Bridge Report:(6890)Ferrotec the second quarter of the fiscal year ending March 2021

He Xian Han, President | Ferrotec Holdings Corporation (6890) |

|

Company Information

Exchange | JASDAQ |

Industry | Electric Equipment (Manufacturing) |

President | He Xian Han |

HQ Address | Nihonbashi Plaza Building, Nihonbashi 2-3-4, Chuo-ku, Tokyo |

Year-end | March |

Website |

Stock Information

Share Price | Shares Outstanding | Market Cap. | ROE (Act.) | Trading Unit | |

¥1,557 | 37,158,134 shares | ¥57,855 million | 3.6% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥24.00 | 1.5% | ¥40.41 | 38.5x | ¥1,409.34 | 1.1x |

*Share price as of closing on December 17, 2020. The number of shares issued at the end of the latest quarter excludes its treasury shares. ROE is based on the result of the previous year.

Consolidated Earnings Trends

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS (¥) | DPS (¥) |

March 2017 (Act.) | 73,847 | 5,678 | 5,675 | 3,256 | 105.67 | 18.00 |

March 2018 (Act.) | 90,597 | 8,437 | 7,157 | 2,678 | 77.08 | 24.00 |

March 2019 (Act.) | 89,478 | 8,782 | 8,060 | 2,845 | 76.90 | 24.00 |

March 2020 (Act.) | 81,613 | 6,012 | 4,263 | 1,784 | 48.12 | 24.00 |

March 2021 (Est.) | 85,000 | 6,500 | 5,500 | 1,500 | 40.41 | 24.00 |

*The forecast is from the company. Unit: million yen, yen.

This Bridge Report reviews the overview of Ferrotec’s earnings results of the second quarter of the fiscal year ending March 2021 and earnings estimates for fiscal year March 2021.

Table of Contents

Key Points

1.Company Overview

2.Second Quarter of the Fiscal Year ending March 2021 Earnings Results

3.Fiscal Year ending March 2021 Earnings Forecasts

4.Business Strategies

5.Conclusions

Reference: Regarding corporate governance

Key Points

- In the first half of the term ending March 2021, sales fell 0.6% year on year while operating income grew 9.7% year on year. While sales declined 25.8% year on year for the other business segment, particularly the photovoltaic business which is in a process of withdrawal, the sales of the semiconductor and other equipment-related business grew 5.9% year on year, thanks to the growth of material products used in semiconductor manufacturing processes such as jigs and consumable materials, and the growth of the cleaning business. Sales of the electronic device business for which thermo-electric modules are the mainstay, too, increased 1.8% year on year, as the growth of sales of 5G-related devices offset the decrease of sales of devices for automotive temperature control seats. On the profit front, gross profit increased, due partly to a decrease in photovoltaic cell-related sales, and SG&A costs decreased, thanks to cost cuts and the yen appreciation.

- The company’s full-year forecasts are unchanged, calling for sales and operating income to increase 4.1% and 8.1% year on year, respectively. Although earnings in the first half of the term exceeded the company’s estimates, its full-year forecasts are unchanged, due partly to the uncertain outlook amid the U.S.-China trade friction and the fact that the company is currently investigating the impact from subsidiary restructuring. There is no concern in any of its businesses. In the semiconductor and other equipment-related business, semiconductor materials and the cleaning business are expected to perform well in the second half, too. In the electronic device business, sales of devices for communication equipment are expected to be remained at high levels, and the devices for automotive temperature control seats are showing signs of recovery. The term end dividend is planned to be 12 yen/share, and with the first half dividend of 12 yen/share, the annual dividend will be 24 yen/share.

- Ferrotec Holdings plans to push forward with its capital policy geared toward organizational restructuring and the improvement of its financial standing. Capital investments will be implemented with prioritization from the term ending March 2022 onward. It has already begun reorganization and preparations for listing of its Chinese subsidiary, and has started up a new business that has received funds from Chinese government-affiliated funds and private investment funds. The company has expanded its business with the growth of the semiconductor market and China’s policies to promote domestic production of high-tech products working as a tailwind. Meanwhile, the bloating of its balance sheet sparked concern over financial risk. Going forward, the company will aim for further growth and the enhancement of corporate value while securing a balance between business opportunities and finance.

1. Company Overview

Ferrotec Holdings Corporation conducts business mainly on the basis of the following two segments: the semiconductor and other equipment-related Business, in which it offers parts for semiconductors and fine panel display (FPD) manufacturing equipment, consumable materials and wafers used in the process of manufacturing semiconductors, and semiconductors for equipment offering cleaning services of equipment parts, and the Electronic Device Business that focuses on the thermal element “thermo-electric modules,” with 52 companies serving as Ferrotec’s subsidiaries (46 consolidated subsidiaries and 6 non-consolidated affiliated companies accounted for by the equity method and other related companies).

Ferrotec was born as a company with highly unique technologies including thermoelectric modules with uses in thermal elements and vacuum technologies that respond to magnetic fluids that were born from the NASA space program in the 1980s. Over the course of its 40 years history of operations, the Company has developed a wide range of diverse technologies with applications in the automobile, electronics, next generation energy and other industries. As a transnational company, Ferrotec deploys its businesses in Japan, Europe, the Americas, China, and Asia, and boasts of marketing, development, manufacturing, sales, and management capabilities in various countries and regions. A holding company structure was implemented from April 2017.

[Corporate Ethos and Priority Policies for Enhancing Organizational Strength and Achieving Sustainable Development]

The Ferrotec group strives to be a company that is trusted by stakeholders such as customers, shareholders, employees, business partners, and local communities, by achieving sustainable growth and complying with laws, regulations, social order, and international rules with decency in its corporate activities.

Initiatives to enhance corporate value | Promote independent management of all subsidiaries, and redistribute management resources |

Thorough awareness that puts quality first | Perfect design and product quality that pleases customers, and improvement of the quality of services inside and outside the company |

Strengthen corporate governance | Thorough internal control and management of affiliated companies, and strengthening of risk management and compliance |

1-1.Business Segments

Ferrotec’s operations includes semiconductor seal related products such as vacuum seal, quartz products, ceramic products, etc. used in manufacturing equipment of semiconductor, FPD, LED etc., electronic device business centering on thermo modules and business segments that are not included in the reportable segments. Other businesses, which handle silicon crystal and solar cell wafers, saw blades, machine tools, surface treatment, industrial washing machines etc.

Semiconductor equipment related business

Ferrotec provides total engineering services in the Equipment Related business segment, including the manufacture and sale of Vacuum Feedthrough of equipment parts for solar power, semiconductor, FPD and LED applications, consumable products used in manufacturing of devices, quartz products, ceramic products, CVD-SiC products, quartz crucibles, silicon wafer processing and equipment cleaning services.

Its vacuum seal boasts of top market share in the world, and is a functional part that insulates the interior of manufacturing equipment from gas and dust contamination while supporting rotating action of the above-mentioned equipment. These Vacuum Feedthrough use magnetic fluids (Fluids that respond to magnetic fields), which has been a core technology of Ferrotec since its founding. Because of instability in these applications arising from their link with corporate capital investments cycles, the Company focuses its marketing efforts upon expanding sales to applications for which demand is more stable, including transportation equipment, precision robots, and general industry usages. In addition, Ferrotec has also focused its efforts upon assuming consigned manufacture of vacuum chambers that use Vacuum Feedthrough and gate valves (Both use vacuum related equipment). At the same time, quartz, ceramic, and CVD-SiC products are critical elements in the process of semiconductor manufacturing. Quartz products are able to resist high temperature conditions that exist in the semiconductor manufacturing process, and are a high purity silica glass product that protects semiconductors from undergoing chemical reaction by preventing it from activating with gas. The Company boasts of semiconductor manufacturing equipment manufacturers as their main clients in Japan and overseas who purchase ceramic products, which are Ferrotec’s core material and technology. At the same time, semiconductor inspection tools for machinable ceramics and fine ceramics used in semiconductor manufacturing equipment are two main products in this CVD-SiC.

