Bridge Report:(6890)Ferrotec Fiscal year ended March 2021

He Xian Han, President | Ferrotec Holdings Corporation (6890) |

|

Company Information

Exchange | JASDAQ |

Industry | Electric Equipment (Manufacturing) |

President | He Xian Han |

HQ Address | Nihonbashi Plaza Building, Nihonbashi 2-3-4, Chuo-ku, Tokyo |

Year-end | March |

Website |

Stock Information

Share Price | Shares Outstanding | Market Cap. | ROE (Act.) | Trading Unit | |

¥3,345 | 37,305,202 shares | ¥124,785 million | 14.3% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥28.00 | 0.8% | ¥209.09 | 16.0x | ¥1,803.03 | 1.9x |

*Share price as of closing on June 18, 2021. Each number is based on the results in the Fiscal year ended March 2021.

Consolidated Earnings Trends

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS (¥) | DPS (¥) |

March 2018 (Act.) | 90,597 | 8,437 | 7,157 | 2,678 | 77.08 | 24.00 |

March 2019 (Act.) | 89,478 | 8,782 | 8,060 | 2,845 | 76.90 | 24.00 |

March 2020 (Act.) | 81,613 | 6,012 | 4,263 | 1,784 | 48.12 | 24.00 |

March 2021 (Act.) | 91,312 | 9,640 | 8,227 | 8,280 | 222.93 | 30.00 |

March 2022 (Est.) | 105,000 | 15,000 | 13,600 | 7,800 | 209.09 | 28.00 |

*The forecast is from the company. Unit: million yen, yen. DPS for FY 3/21 includes a commemorative dividend of 4.00 yen/share. Net income is net income attributed to parent shareholders. The same shall apply hereafter.

This Bridge Report reviews the overview of Ferrotec’s earnings results of the fiscal year ended March 2021 and earnings estimates for fiscal year March 2022.

Table of Contents

Key Points

1.Company Overview

2.Fiscal Year ended March 2021 Earnings Results

3.Fiscal Year ending March 2022 Earnings Forecasts

4.Fundraising and Financial Management

5.New Medium-term Management Plan (FY 3/2022 - FY 3/2024)

6.Conclusions

Reference: Regarding corporate governance

Key Points

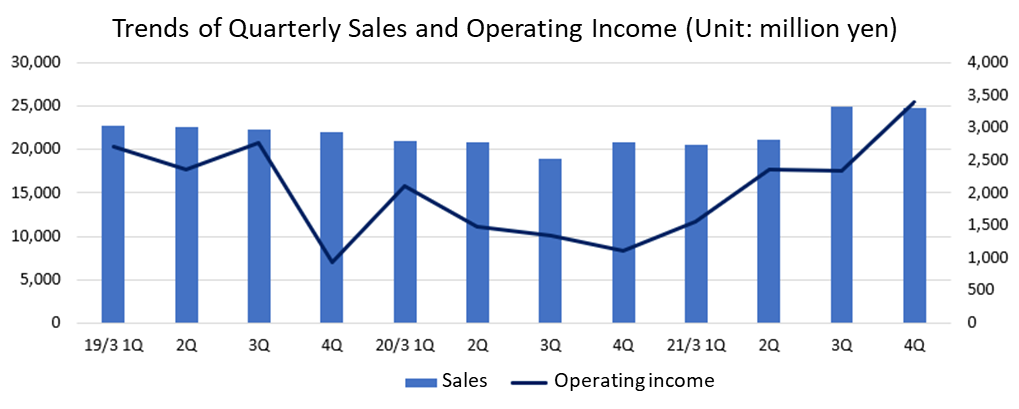

- For the term ended March 2021, sales grew 11.9% year on year to 91,312 million yen. The sales of the semiconductor and other equipment-related business rose 14.7% year on year, due to the sales increase of material products (quartz, silicon parts, ceramics, and CVD-SiC) used in the semiconductor manufacturing process, etc. The sales of the electronic device business increased 28.1% year on year, thanks to the healthy performance of electronic devices for equipment related to the next-generation telecommunication system 5G. As for profits, gross profit increased due to the sales growth, and operating income rose 60.3% year on year to 9,640 million yen, as the augmentation of SG&A was not significant. Net income rose 363.9% year on year to 8,280 million yen, as the impairment loss in the photovoltaic business, etc. was posted as extraordinary loss, but gain from changes in equity for three wafer companies was posted as an extraordinary income. Both sales and profit exceeded the earnings forecasts which were revised upwardly in February 2021, hitting a record high.

