deleted from FY 3/21 | ||

Consolidated Sales Operating Profit on Sales | 9.3% | 9.8% | Transition in the range of 8 to 13% | ||

Under the Equipment Related Business, following the increase in sales of the medium and large diameter wafers, the segment profit ratio is expected to fall till FY 3/22. However, the wafer business is expected to turn profitable again in FY 3/23 or later. Further, the quartz products and the equipment parts cleaning service, which are growing rapidly, will become a primary source of earnings. Under the Electronic Device Business, following the increase in sales of power semiconductor circuit boards, operating income margin is expected to fall due to changes in the in-segment mixture. However, it is expected to recover in the long term due to development of new applications of thermo-qelectric modules for automobiles and investment in high added value products with power semiconductor circuit boards. The segment of the Photovoltaic Business will be removed in FY 3/21 and included in Other. In case of limited products for business continuity, profitability will be a prerequisite.

On a consolidated basis, the depreciation cost is expected to rise due to the expansion in the semiconductor wafer business; however, the increase in profits from semiconductor materials, equipment parts cleaning, and power semiconductor circuit boards, which are positioned as strategic growth products, in addition to the removal of segmentation in the Photovoltaic Business, will become factors for the increase in whole profits. The earnings from semiconductor wafers are expected to recover in FY 3/23 or later, due to which a recovery in operating income margin is also expected.

Capital investment Plan

| FY 3/ 18 | FY 3/ 19 | FY 3/ 20 Est. | FY 3/ 21 Forecast | FY 3/ 22 Forecast |

Large Diameter Wafer | - | 18,563 | 41,000 | 2,600 | 2,100 |

Other Wafers | - | 17,390 | 7,000 | 9,400 | 8,900 |

Total | 12,300 | 35,953 | 48,000 | 12,000 | 11,000 |

The total capital investment is estimated to be approximately 71 billion yen. Investment will peak in FY 3/20, when the Company will focus on investing in medium and large diameter wafers (8-inch and 12-inch). After the peak, it will be reduced. Initiatives will be taken to continually increase production capacity in semiconductor materials (quartz products, silicon parts, ceramic products) and the cleaning business.

Financial indicator

| FY 3/ 18 | FY 3/ 19 | FY 3/ 20 Est. | FY 3/ 21 Forecast | FY 3/ 22 Forecast |

ROIC* | 8.4% | 6.0% | 4.3% | 4.4% | 6.0% |

ROE | 5.2% | 5.7% | 9.2% | 8.7% | 10.8% |

ROS* | 7.9% | 9.0% | 8.9% | 7.5% | 8.0% |

Capital investment | 12,300 | 35,953 | 48,000 | 12,000 | 11,000 |

*Unit: million yen

* ROIC = Operating Income × (1- Effective Tax Rate)/(Working Capital + Fixed Assets)

* ROS = Ordinary Income/Sales × 100

Following the large-scale capital investment in mainly large diameter wafers, ROIC and ROE are expected to temporarily go down till FY 3/21. After the capital investment reaches a resting point in FY 3/21 or later, the Company will make efforts to improve ROIC by putting that business on track and implementing the following improvement measures.

ROIC Improvement Measures:

Cost Reduction | Shifting the production of the main business department to the Dongtai Factory and Changshan Factory, where manufacturing cost is low |

Reduction of Working Capital | Company-wide reduction of stocks by 10% |

Streamlining of production | Company-wide promotion of automation |

5.Conclusions

In “Made in China 2025” that China has been propelling forward as a national project, it has set greater growth goals for the semiconductor field than those of the global market and aims to improve the rate of procuring semiconductor manufacturing equipment and parts in its own country. The government of the United States has security concerns over this approach by China, which has resulted in trade conflicts between the two countries in combination with the issue of the U.S. trade deficit with China. Therefore, it is likely that export of the state-of-the-art semiconductor manufacturing equipment and its parts made in the United States to Chinese firms will be regulated if relevant Chinese companies are judged by the United States as “companies that possibly pose security threats to the United States.”

Meanwhile, Chinese semiconductor manufacturers will be likely to reconsider their current strategies, including supply chains and procurement sources, as part of their risk management effort. Specifically, this means that those manufacturers will endeavor to procure materials in China and adopt semiconductor manufacturing equipment made in China as much as possible. In other words, China will strive to improve the equipment self-sufficiency rate and enhance domestic manufacturing on a national scale. These approaches may provide Ferrotec, which has a number of manufacturing and service bases related to semiconductors in China and offers consumable materials and services on a certain scale to myriad Chinese semiconductor manufacturers that are expected to thrive further, with an opportunity for expanding business. The Company plans to engage in business and pursue growth strategies by making the most of its strengths while paying attention to the conditions of the semiconductor and high-technology markets, and changes and impacts of the U.S.-China trade friction.