*CVD-SiC products are the term used to describe SiC products manufactured by "CVD method (Chemical Vapor Deposition method)" (created from compounds of silicon and carbon gas). Currently, semiconductor equipment and structural parts are provided, and research and development for products used in aeronautics and space (Turbine, mirrors), automobile (Power semiconductors), energy (Nuclear power related), information technology (Semiconductor manufacturing equipment parts) and other applications are also being conducted.

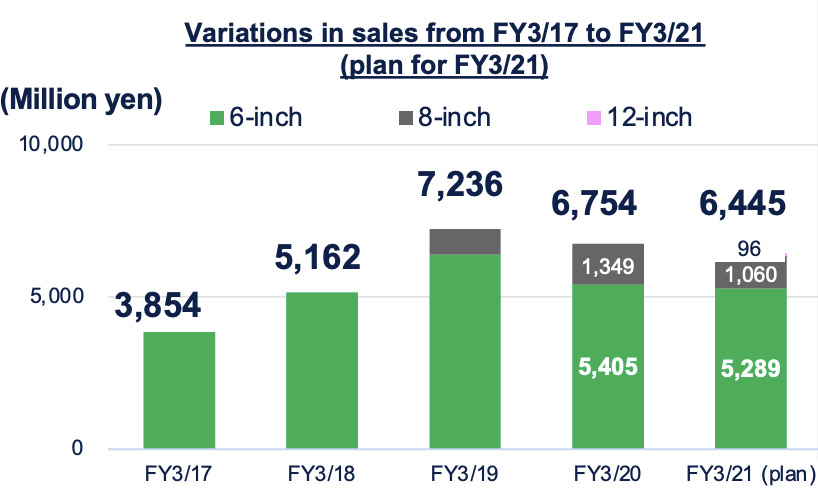

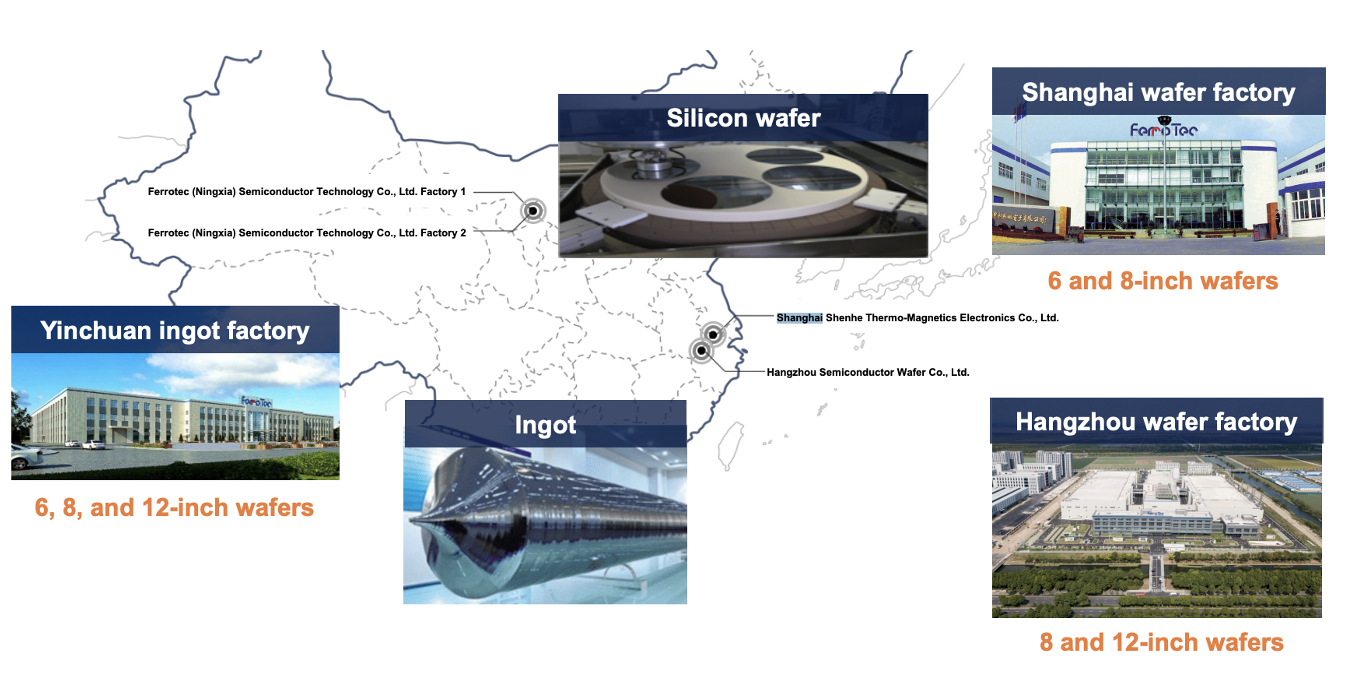

As for silicon wafer processing, Ferrotec handles 6-inch (diameter), 8-inch and also 12-inch wafers from now on, and has a leading share of more than half of the manufacturing equipment cleaning services market in China.

(From the company website)

Electronic Device Business

Thermal element “thermoelectric modules” are products that can instantly raise or lower temperatures to a highly precise degree and are a core product of this business. Thermoelectric modules are used primarily in heated automobile seats, and also in a wide range of other applications including heated wafers in semiconductor manufacturing equipment, genetic analysis equipment, optical communications, and consumer electronics and power semiconductor substrates that is sold as unitized products. Ferrotec is also working on developing new demand and expanding further applications through cost reduction and quality improvement through development of new products using high performance materials and introduction of automated lines. Earnings of magnetic fluids, including applications currently being developed for use in linear vibration motors for smartphones and speakers for 4K televisions, are also conducted.

(From the company website)

(From the company website)

2.Second Quarter of the Fiscal Year ending March 2021 Earnings Results

2-1.Consolidated Earnings

| 1H of FY 3/20 | Ratio to sales | 1H of FY 3/21 | Ratio to sales | YoY | Forecast | Difference from the Forecast |

Sales | 41,849 | 100.0% | 41,595 | 100.0% | -0.6% | 40,000 | +4.0% |

Gross Income | 13,907 | 33.2% | 14,098 | 33.9% | +1.4% | 13,320 | +5.8% |

SG&A | 10,341 | 24.7% | 10,185 | 24.5% | -1.5% | 10,320 | -1.3% |

Operating Income | 3,566 | 8.5% | 3,913 | 9.4% | +9.7% | 3,000 | +30.4% |

Ordinary Income | 2,472 | 5.9% | 2,824 | 6.8% | +14.3% | 2,500 | +13.0% |

Net Income | 1,539 | 3.7% | 70 | 0.2% | -95.4% | 0 | - |

*Unit: million yen

Sales decreased 0.6% year on year while operating income grew 9.7% year on year.

Sales fell 0.6% year on year to 41.59 billion yen. Sales of the other business segment declined 25.8% year on year, mainly for the solar cell business and the industrial washing machine business, but sales of the semiconductor and other equipment-related business grew 5.9% year on year, thanks partly to the growth of material products used in semiconductor manufacturing processes, such as quartz, ceramic, and CVD-SiC products. The sales of the electronic device business, for which thermoelectric modules are the mainstay, increased 1.8% year on year, as the growth of sales of devices for equipment related to the 5G next-generation communication system offset the decrease of sales of devices for automotive temperature control seats.

Operating income increased 9.7% year on year to 3.91 billion yen as gross profit rose, due partly to a decrease in photovoltaic cell-related business, and SG&A costs fell, thanks to cost cuts and the yen appreciation against dollar and yuan compared to the same period last year. However, the company booked 1.07 billion yen in impairment losses associated with the photovoltaic business under extraordinary losses, and tax expenses rose, resulting in net income plummeting 95.4% year on year to 70 million yen.