- For the term ending March 2022, sales are estimated to grow 15.0% year on year to 105 billion yen and operating income is projected to grow 55.6% year on year to 15 billion yen. This term, the demand-supply balance of semiconductors will remain tight. It is expected that the company will meet the increased demand and the semiconductor and other equipment-related business, and the electronic device business will perform well. Profit is estimated to grow considerably this term, too, as the augmentation of SG&A will be offset by the sales growth, the rise in utilization rate, etc. As for dividends, the company plans to pay an ordinary dividend of 28.00 yen/share, which is substantially an increase of 2.00 yen/share from the previous term, in which the company paid 30.00 yen/share, including a commemorative dividend of 4.00 yen/share. The estimated payout ratio is 13.4%, which is lower than that of the previous term ended March 2021 (15.1%), due to the investment expansion. However, the company aims to return profit to shareholders as much as possible with stable dividends according to the improvement in profitability.

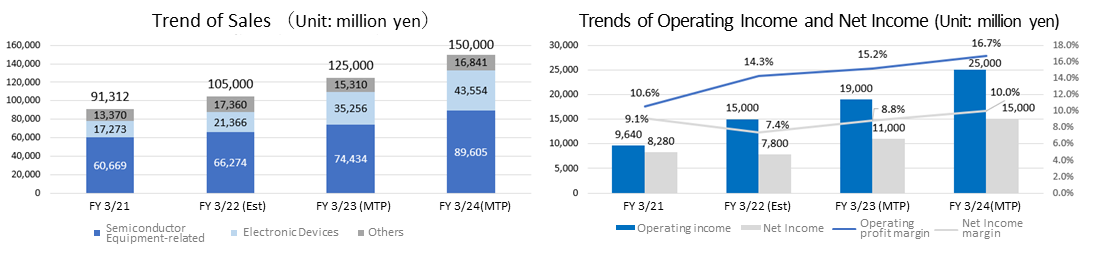

- The company formulated and announced a three-year mid-term management plan, whose initial fiscal year is this term. Assuming that the semiconductor market will grow for the foreseeable future, the company aims to achieve sales of 150 billion yen in the term ending March 2024, which is the final fiscal year of the plan. In addition, the company will raise operating income margin to 16.7%, by establishing an optimal business portfolio. The company will concentrate on the expansion of businesses and products of semiconductor materials, thermo modules, equipment parts cleaning, power semiconductor substrates, and recycled wafers.

- Like in the previous term, profit is expected to grow considerably this term. Its share price skyrocketed, because its performance made a favorable impression on investors. The share price exceeded the high price in January 2018 and is now at the 3,000-yen level. When the share price marked the high price of 2,900 yen in January 2018 in the monthly chart, PER was 23, while EPS was estimated to be 126.67 yen in the term ended March 2018 (source: the brief report on financial results for the third quarter of the term ended March 2018), and the current PER is lower than that. As the distribution of 5G has finally started, 6G is increasingly discussed. The purposes of use of semiconductors, such as CASE, IoT, and robotics, have diversified and such semiconductors are used abundantly than in 2018. The demand-supply balance will settle eventually, but the business environment is expected to remain favorable for the foreseeable future.

- We would like to pay attention to the progress of plans and the trends of new burgeoning products, such as recycled wafers and power semiconductor substrates, as well as the current core products, which are semiconductor materials whose sales are expected to grow steadily.

1. Company Overview

Ferrotec Holdings Corporation conducts business mainly on the basis of the following two segments: the semiconductor and other equipment-related Business, in which it offers parts for semiconductors and fine panel display (FPD) manufacturing equipment, consumable materials and wafers used in the process of manufacturing semiconductors, and semiconductors for equipment offering cleaning services of equipment parts, and the Electronic Device Business that focuses on the thermal element “thermo-electric modules,” with 52 companies serving as Ferrotec’s subsidiaries (46 consolidated subsidiaries and 6 non-consolidated affiliated companies accounted for by the equity method and other related companies).