In fact, Huawei Technologies Co., Ltd., the leading communications equipment company in China, has completed development of semiconductors for the next-generation communications standard “5G” system, aiming to be ahead of American companies in terms of technology and increase market share. Huawei will reportedly reduce the number of semiconductors procured from firms in the United States and other nations, and improve the equipment self-sufficiency rate, which is currently about 50%, to around 70% amid the U.S.-China trade war that is getting militant more and more (according to newspaper reports). The uncertainty due to the bilateral trade conflicts has resulted in weak growth in the share price of Ferrotec; however, it is possible that, in the medium and long term, the movement in China will bring about positive effects on technological innovation in the Chinese semiconductor and high-technology fields, which will in turn confer benefits upon Ferrotec. For that, the Company will need to steadily forge ahead with the policies that it has formulated as the medium-term management goals. We would like to keep an eye on the Company’s progress with its efforts.

Reference: Regarding Corporate Governance

◎ Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 8 directors, including outside ones 2 |

Auditors | 3 directors, including outside ones 3 |

◎ Corporate Governance Report(Updated on November 15, 2018)

Basic policy

The company considers that it is important to improve its corporate value, emphasize the soundness of its business administration to become an enterprise that will be trusted and supported by stakeholders, including shareholders, customers, business partners, and local communities, and also establish a managerial system responding the rapid changes to the business environment swiftly and accurately.

The major businesses of our corporate group are the development, manufacturing, and sale of vacuum seals used for manufacturing equipment, etc. for semiconductors and flat panel displays (FPDs), quartz products, ceramic products, CVD-SiC products, silicon crystal manufacturing equipment for solar cells, silicon products for solar cells, crucibles, rectangular tanks, thermo modules used for temperature adjustment devices, etc., silicon products, magnetic fluid, products developed by applying them, and so on.

Two out of eight directors are outside ones, and the term of each director is one year, so that the company can respond to the changes to the business environment swiftly. In addition to a monthly meeting of the board of directors, the company flexibly holds an extraordinary meeting of the board of directors every time an important transaction emerges.

As for business operation, ten operating officers (including 9 males and 1 female or 5 directors [who are all male]) are appointed as managers in charge of respective tasks or sections and assigned with clearly defined roles for business operation.

The company has the audit and supervisory board. The board of auditors is composed of 3 outside auditors (including a full-time one), and aims to strengthen corporate governance.

The company receives advice about legal affairs from Goto Law Office when this is necessary for business, in accordance with a legal consultancy contract.

The company also undergoes account audit by Ernst & Young ShinNihon LLC serving as comptroller in accordance with an audit contract, and tries to disclose information without delay as a company listed in the standard section of the JASDAQ market of Tokyo Stock Exchange, if an event specified in the provisions regarding disclosure occurs.

<Main Principles and Reasons for Non-Implementation>

The Company implements all of the basic principles defined by its corporate governance code.

<Disclosure Based on the Principles of the Corporate Governance Code>

【Principle 5-1 Policies for constructive dialogue with shareholders】

With the aim of achieving sustainable growth and improving corporate value, the company will promote the constructive dialogue with shareholders and explain its managerial policy and status understandably so that shareholders will understand them.

Policies for constructive dialogue with shareholders

(1) A director in charge of IR and managerial plans is included in the management that manages the dialogue with shareholders.

(2) The president’s office for the cooperation among divisions for supporting the dialogue with shareholders cooperates with the accounting department in supporting the dialogue with shareholders.

(3) For enriching the means of dialogue other than individual interviews, the company holds a session for briefing financial results, and a business briefing session after each general meeting of shareholders, and utilizes a variety of information transmission methods, including printed matters. At the sessions for briefing financial results and business, the representative director gives explanations.

(4) The information on each dialogue is managed rigorously in accordance with the regulations for the management of insider information.

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2019 Investment Bridge Co.,Ltd. All Rights Reserved. |

To view back numbers of Bridge Reports on Ferrotec Holdings Corporation (6890) and other companies, or IR related seminars of Bridge Salon, please go to our website at the following url.

URL: https://www.bridge-salon.jp/