Exchange rates (average rates during the term) were 108.24 yen per dollar (109.97 yen in the same period a year earlier) and 15.32 yen per yuan (16.23 yen in the same period a year earlier). Capital investments fell 47.0% year on year to 10.13 billion yen (19.12 billion yen in the same period a year earlier), while depreciation increased 34.1% year on year to 4.6 billion yen (3.43 billion yen in the same period a year earlier).

Business Segment Sales and Profits

| 1H of FY 3/20 | Ratio to sales Profit margin | 1H of FY 3/21 | Ratio to sales Profit margin | YoY | Forecast | Difference from the Forecast |

Semiconductor and other equipment -related | 27,182 | 65.0% | 28,784 | 69.2% | +5.9% | 28,140 | +2.3% |

Electronic Device | 6,991 | 16.7% | 7,116 | 17.1% | +1.8% | 6,770 | +5.1% |

Others | 7,675 | 18.3% | 5,693 | 13.7% | -25.8% | 5,090 | +11.8% |

Total Sales | 41,849 | 100.0% | 41,595 | 100.0% | -0.6% | 40,000 | +4.0% |

Semiconductor and other equipment -related | 2,680 | 9.9% | 2,177 | 7.6% | -18.8% | - | - |

Electronic Device | 1,320 | 18.9% | 1,867 | 26.2% | +41.5% | - | - |

Others | 190 | 2.5% | 344 | 6.1% | +80.6% | - | - |

Adjustments | -625 | - | -476 | - | - | - | - |

Total Operating Income | 3,566 | 8.5% | 3,913 | 9.4% | +9.7% | 3,000 | +30.4% |

*Unit: million yen

2-2.Business Segment Trends

Semiconductor and other equipment-related business

| 1H of FY 3/20 | Ratio to sales | 1H of FY 3/21 | Ratio to sales | YoY | Initial Forecast | Difference from the Forecast | |

Vacuum Feedthroughs | 4,031 | 9.6% | 4,377 | 10.5% | +8.6% | 4,390 | -0.3% | |

Semiconductor Wafer | 4,502 | 10.8% | 3,102 | 7.5% | -31.1% | 2,810 | +10.4% | |

EB guns and LED Deposition Equipment | 1,720 | 4.1% | 1,450 | 3.5% | -15.7% | 1,460 | -0.7% | |

Quartz Crucibles | 544 | 1.3% | 450 | 1.1% | -17.3% | 430 | +4.7% | |

Quartz | 8,189 | 19.6% | 9,122 | 21.9% | +11.4% | 9,210 | -1.0% | |

Ceramics | 4,603 | 11.0% | 5,682 | 13.7% | +23.4% | 5,380 | +5.6% | |

CVD-SiC | 1,218 | 2.9% | 1,143 | 2.7% | -6.2% | 1,080 | +5.8% | |

Equipment parts cleaning | 2,375 | 5.7% | 3,459 | 8.3% | +45.6% | 3,380 | +2.3% | |

Sales | 27,182 | 65.0% | 28,784 | 69.2% | +5.9% | 28,140 | +2.3% | |

*Unit: million yen

Sales came to 28.78 billion yen, up 5.9% year on year, and operating income to 2.17 billion yen, down 18.8% year on year. Sales grew for semiconductor materials and the cleaning business, but startup costs for the new Hangzhou wafer plant, which is making progress in gaining customer approval, worked as a drag, causing operating income to fall.

Vacuum feedthroughs sales increased 8.6% year on year, backed by a recovery in capital investment by semiconductor and organic EL panel manufacturers, but for wafer processing, sales slumped 31.1% year on year on a delayed demand recovery for 8-inch wafers. EB (electron beam) gun/LED deposition equipment and quartz crucible sales also fell.

As for semiconductor materials such as quartz, ceramic, and CVD-SiC, quartz product sales advanced 11.4% year on year due to boosted production volume by running the Changshan and Dongtai plants to respond to heightened demand fueled by higher capacity utilization at semiconductor manufacturers, and sales of ceramic products jumped 23.4% year on year on growth of components for film formation and etching equipment, and materials for semiconductor inspector jigs. Meanwhile, CVD-SiC product sales fell 6.2% year on year, with growth in China insufficient to offset the slump in Europe and the U.S. At the same time, higher demand from Chinese semiconductor and FPD customers led to sales growth of 45.6% year on year for equipment parts cleaning services.

Electronic Device Business

| 1H of FY 3/20 | Ratio to sales | 1H of FY 3/21 | Ratio to sales | YoY | Initial Forecast | Difference from the Forecast |

Thermo-electric module | 6,651 | 15.9% | 6,814 | 16.4% | +2.5% | 6,480 | +5.2% |

Ferrofluid, Others | 340 | 0.8% | 302 | 0.7% | -11.2% | 290 | +4.1% |

Electronic Device Business | 6,991 | 16.7% | 7,116 | 17.1% | +1.8% | 6,770 | +5.1% |

*Unit: million yen

Sales stood at 6.81 billion yen, up 2.5% year on year, and operating income at 1.86 billion yen, up 41.5% year on year. For their mainstay, thermo-electric modules, sales of products for automotive temperature control seats fell due to a decrease in automobile sales, but sales of products used in mobile communication system equipment for 5G, and medical testing equipment such as those used in PCR tests rose, particularly in China and sales of products for wearable devices and IoT increased. As for power semiconductor substrates, sales of DCB substrates used in industrial machinery, etc. fell affected by the COVID-19 pandemic. However, the acquisition of certification for AMB substrates for automotive applications, etc. is progressing smoothly, and the company has begun making capital investments for mass production. For Ferrofluids, demands for speaker and smartphone applications remained at a stable level.

2-3.Financial Condition and Cash Flow

Balance Sheet Summary

| 3/20 | 9/20 |

| 3/20 | 9/20 |

Cash | 23,709 | 34,880 | Payables | 18,251 | 17,091 |

Receivables | 20,435 | 23,135 | ST Interest-Bearing Liabilities | 26,016 | 27,507 |

Inventories | 17,269 | 19,127 | Current liabilities | 61,443 | 62,704 |

Current Assets | 71,451 | 97,791 | LT Interest-Bearing Liabilities | 52,456 | 55,007 |

Tangible Assets | 110,816 | 112,214 | Noncurrent liabilities | 78,418 | 83,156 |

Intangible Assets | 500 | 430 | Net Assets | 50,147 | 71,829 |

Investments and Others | 7,241 | 7,254 | Total Liabilities and Net Assets | 190,010 | 217,690 |

Noncurrent Assets | 118,558 | 119,899 | Total Interest-Bearing Liabilities | 78,473 | 82,515 |

*Unit: million yen

Total assets at the end of the second quarter rose 27.68 billion yen from the end of the previous term to 217.69 billion yen. Cash and accounts receivable increased due to the sale of the stock of their subsidiary, Hangzhou Semiconductor Wafer Co., Ltd. (FTHW), in September, and construction in progress increased due to capital investments in the wafer and recycled wafer businesses. In liabilities and net assets, capital surplus and minority interest increased due to the sale of FTHW shares and increased capital for its cleaning business subsidiary in August. The capital-to-asset ratio was 24.1% (25.5% at the end of the previous term). The exchange rates (end-of-term rate) were 107.74 yen per dollar (109.56 yen at the end of the same period of the previous term), and 15.23 yen per yuan (15.67 yen at the end of the same period of the previous term).

Cash Flow

| 1H of FY 3/20 | 1H of FY 3/21 | YoY | |

Operating cash flow (A) | 933 | 5,529 | +4,596 | +492.5% |

Investing cash flow (B) | -19,229 | -9,966 | +9,262 | - |

Free Cash Flow (A + B) | -18,295 | -4,437 | +13,858 | - |

Financing cash flow | 14,909 | 15,874 | +965 | +6.5% |

Cash and Equivalents at the end of term | 28,086 | 34,880 | +6,794 | +24.2% |

*Unit: million yen

The company secured an operating CF of 5.52 billion yen, due partly to a pretax income of 1.74 billion yen (2.52 billion yen in the same period of the previous term), a depreciation of 4.6 billion yen (3.43 billion yen in the same period of the previous term), other income of 4.54 billion yen (loss of 1.12 billion yen in the same period of the previous term), and a decrease in working capital. Investing CF was mainly attributable to the acquisition of tangible assets, etc., and financing CF was chiefly due to an increase in long- and short-term borrowings and income from the sale of subsidiary shares (11.35 billion yen).