Ferrotec was born as a company with highly unique technologies including thermoelectric modules with uses in thermal elements and vacuum technologies that respond to magnetic fluids that were born from the NASA space program in the 1980s. Over the course of its 40 years history of operations, the Company has developed a wide range of diverse technologies with applications in the automobile, electronics, next generation energy and other industries. As a transnational company, Ferrotec deploys its businesses in Japan, Europe, the Americas, China, and Asia, and boasts of marketing, development, manufacturing, sales, and management capabilities in various countries and regions. A holding company structure was implemented from April 2017.

[Corporate Ethos and Priority Policies for Enhancing Organizational Strength and Achieving Sustainable Development]

The Ferrotec group strives to be a company that is trusted by stakeholders such as customers, shareholders, employees, business partners, and local communities, by achieving sustainable growth and complying with laws, regulations, social order, and international rules with decency in its corporate activities.

Initiatives to enhance corporate value | Promote independent management of all subsidiaries, and redistribute management resources |

Thorough awareness that puts quality first | Perfect design and product quality that pleases customers, and improvement of the quality of services inside and outside the company |

Strengthen corporate governance | Thorough internal control and management of affiliated companies, and strengthening of risk management and compliance |

1-1.Business Segments

Ferrotec’s operations includes semiconductor seal related products such as vacuum seal, quartz products, ceramic products, etc. used in manufacturing equipment of semiconductor, FPD, LED etc., electronic device business centering on thermo modules and business segments that are not included in the reportable segments. Other businesses, which handle silicon crystal and solar cell wafers, saw blades, machine tools, surface treatment, industrial washing machines etc.

Semiconductor equipment related business

Ferrotec provides total engineering services in the Equipment Related business segment, including the manufacture and sale of Vacuum Feedthrough of equipment parts for solar power, semiconductor, FPD and LED applications, consumable products used in manufacturing of devices, quartz products, ceramic products, CVD-SiC products, quartz crucibles, silicon wafer processing and equipment cleaning services.

Its vacuum seal boasts of top market share in the world and is a functional part that insulates the interior of manufacturing equipment from gas and dust contamination while supporting rotating action of the above-mentioned equipment. These Vacuum Feedthrough use magnetic fluids (Fluids that respond to magnetic fields), which has been a core technology of Ferrotec since its founding. Because of instability in these applications arising from their link with corporate capital investments cycles, the Company focuses its marketing efforts upon expanding sales to applications for which demand is more stable, including transportation equipment, precision robots, and general industry usages. In addition, Ferrotec has also focused its efforts upon assuming consigned manufacture of vacuum chambers that use Vacuum Feedthrough and gate valves (Both use vacuum related equipment). At the same time, quartz, ceramic, and CVD-SiC products are critical elements in the process of semiconductor manufacturing. Quartz products are able to resist high temperature conditions that exist in the semiconductor manufacturing process and are a high purity silica glass product that protects semiconductors from undergoing chemical reaction by preventing it from activating with gas. The Company boasts of semiconductor manufacturing equipment manufacturers as their main clients in Japan and overseas who purchase ceramic products, which are Ferrotec’s core material and technology. At the same time, semiconductor inspection tools for machinable ceramics and fine ceramics used in semiconductor manufacturing equipment are two main products in this CVD-SiC.

*CVD-SiC products are the term used to describe SiC products manufactured by "CVD method (Chemical Vapor Deposition method)" (created from compounds of silicon and carbon gas). Currently, semiconductor equipment and structural parts are provided, and research and development for products used in aeronautics and space (Turbine, mirrors), automobile (Power semiconductors), energy (Nuclear power related), information technology (Semiconductor manufacturing equipment parts) and other applications are also being conducted.

As for silicon wafer processing, the posting of sales of 12-inch (diameter) wafers started in the term ended March 2021, in addition to 6-inch and 8-inch wafers and has a leading share of more than half of the manufacturing equipment cleaning services market in China.

(From the company website)

Electronic Device Business

Thermal element “thermoelectric modules” are products that can instantly raise or lower temperatures to a highly precise degree and are a core product of this business. Thermo modules are mainly used for automotive temperature control seats and many other purposes, including wafer temperature control in semiconductor manufacturing equipment, genetic testing apparatus, optical communications, home appliances, and other application products such as power semiconductor substrates. The company has the largest share in the global market of thermo modules. By developing new products using high-performance materials and reducing costs and improving quality by adopting automated manufacturing lines, the company is stirring new demand and diversifying purposes of use of its products.