Financial management policy

The company has abundant business opportunities, backed by expansion of the semiconductor market, especially in China. Against this backdrop, its strength lies in its stable business base for semiconductor material products, thermo-electric modules, vacuum feedthroughs, etc. Meanwhile, assets and interest-bearing liabilities are rapidly increasing due to aggressive investments in large-diameter semiconductor wafers and such. Due to this, the company will endeavor to secure an appropriate balance between pursuing business and investment opportunities and bolstering its financial situation. Regarding investments and liabilities, the company will strengthen management of capital investment and investment levels, as well as tighten control/management of interest-bearing liabilities levels. For financing, Ferrotec will work to diversify financing methods, ensure the stability of such financing, and consider business and capital collaboration with business partners in China.

Diversification of financing methods

From the perspective of securing a balance between business opportunities and finance, the company increased capital (160 million yuan; about 2.5 billion yen) in August 2020 in preparation for the listing of its cleaning business subsidiary, and in September the company sold some of its stake in FTHW, a subsidiary that manufactures semiconductor wafers. Ferrotec’s stake in said cleaning subsidiary fell to 67.0%, resulting in an increase in minority interests under net assets.

The FTHW shares were sold for 1.97 billion yuan (roughly 30.3 billion yen), of which 1.48 billion yuan (about 22.7 billion yen) was held by Ferrotec, and 490 million yuan (about 7.6 billion yen) held by a Chinese subsidiary. The sale of the shares held by Ferrotec was reflected in consolidated results for the second quarter, leading to a 22.7 billion yen increase in net assets. The sale of the shares held by the Chinese subsidiary (closes books in December) are to be reflected in the third quarter results.

In addition, in the third quarter, Ferrotec increased FTHW’s capital by 1.6 billion yuan (roughly 24.6 billion yen) and that of its wafer recycling subsidiary by 410 million yuan (roughly 6.3 billion yen). Ferrotec also established a SiC (silicon carbide) company with a capital of 890 million yuan (about 13.7 billion yen), investing 31.5% (280 million yuan; 4.3 billion yen). More details about this SiC company will be provided later. The capital increase for the wafer recycling subsidiary is to be reflected in the fourth quarter results, with the company’s final investment ratio coming to 41.3%, making it a consolidated subsidiary, and minority interests on the balance sheet would increase, too.

Following the capital increase, the plan is for Ferrotec’s investment ratio in FTHW to decrease to 29.5%, and for FTHW to become an equity method affiliate. At present, however, this is yet to be determined as the company is in the process of investigating the impact of such a move. If FTHW becomes a consolidated subsidiary, minority interests on the balance sheet would increase, and its earnings would be reflected in minority interests profit and loss on the income statement. If it becomes an equity-method affiliate, FTHW would be recorded as an investment on the balance sheet, and its earnings would be reflected in equity-method profit and loss on the income statement.

Fund procurement and the usage of procured funds for the fiscal year ending March 2021

The company will invest 29.4 billion yen in capital investment, and procure funds amounting to 26 billion yen, as initially planned. The latter breaks down t (1) 9.5 billion yen procured from financial institutions, (2) 9.5 billion yen borrowed from the Chinese semiconductor wafer subsidiary, (3) 3 billion yen acquired through a Chinese wafer investment subsidy, and (4) 4 billion yen from the increased capital of the Chinese wafer recycling business.

In addition, the funds procured through the sale of subsidiary shares and capital increase will be used to repay interest-bearing liabilities and to capital investments. Of the approximately 30.3 billion yen received for selling shares of its semiconductor wafer subsidiary, the company plans to allocate about 24.5 billion yen to the repayment of interest-bearing liabilities, and around 4.3 billion yen to SiC investment etc. The total of around 33.4 billion yen gained through the issuance of new shares via third-party allotment by a subsidiary will be mainly used as investment funds for the next term onward.

3.Fiscal Year ending March 2021 Earnings Forecasts

3-1. Full Year Consolidated Earnings

| FY 3/20 Act | Ratio to sales | FY 3/21 Est. | Ratio to sales | YoY |

Sales | 81,613 | 100.0% | 85,000 | 100.0% | +4.1% |

Gross Income | 26,928 | 33.0% | 27,942 | 32.9% | +3.8% |

SG&A | 20,915 | 25.6% | 21,192 | 24.9% | +1.3% |

Operating Income | 6,012 | 7.4% | 6,500 | 7.6% | +8.1% |

Ordinary Income | 4,263 | 5.2% | 5,500 | 6.5% | +29.0% |

Net Income | 1,784 | 2.2% | 1,500 | 1.8% | -16.0% |

*Unit: million yen

Sales and operating income projected to increase 4.1% and 8.1% year on year, respectively

Although earnings for the first half of the term exceeded the company’s estimates, its full-year estimates are unchanged, due partly to the uncertain outlook amid the U.S.-China trade friction and the fact that the company is currently investigating the impact from subsidiary restructuring.

Sales are estimated to grow 4.1% year on year to 85 billion yen. Year-on-year sales growth of 11.1% are estimated for the semiconductor and other equipment-related business, driven by semiconductor materials and the cleaning business, sales of which are expected to remain brisk in the second half, and 5.0% year on year sales growth for the electronic device business, backed by higher sales of thermo-electric modules centered on communication applications. These sales growths are expected to outweigh declines of other business segments. Operating income is projected to advance 8.1% year on year to 6.5 billion yen. Although gross profit margin is expected to decline, the company sees operating income margin improving 0.2 points to 7.6%, boosted by sales expansion and lower SG&A costs owing to cost reductions and yen appreciation.

The term end dividend is planned to be 12 yen/share, and with the first half dividend of 12 yen/share, the annual dividend will be 24 yen/share.

3-2 Business Segment Earnings Trends

| FY 3/20 Act | Ratio to sales | FY 3/21 Est. | Ratio to sales | YoY | Forecast in the 1Q | Difference from the forecast |

Vacuum Feedthroughs | 8,136 | 10.0% | 8,072 | 9.5% | -0.8% | 8,640 | -6.6% |

Semiconductor Wafer | 6,754 | 8.3% | 6,445 | 7.6% | -4.6% | 6,800 | -5.2% |

EB guns and LED Deposition Equipment | 3,973 | 4.9% | 3,567 | 4.2% | -10.2% | 3,000 | +18.9% |

Quartz crucibles | 955 | 1.2% | 937 | 1.1% | -1.9% | 910 | +3.0% |

Quartz | 16,373 | 20.1% | 19,402 | 22.8% | +18.5% | 19,290 | +0.6% |

Ceramics | 9,048 | 11.1% | 10,670 | 12.6% | +17.9% | 10,460 | +2.0% |

CVD-SiC | 2,036 | 2.5% | 2,263 | 2.7% | +11.1% | 2,230 | +1.5% |

Equipment parts cleaning | 5,606 | 6.9% | 7,398 | 8.7% | +32.0% | 7,080 | +4.5% |

Semiconductor and other equipment-related business | 52,881 | 64.8% | 58,754 | 69.1% | +11.1% | 58,410 | +0.6% |

Thermo-electric module | 12,701 | 15.6% | 13,795 | 16.2% | +8.6% | 14,030 | -1.7% |

Ferrofluid, Others | 789 | 1.0% | 770 | 0.9% | -2.4% | 740 | +4.1% |

Electronic Device Business | 13,489 | 16.5% | 14,565 | 17.1% | +8.0% | 14,770 | -1.4% |

Others | 15,243 | 18.7% | 11,681 | 13.7% | -23.4% | 11,820 | -1.2% |

Consolidated Sales | 81,613 | 100.0% | 85,000 | 100.0% | +4.1% | 85,000 | +0.0% |

*Unit: million yen

Semiconductor and other equipment-related business

The company anticipates semiconductor materials such as quartz, ceramic, and CVD-SiC products, and the cleaning business continuing to perform well in the second half, calling for sales to increase 11.1% year on year to 58.75 billion yen for the full term. However, costs associated with the startup of the new Hangzhou wafer plant are expected to weigh on profit.

Vacuum feedthrough sales are estimated to decrease in the second half, both on a year-on-year basis and versus first-half performance, with sales to organic EL panel manufacturers showing signs of plateauing. Meanwhile, the second half of semiconductor wafer processing, sales are expected to grow both on a year-on-year and half-on-half basis thanks to contributions from boosted production of 12-inch wafers, making up for sluggish 8-inch wafer sales, which are projected to remain on par with first-half levels.

For semiconductor materials, in the second half the company sees sales of quartz products increasing year on year and from the first half, due partly to demand for consumables amid high capacity utilization at semiconductor manufacturers, demand for new capital investments in logic semiconductors and memory semiconductors centered on NAND, and contributions from Si parts, for which demand for etching processes is expected to grow. As for ceramic products, the company sees sales falling from the first half, but growing year on year, particularly for etching equipment components and materials for semiconductor inspector jigs for overseas markets. Sales of CVD-SiC products are projected to remain largely on par with first-half levels due to a temporary drop for Chinese equipment manufacturers caused by the change in selling methods, and to postponement of mass production of consumable parts for semiconductor etching equipment, shifted to the first quarter of 2021, but grow year on year. The equipment parts cleaning service, for which performance is linked to the production of Chinese semiconductor manufacturers, etc., is expected to see sales increase both year on year and from the first half.

(From the company material)

Electronic device business

In the second half, sales of electronic devices for communication equipment are forecasted to grow year on year, remaining at high levels as in the first half. Products for automotive temperature control seats are showing signs of recovery. Meanwhile, power semiconductor substrates are expected to remain in line with first-half levels, but fall year on year. The company plans to step up the development of silicon nitride for automotive applications (AMB substrates). Power semiconductor substrate sales are estimated at 2.53 billion yen (2.83 billion yen in the previous term), included in the 13.79 billion yen sales forecast for thermo-electric modules for the full year.

4. Business strategies

4-1. Semiconductor Market Trends and the Promotion of Domestic Production in China

According to World Semiconductor Trade Statistics (WSTS) of June 9, 2020, the semiconductor market scale is expected to expand 3.3% year on year in 2020, and maintain upward momentum in 2021, up 6.2% year on year. Also, according to Semiconductor Equipment and Materials International (SEMI) data of September 2020, the Wafer Fab Equipment (WFE) market, which the company operates mainly, is supposed to see continued growth, up 10% in 2020 and up 6% in 2021 driven by the healthy semiconductor market.

China is also accelerating moves to promote the domestic production of high-tech products. At the 5th Plenum of the 19th Central Committee of the Communist Party of China (CPC) held in October 2020, it was decided that in the 14th Five-Year Plan, independent development of science and technology will serve as a national growth strategy, with technological innovation playing a pivotal role in modernizing the country, and focus will be placed on strengthening production capability, improving quality, enhancing Internet literacy, and becoming a digital-oriented country. Also, as a long-term plan through 2035, the committee also resolved to make exponential progress in economy, science and technology, and comprehensive national power, aiming to become a global leader in technological innovation. It also plans to raise GDP per capita to the status of a moderately developed country.

4-2. Future Business Strategies

Structural reorganization, capital policy, and capital investment

Ferrotec plans to push forward with organizational restructuring, while proceeding with its capital policy geared toward improving its financial position. Capital investments will be implemented with prioritization from the term ending March 2022 onward.

As for organizational restructuring, the company plans to reorganize its Chinese subsidiaries and list them. It is promoting joint ventures with Chinese government-affiliated funds and private investment funds, while preparing to list subsidiaries that handle its parts cleaning and semiconductor wafer manufacturing businesses in China. In terms of capital policy, the company will work to reduce the group’s interest-bearing liabilities and procure capital in China in a bid to improve the group’s financial position. As for capital investments, the company will continue to increase production capacity for material products, cleaning, power substrates, etc., which are in strong demand, while considering outlays for semiconductor wafers, wafer recycling, and SiC single crystals based on market trends and progress with the capital procurement in China.

Made in China 2025, a point of focus for business operations in China

In China, as part of their efforts to shift priority from volume to quality and to make China a leading global manufacturing power by 2025, the government is moving forward with its Made in China 2025 policy. In the semiconductor field, this policy was expected to lead to 30% of equipment and 50% of materials being manufactured in China in 2020. At the same time, the Chinese government will step up preferential policies geared toward a further increase in domestic production.

Ferrotec views Made in China 2025 as a business opportunity, and plans to expand its businesses in material product, cleaning service, wafer, power substrates, and other business in China. It will actively utilize preferential policies affiliated with national and government technology centers and national projects to curb costs, while pursuing innovative technologies and product fields that independent Chinese companies cannot match. The company will also set up a holding company to manage multiple Chinese subsidiaries and bolster group capabilities. In terms of investments, it will focus on innovative technologies and expanding/strengthening businesses, and also work to secure funds for growth through a variety of schemes.

Joint ventures with contributions from Chinese government-affiliated funds and private investment funds, and promoting the procurement of funds for growth in China

Subsidiary that manufactures semiconductor silicon wafers (Hangzhou City, Zhejiang Province) | •Group shareholding rati 29.5% (as of the end of October 2020; after issuance of new shares via third-party allotment) •Plans to consider investment for boosting production capacity of 12-inch wafers. Considering listing on either the Shanghai or Shenzhen stock market in the future |

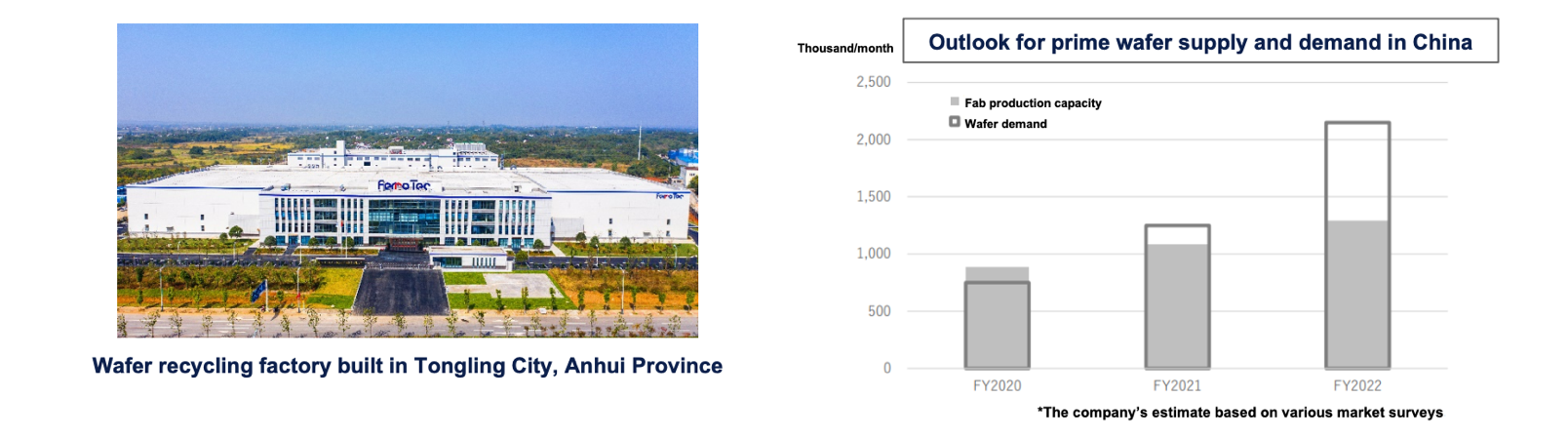

Subsidiary that handles equipment parts cleaning service (Tongling City, Anhui Province) | •Group shareholding rati 67.0% (as of the end of October 2020), holds majority stake •Considering boosting production capacity of said business in response to China’s policy to increase domestic production, and currently preparing to list on the Chinese Science and Technology Innovation Board (STAR) |