Furthermore, the company has the largest share in the global market of magnetic fluid, which is used increasingly for linear vibration motors for smartphones, speakers for 4K TV and automobiles, high-quality sound headphones, etc.

|

|

Others

|

|

(From the company website)

2.Fiscal Year ended March 2021 Earnings Results

2-1.Consolidated Earnings

| FY 3/20 | Ratio to sales | FY 3/21 | Ratio to sales | YoY | Forecast | Difference from the Forecast |

Sales | 81,613 | 100.0% | 91,312 | 100.0% | +11.9% | 89,000 | +2.6% |

Gross Income | 26,928 | 33.0% | 30,782 | 33.7% | +14.3% | - |

|

SG&A | 20,915 | 25.6% | 21,141 | 23.2% | +1.1% | - |

|

Operating Income | 6,012 | 7.4% | 9,640 | 10.6% | +60.3% | 9,000 | +7.1% |

Ordinary Income | 4,263 | 5.2% | 8,227 | 9.0% | +93.0% | 8,000 | +2.8% |

Net Income | 1,784 | 2.2% | 8,280 | 9.1% | +363.9% | 7,000 | +18.3% |

*Unit: million yen. Forecast is the revised forecast announced in February 2021.

Sales and profit increased, exceeded the revised forecast. Both sales and profit hit a record high.

Sales grew 11.9% year on year to 91,312 million yen. The sales of the semiconductor and other equipment-related business rose 14.7% year on year, due to the sales increase of material products (quartz, silicon parts, ceramics, and CVD-SiC) used in the semiconductor manufacturing process, etc. The sales of the electronic device business increased 28.1% year on year, thanks to the healthy performance of electronic devices for equipment related to the next-generation telecommunication system 5G. As for profits, gross profit increased due to the sales growth, and operating income rose 60.3% year on year to 9,640 million yen, as the augmentation of SG&A was not significant. Net income rose 363.9% year on year to 8,280 million yen, as the impairment loss in the photovoltaic business, etc. was posted as extraordinary loss, but gain from changes in equity for three wafer companies was posted as an extraordinary income. Both sales and profit exceeded the earnings forecasts which were revised upwardly in February 2021, hitting a record high.

Exchange rates (average rates during the term) were 106.43 yen per dollar (109.24 yen in the previous year) and 15.42 yen per yuan (15.82 yen in the previous year). Capital investments fell 57.9% year on year to 14.297 billion yen (33.92 billion yen in the previous year), while depreciation increased 20.5% year on year to 9.155 billion yen (7.6 billion yen in the previous year).

2-2.Business Segment Trends

Business Segment Sales and Profits

| FY 3/20 | Ratio to sales Profit margin | FY 3/21 | Ratio to sales Profit margin | YoY |

Semiconductor and other equipment -related | 52,880 | 64.8% | 60,669 | 66.4% | +14.7% |

Electronic Device | 13,489 | 16.5% | 17,273 | 18.9% | +28.1% |

Others | 15,243 | 18.7% | 13,370 | 14.6% | -12.3% |

Total Sales | 81,613 | 100.0% | 91,312 | 100.0% | +11.9% |

Semiconductor and other equipment -related | 4,192 | 7.9% | 6,183 | 10.2% | +47.5% |