Subsidiary that operates the semiconductor wafer recycling business (Tongling City, Anhui Province) | •Group shareholding rati 41.3% (as of the end of October 2020; after issuance of new shares via third-party allotment) •Plans to begin mass production in 2Q (April-June) of FY 2021 or later, and considering monthly production of 120,000 units in the first stage, then 200,000 units thereafter |

Subsidiary that manufactures SiC (silicon carbide) single crystal ingot wafers (Tongling City, Anhui Province) | •Group shareholding rati 31.5% (as of the time of founding in October 2020) •Established a joint venture with the Chinese Academy of Sciences and government/private funds, and will jointly develop and manufacture SiC single crystals as a new business |

Semiconductor wafer recycling subsidiary: Increased phase-1 production capacity and raised capital through the issuance of new shares via third-party allotment

The semiconductor wafer recycling business utilizes the resources of the group’s wafer business, and knowledge built up through the operation of the cleaning business, which are areas of strength for the group. For film removal processes, Ferrotec has a technology tie-up with a business partner. Construction of the wafer recycling factory was completed in November 2020. Trial production is scheduled to start in the first quarter of 2021 (January-March), and mass production to start in the second quarter of 2021 (April-June).

Due to the acceleration of the Chinese government’s efforts to promote domestic production of semiconductors, demand for wafer recycling is rapidly increasing. In order to meet the strong demand centered on 12-inch wafers, Ferrotec (Anhui) Technology Co., Ltd. (FTSA), a wafer recycling subsidiary, increased its monthly production capacity for the first phase from the initial plan of 65,000 wafers to 120,000 wafers (investment amount also raised from 7.85 billion yen to 14.02 billion yen). As such, the subsidiary increased capital through the issuance of new shares via third-party allotment, raising 6.3 billion yen (410 million yuan) at the end of October 2020. This resulted in a capital of 19 billion yen (1.23 billion yuan). Due to the issuance of these new shares, the group’s shareholding ratio decreased from 70.0% to 41.3%, and the investment ratio of multiple government-affiliated funds rose.

(From the company material)

Started up SiC business as a joint venture with the Chinese Academy of Sciences and government/private funds

In October 2020, Ferrotec established a joint venture with Shanghai Institute of Ceramics, Chinese Academy of Sciences (SICCAS), government-affiliated funds, and private investment funds in Tongling City, Anhui Province (group investment rati 31.5%). The company established the new subsidiary with the aim of developing and manufacturing SiC (silicon carbide) single crystal ingots and wafers, the markets of which are expected to expand going forward as an innovative (i.e., third-generation) semiconductor in China. Completion of plant construction, the delivery of equipment, and trial production are scheduled in 2021.

The Ferrotec group has defect control and equipment manufacturing technologies built up through operations in the semiconductor Si single crystal business, and SiC expertise and the customer base gained through the CVD-SiC (jigs for semiconductor manufacturing equipment) business. SICCAS, a leading SiC research institute in China, has expertise and human resources. Also, government-affiliated/private funds and government subsidies should provide support in terms of fund procurement.

SiC reduces switching losses and conduction losses, and has a higher tolerance for temperature fluctuations. There has been an increase in the uptake of SiC in automotive applications, such as on-board chargers and DC converters. However, due to technical challenges including crystal growth (to obtain large diameter wafers), substrate processing, electrical property control, and crystal defect control, only a limited number of firms in Europe, the U.S., and Japan are currently capable of mass production. China is rushing to realize domestic production of SiC amid the rise in domestic demand for electric vehicles, etc.

Third-generation semiconductors refer to semiconductors that include new materials such as silicon carbide (SiC), gallium nitride (GaN), zinc oxide (ZnO), and graphite (C). Compared to first-generation (made with silicon, etc.) and second-generation (made with gallium arsenide, etc.) semiconductors, third-generation semiconductors can be used in high-voltage, high-frequency, and high-temperature environments. Due to this, they are used in 5G (5th generation mobile network) radio frequency components, high-efficiency bipolar tubes, LEDs (light emitting diodes), etc. In the future, use of these semiconductors is expected to expand to new energy vehicles, white goods, railway transportation, medical equipment, etc.

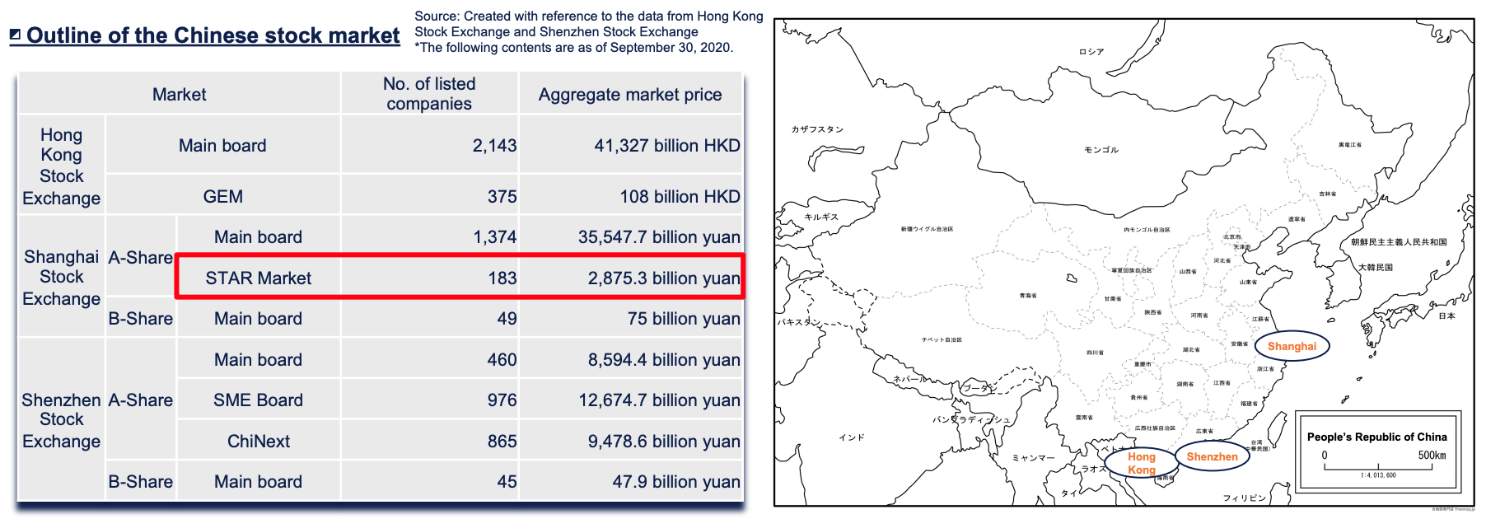

STAR, the Chinese version of Nasdaq

In addition to the Shanghai and Shenzhen stock markets, Ferrotec will utilize the new Shanghai-based STAR Market, also known as China’s version of Nasdaq, when listing subsidiary shares. STAR is a market for emerging companies, predominantly tech firms, and began trading on July 22, 2019. As of September 30, 2020, 183 companies have been listed on STAR, and the combined market cap among said listings was 2,875.3 billion yuan.