Electronic Device | 2,768 | 20.5% | 4,453 | 25.8% | +60.8% |

Others | 260 | 1.7% | -321 | - | - |

Adjustments | -1,208 | - | -674 | - | - |

Total Operating Income | 6,012 | 7.4% | 9,640 | 10.6% | +60.3% |

*Unit: million yen

(1) Semiconductor and other equipment-related business

| FY 3/20 | Ratio to sales | FY 3/21 | Ratio to sales | YoY |

Vacuum Feedthroughs | 8,136 | 15.4% | 8,795 | 14.5% | +8.1% |

Quartz | 13,621 | 25.8% | 17,116 | 28.2% | +25.7% |

Silicon parts | 2,752 | 5.2% | 3,226 | 5.3% | +17.2% |

Ceramics | 9,048 | 17.1% | 12,267 | 20.2% | +35.6% |

CVD-SiC | 2,036 | 3.9% | 2,186 | 3.6% | +7.4% |

EB-Gun, LED | 3,973 | 7.5% | 3,872 | 6.4% | -2.5% |

Semiconductor wafer | 6,754 | 12.8% | 4,638 | 7.6% | -31.3% |

Equipment parts cleaning | 5,606 | 10.6% | 7,579 | 12.5% | +35.2% |

Quartz crucibles | 955 | 1.8% | 990 | 1.6% | +3.7% |

Sales | 52,880 | 100.0% | 60,669 | 100.0% | +14.7% |

*Unit: million yen

Sales and profit grew. Sales increased 14.7% year on year to 60,669 million yen, and operating income rose 47.5% year on year to 6,183 million yen.

As for vacuum seal, the makers of semiconductors and organic EL panels resumed equipment investment, so the recovery trend became apparent in the middle of the year, so the sales of the products and commissioned processing increased.

As for the material products (quartz products, ceramics, silicon parts, CVD-SiC, etc.) used for the semiconductor manufacturing process, sales grew considerably, as the demand for semiconductors for PCs and servers expanded steeply due to the global popularization of remote work and online conference systems amid the COVID-19 pandemic, so the device makers’ equipment utilization rate became high.

The demand for cleaning of equipment parts for manufacturing semiconductors and organic EL panels was strong, and the operation of new factories started, boosting sales.

As for silicon wafer processing, the shares of the Chinese subsidiary that handles the products were transferred to the local governments of China, private investment funds, etc. and the allocation of new shares to a third party was carried out, so it was transformed from a consolidated subsidiary to an equity-method affiliate. Accordingly, its sales and profit/loss in the fourth quarter (Jan. to Mar.) were not posted.

(2) Electronic Device Business

| FY 3/20 | Ratio to sales | FY 3/21 | Ratio to sales | YoY |

Thermo-electric module | 9,863 | 73.1% | 13,036 | 75.5% | +32.2% |

Power semiconductor substrates | 2,838 | 21.0% | 3,491 | 20.2% | +23.0% |

Ferrofluid, Others | 789 | 5.8% | 746 | 4.3% | -5.4% |

Electronic Device Business Sales | 13,489 | 100.0% | 17,273 | 100.0% | +28.1% |

*Unit: million yen

Sales and profit grew. Sales increased 28.1% year on year to 17,273 million yen, and operating income rose 60.8% year on year to 4,453 million yen.

As for thermo modules, which are their mainstay, the performance of products for automotive temperature control seats was stagnant but started recovering gradually in the second half.

On the other hand, the products for mobile communication system equipment for 5G performed well, and the products for medical testing equipment such as PCR sold well. For other industrial purposes, the performance of thermo modules for consumer products, including home appliances, remained healthy. The sales of thermo modules for semiconductors exceeded the estimate.

As for power semiconductor substrates, DCB substrates performed well, thanks to the recovery of the power device market and the enhancement of capacities. The company started mass-producing AMB substrates, which are new products, as more customers recognized them.

As for magnetic fluid, products for vibration in speakers and smartphones sold to some degree.

2-3.Financial Condition and Cash Flow

◎Balance Sheet Summary

| FY 3/20 | FY 3/21 | Increase/ decrease |

| FY 3/20 | FY 3/21 | Increase/ decrease |

Current Assets | 71,451 | 88,077 | +16,625 | Current liabilities | 61,443 | 58,890 | -2,553 |

Cash | 23,709 | 30,202 | +6,493 | Payables | 18,251 | 20,269 | +2,017 |

Receivables | 20,435 | 32,201 | +11,766 | ST Interest-Bearing Liabilities | 26,169 | 17,653 | -8,515 |

Noncurrent Assets | 118,558 | 89,112 | -29,446 | Noncurrent liabilities | 78,418 | 40,059 | -38,359 |

Tangible Assets | 110,816 | 53,043 | -57,773 | LT Interest-Bearing Liabilities | 55,245 | 32,114 | -23,130 |

Intangible Assets | 500 | 1,814 | +1,314 | Total Liabilities | 139,862 | 98,949 | -40,912 |

Investments and Other assets | 7,241 | 34,254 | +27,012 | Net Assets | 50,147 | 78,239 | +28,091 |

Total Asset | 190,010 | 177,189 | -12,820 | Retained earnings | 10,831 | 18,221 | +7,389 |

|

|

|

| Total Interest-Bearing Liabilities | 190,010 | 177,189 | -12,820 |

*Unit: million yen. Interest Bearing Liabilities include Lease liabilities.

Total assets declined 12.8 billion yen from the end of the previous term to 177.1 billion yen, as accounts receivable, investments and other assets increased through the transformation of three wafer companies into equity-method affiliates, while tangible fixed assets decreased.

Total liabilities dropped 40.9 billion yen from the end of the previous term to 98.9 billion yen, as the repayment of debts by selling some shares of the three wafer companies, the exclusion of borrowings of the three wafer companies from the scope of consolidation, etc.

Net assets increased 28 billion yen from the end of the previous term to 78.2 billion yen, due to the sale of some shares of the three wafer companies, the allocation of new shares to a third party, etc.

Capital-to-asset ratio rose 12.4 points from the end of the previous term to 37.9%.

Cash Flow

| FY 3/20 | FY 3/21 | Increase/decrease |

Operating cash flow (A) | 8,902 | 13,217 | +4,314 |

Investing cash flow (B) | -34,472 | -20,879 | +13,592 |

Free Cash Flow (A + B) | -25,569 | -7,661 | +17,907 |

Financing cash flow | 17,996 | 21,694 | +3,698 |

Cash and Equivalents at the end of term | 23,709 | 30,202 | +6,493 |

*Unit: million yen

The surplus of operating CF expanded, due to the increases in pretax profit and depreciation. The deficit of investing CF shrank, due to the decline in expenditure for acquiring tangible fixed assets, etc.

The surplus of financing CF increased, due to the revenues from selling shares of subsidiaries without changing the scope of consolidation.

The cash position improved.

3.Fiscal Year ending March 2022 Earnings Forecasts

3-1. Full Year Consolidated Earnings

| FY 3/21 Act | Ratio to sales | FY 3/22 Est. | Ratio to sales | YoY |

Sales | 91,312 | 100.0% | 105,000 | 100.0% | +15.0% |

Operating Income | 9,640 | 10.6% | 15,000 | 14.3% | +55.6% |

Ordinary Income | 8,227 | 9.0% | 13,600 | 13.0% | +65.3% |

Net Income | 8,280 | 9.1% | 7,800 | 7.4% | -5.8% |

*Unit: million yen

Expect Sales and Profit increase

For the term ending March 2022, sales are estimated to grow 15.0% year on year to 105 billion yen and operating income is projected to grow 55.6% year on year to 15 billion yen. This term, the demand-supply balance of semiconductors will remain tight. It is expected that the company will meet the increased demand and the semiconductor and other equipment-related business, and the electronic device business will perform well. Profit is estimated to grow considerably this term, too, as the augmentation of SG&A will be offset by the sales growth, the rise in utilization rate, etc. As for dividends, the company plans to pay an ordinary dividend of 28.00 yen/share, which is substantially an increase of 2.00 yen/share from the previous term, in which the company paid 30.00 yen/share, including a commemorative dividend of 4.00 yen/share. The estimated payout ratio is 13.4%, which is lower than that of the previous term ended March 2021 (15.1%), due to the investment expansion. However, the company aims to return profit to shareholders as much as possible with stable dividends according to the improvement in profitability.

3-2 Business Segment Earnings Trends

Business Segment Sales Trend

| FY 3/21 | Ratio to sales | FY 3/22 Est | Ratio to sales | YoY |

Semiconductor and other equipment -related | 60,669 | 66.4% | 66,274 | 63.1% | +9.2% |