(From the company material)

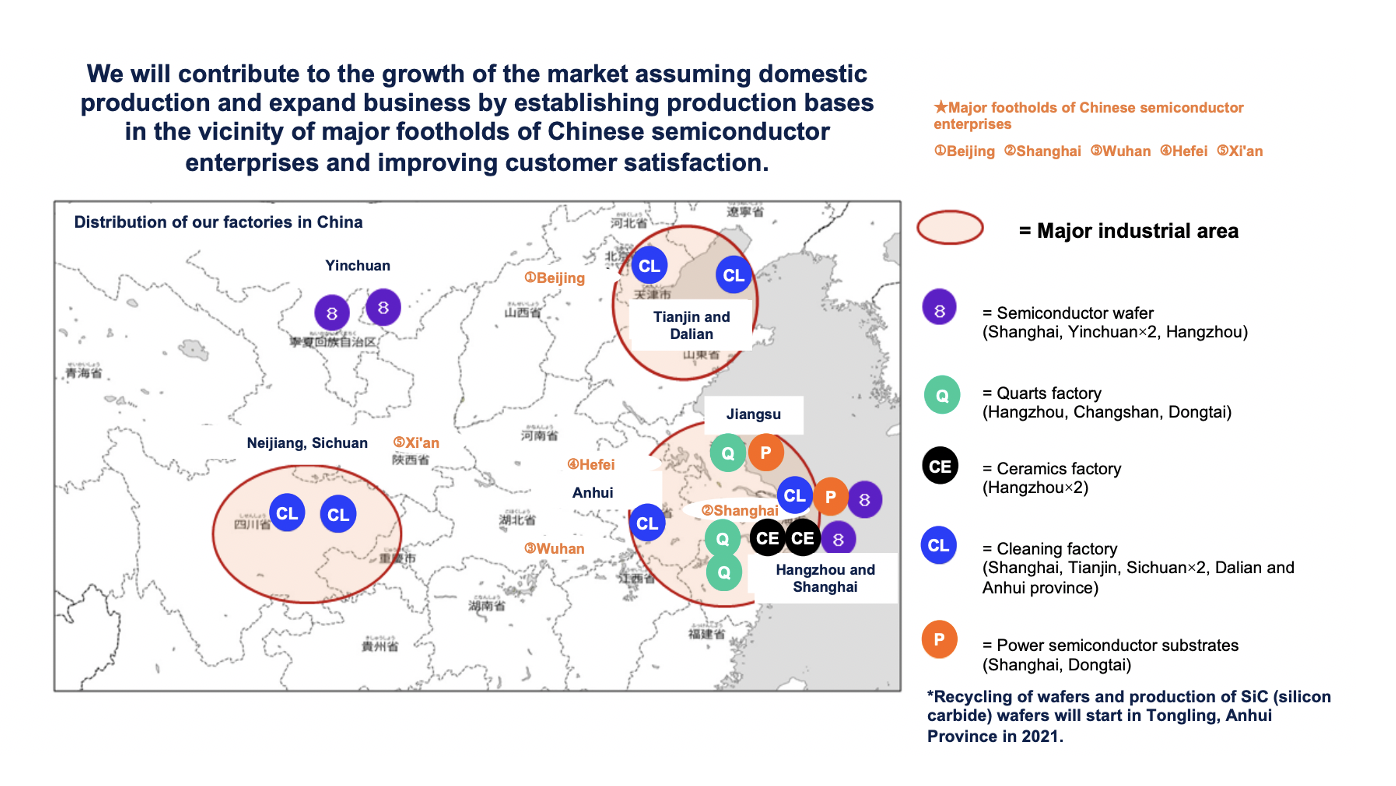

Map of production bases of Ferrotec Group in China

(From the company material)

Assuming a shift to domestic production, the company aims to contribute to market growth and expand the scope of the group’s business by establishing production sites near major footholds of Chinese semiconductor companies and improving customer satisfaction.

4-3. Recent Developments for Each Business Segment

Semiconductor and other equipment-related business

Wafer business

The company sold some shares of Hangzhou Semiconductor Wafer Co., Ltd. (FTHW) in Zhejiang Province after which, the said subsidiary issued new shares through a third-party allotment. While steady progress is being made with efforts to acquire certification for 12-inch semiconductor wafers, with the company still in the upfront investment stage, large-scale investments made thus far have led to expansion in the scale of assets and interest-bearing liabilities in the wafer business, increasing financial risk. The aforementioned share sell-off and issuance of new shares via third-party allotment were carried out due partly to the booming capital market in China, in order to secure a balance between business and investment opportunities and finance.

Following the sale of shares, Ferrotec Holding’s investment ratio dropped to 40.0% but said sale generated 1.97 billion yuan (about 30.3 billion yen). As for the issuance of new shares via third-party allotment, Ferrotec raised 1.6 billion yuan (about 24.6 billion yen), while its investment ratio fell to 29.5%.

The diameter of wafers manufactured by the group is increasing from 6 to 8 and 12 inches. For 6-inch wafers, demand is currently strong, and monthly production has remained at 420,000. For 8-inch wafers, the company is strengthening its direct sales system, and also in the process of promoting customer accreditation at the new Hangzhou plant. At the end of the current term, it will establish a manufacturing system in which it can produce 100,000 wafers per month. From 2021 onward, Ferrotec will create a system to increase production according to demand. Mass production of 12-inch wafers is slated to start in the fourth quarter (October-December) with monthly production of 30,000 wafers. In the future, the company will make additional capital investments on the premise of raising funds in China, such as through the issuance of new shares through third-party allotment.

(From the company material)

Semiconductor materials

Sales of quartz products, for which demand for consumables is strong, are expected to grow particularly sharply among material products. As such, Ferrotec is making investments to boost production at its plants in Hangzhou and Changshan in Zhejiang Province, Dongtai in in Jiangsu Province in China, and Yamagata Prefecture in Japan. As for ceramics products and CVD-SiC products, the company has an advantage in developing materials and technologies for processing and coating in Japan. For ceramic products, it is bolstering its high-value-added machinable ceramics for laser processing probe cards. At the Hangzhou plant in Zhejiang Province, China, the company plans to increase production capacity for fine ceramics, which are in high demand.

Equipment parts cleaning

This business is targeted at the Chinese market. Operations are carried out at Ferrotec (Anhui) Technology Co., Ltd. (FTSA), which is based in Tongling City, Anhui Province, and its four subsidiaries, a total of five bases and six plants. The scale of the business is growing on the back of production expansion by semiconductor and FPD (organic EL and liquid crystal) manufacturers, with the market share in China approaching 60%. As Chinese semiconductor and FPD manufacturers are slated to launch new projects one after another, FTSA plans to increase cleaning volume in Tongling, and a government-affiliated fund in Tongling has also co-invested in the project. In addition, preparations to list FTSA on the STAR Market are under way.

Electronic device business

For thermo-electric modules, applications for 5G communication devices are expanding (estimated number of 5G communication bases in Chin 650,000 in 2020, 770,000 in 2021, and 930,000 in 2022). Applications are also diversifying as a result of digitalization for consumer products such as wearable devices, IoT, home appliances, etc. In addition, the company plans to turn the Russian company, RMT, which boasts strength in micro-thermoelectric modules, into a wholly owned subsidiary by the end of 2020. RMT possesses technological capabilities to produce micro-thermoelectric modules (less than 150 μ) and multistage modules, as well as development capabilities for high-quality bismuth telluride (Bi2Te3) material.

With thermo-electric modules being adopted for controlling the temperatures of underwear and jackets, demand for thermoelectric modules for wearable products is expected to grow significantly going forward.

Power semiconductor substrates

In the term ending March 2021, sales are forecast to decrease 10.7% year on year to 2.53 billion yen due partly to a decline in demand for industrial equipment and automotive devices. However, with the wave of global power consumption reduction working as a tailwind, the scale of the power semiconductor market, which was 2.9 trillion yen in 2018, is expected to expand to 4.2 trillion yen in 2030 (according to a research company). The group’s clients are mainly European, Japanese, and Chinese companies. Thanks partly to trade friction, its market share in China has expanded. Also, an increasing number of global manufacturers are adopting its products.

As demand is expected to increase in the automotive field, the company launched AMB substrates in addition to DCB substrates. With the power semiconductor substrate plant in Dongtai City, Jiansu Province currently expanding production capacity, continued sales growth is anticipated for the next term onward. Monthly production capacity of Shanghai and Dongtai plants in 2020 is 600,000 DCB substrates and 100,000 AMB substrates. The company plans to lift this to one million DCB substrates and 200,000 AMB substrates in FY 2021. In the future, it intends to list the Dongtai subsidiary on the STAR Market.

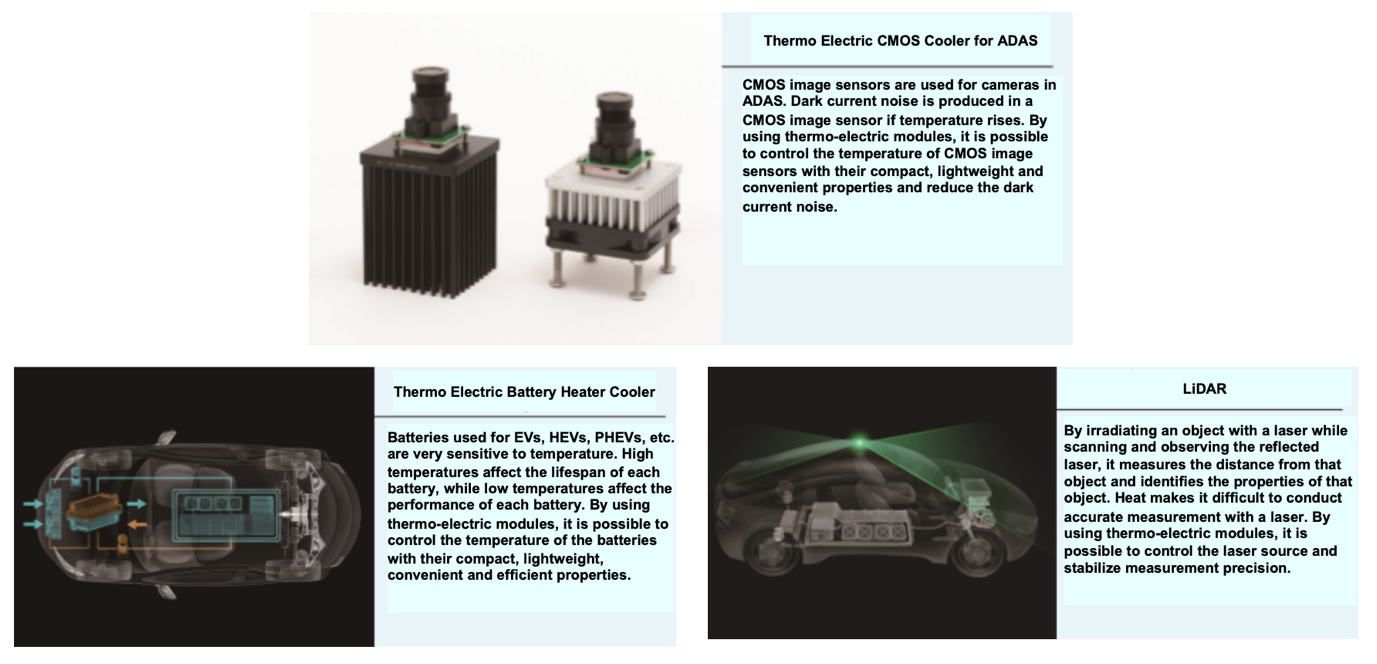

Automotive related business

Ferrotec is making a full-scale foray into the automotive field, where semiconductor demand is expected to grow. This move is to utilize the strengths of its products, including the heat dissipating / cooling properties of thermo-electric modules, and the sealing properties of magnetic fluids. The company’s thermal modulation products can be used for various purposes, such as CMOS sensors, lithium ion batteries, lidars that beams laser light, cup holders. It has already established an independent department and begun enhancing marketing. Going forward, the company will accelerate the expansion of this business, including the implementation of M&As.

Applications of thermo-electric modules in automotive devices (examples of products for EV, ADAS)

5.Conclusions

Ferrotec kept its full-year forecasts conservative, but there are no causes for concern, with semiconductor materials and thermo-electric modules for 5G continuing to perform well, and for thermo-electric modules, the products for automotive temperature control seats are also on a recovery trend. While factors such as the U.S.-China trade friction pose a threat to earnings, the outlook for the next term is bright, with the semiconductor market and semiconductor manufacturing equipment market looking set for continued growth in 2021, and the Chinese government’s national policies expected to provide a tailwind.

Expectations are rising not only for earnings, but also for organizational restructuring and capital policy initiatives. The company has expanded its business on the back of growth of the semiconductor market and China’s policies to promote domestic production of high-tech products. At the same time, the bloating of its balance sheet sparked concern over financial risk. Going forward, the company will aim for further growth and the enhancement of corporate value, while securing a balance between business opportunities and finance. We look for the company to swiftly achieve its medium-term management targets (sales of 125 billion yen, an operating income of 12.5 billion yen, an ROE of over 10%, an ROIC of over 6%, a capital-to-asset ratio of over 40%), which were retracted due to uncertainty over the global economy amid the impact from the COVID-19 pandemic.

Reference: Regarding Corporate Governance

◎ Organization type, and the composition of directors and auditors

Organization type | Company with board of auditors |

Directors | 8 directors, including outside ones 2 |

Auditors | 3 directors, including outside ones 2 |

◎ Corporate Governance Report(Updated on August 18, 2020)

Basic policy

The company considers that it is important to improve its corporate value, emphasize the soundness of its business administration to become an enterprise that will be trusted and supported by stakeholders, including shareholders, customers, business partners, and local communities, and also establish a managerial system responding the rapid changes to the business environment swiftly and accurately.

The organizational chart of the corporate governance of our company as of the submission date is included in “V. Others, 2. Other items regarding the corporate governance structure, etc.”

Our company’s board of directors is chaired by the representative director and president He Xian Han. The other 8 members (including 2 outside directors) are the representative director and chairman Akira Yamamura the representative director and vice-president Takeru Yamamura, the director Hiroo Wakaki, the director Takanori Suzuki, the director Eiji Miyanaga, the outside director Kyuzo Nakamura, and the outside director Kuniaki Yanagisawa. In addition to monthly meetings of the board of directors, we hold an extraordinary meeting of the board of directors flexibly, when there is an important matter to be discussed. The board of directors determines important items in accordance with the regulations for the board of directors in addition to laws and the articles of incorporation, and oversees the business operation of each director. All auditors attend meetings of the board of directors, to oversee the business operation of directors. The term of directors is one year, so that we can respond to changes in the management environment swiftly.

Our company adopted a system of the board of auditors, which is composed of the full-time outside auditor Takamasa Higuchi, the outside auditor Go Fujimoto, and the auditor Masaru Yoshida, that is one full-time auditor and two part-time auditors, including 2 outside auditors. It is stipulated that a meeting of the board of auditors is held 8 or more times per year, once per month in principle, and extraordinarily when necessary. Full-time auditors attend meetings of the board of directors and other important meetings, such as meetings of the board of executive officers, and express their opinions when necessary, so as to oversee the business operation of directors. They also exchange information and opinions with the internal audit division and comptrollers, and hold regular meetings, to cement cooperation and improve the auditing function.

For business operation, 9 executive officers (composed of 8 male officers and 1 female officer, including 4 male directors) serve as chiefs of respective sections, so that their roles for business operation are clarified. Monthly meetings of the board of executive officers are held, to deliberate important items, including the items to be discussed at a meeting of the board of directors.

The company receives advice about legal affairs from Goto Law Office when this is necessary for business, in accordance with a legal consultancy contract. The comptroller Ernst & Young ShinNihon LLC audits our accounting in accordance with the audit contract, and provides us with their reports, including their comments during and after audit, and tries to disclose information without delay as a company listed in the standard section of the JASDAQ market of Tokyo Stock Exchange, if an event specified in the provisions regarding disclosure occurs.

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2020 Investment Bridge Co., Ltd. All Rights Reserved. |

To view back numbers of Bridge Reports on Ferrotec Holdings Corporation (6890) and other companies, or IR related seminars of Bridge Salon, please go to our website at the following URL.

URL:https://www.bridge-salon.jp/