Electronic Device | 17,273 | 18.9% | 21,366 | 20.3% | +23.7% |

Others | 13,370 | 14.6% | 17,360 | 16.5% | +29.8% |

Total Sales | 91,312 | 100.0% | 105,000 | 100.0% | +15.0% |

*Unit: million yen

(1) Semiconductor and other equipment-related business

| FY 3/21 | Ratio to sales | FY 3/22 Est | Ratio to sales | YoY | |

Vacuum Feedthroughs | 8,795 | 14.5% | 11,080 | 16.7% | +26.0% | |

Quartz | 17,116 | 28.2% | 18,867 | 28.5% | +10.2% | |

Silicon parts | 3,226 | 5.3% | 4,732 | 7.1% | +46.7% | |

Ceramics | 12,267 | 20.2% | 14,960 | 22.6% | +21.9% | |

CVD-SiC | 2,186 | 3.6% | 2,961 | 4.5% | +35.5% | |

EB-Gun, LED | 3,872 | 6.4% | 3,670 | 5.5% | -5.2% | |

Semiconductor wafer | 4,638 | 7.6% | - | - | - | |

Recycled wafer | - | - | 137 | 0.2% | - | |

Equipment parts cleaning | 7,579 | 12.5% | 8,505 | 12.8% | +12.2% | |

Quartz crucibles | 990 | 1.6% | 1,362 | 2.1% | +37.6% | |

Sales | 60,669 | 100.0% | 66,274 | 100.0% | +9.2% | |

*Unit: million yen. Semiconductor is excluded from consolidation from 4Q of FY 3/21.

Sales are estimated to grow 9.2% year on year to 66,274 million yen.

This term, the demand related to semiconductors is expected to keep expanding, and the sales of semiconductor materials, cleaning, and vacuum seal are estimated to increase.

The exclusion of wafer processing and its sales from the scope of consolidation will be reflected in annual results. Equity-method income/loss will be posted as non-operating income/loss.

Vacuum feedthroughs

Not only the vacuum feedthroughs for semiconductor manufacturing equipment, but also commissioned metal processing for chambers, robot parts, etc. for semiconductor manufacturing equipment will see sales growth.

<Measures>

Collaborative development will be continued with the semiconductor manufacturing equipment maker.

A production equipment system will be established, and investment will be continued.

The relationships among group companies will be cemented to bring out synergy.

The existing channels and brands of group companies will be utilized to enhance marketing and promote sales in the Chinese market.

Quartz Products

The production output of quartz will keep increasing, because the demand for investment in new equipment for semiconductors and the demand from repeat customers due to the high operation rate of semiconductor makers will remain strong.

<Measures>

The company is preparing for further increasing production output, because the demand from leading OEMs will keep growing in 2021. The company will increase equipment for machine processing at Dongtai Plant in China and enhance output at Changshan Plant.

The company will develop products and produce prototypes for next-generation equipment at Yamagata Plant. The mass-production scale will shift from a small scale to a medium scale in 2021 or later.

Silicon Parts

As clients around the world have demanded the increase in production output, the sales of Si materials, Si jigs and consumables are estimated to grow considerably.

<Measures>

The company plans to establish a system for processing and assembling Si parts using Si materials (ingots) at Yinchuan Plant, to increase output considerably in the medium term.

Ceramics Products

As for the machinable ceramics, Photoveel, the sales of products for conventional semiconductor inspection jigs are healthy, and the sales of products for new semiconductor inspection jigs are expected to grow.

As for fine ceramics, the sales of parts for etching and deposition equipment are estimated to grow further inside and outside Japan.

<Measures>

As for machinable ceramics, the company will upgrade equipment to deal with the increase in the output of new miniaturized inspection jigs, which are strongly demanded by new clients, and concentrate on the sales promotion of machinable ceramics with high functions and properties.

As there have been business inquiries about parts related to medical care and analysis, the company will concentrate on sales promotion.

As for fine ceramics, the company will deal with the increase in production output of parts of new semiconductor equipment using alumina materials with excellent dielectric property.

CVD-SiC Products

The demand for components increased thanks to the upgrade of semiconductor equipment for the Chinese market and the high utilization rate of equipment. The demand from Chinese clients is expected to grow considerably.

<Measures>

The company will develop a production system in response to the growth of demand.

They will approach semiconductor manufacturing equipment makers with a proposal for adoption of the company’s products, and work on the development of parts for SiC semiconductors and the improvement of the prototype production system.

Semiconductor Wafer

The posting of sales of 12-inch wafers began in the third quarter of the previous term.

This term, its sales will not be posted, because it is out of the scope of consolidation, but 6-inch wafers are expected to perform well, as 420,000 wafers will be produced per month. As the demand for 8-inch wafers has recovered, the company aims to produce 300,000 wafers per month. As for 12-inch wafers, the company will increase the output from 30,000 wafers per month to 100,000 wafers per month.

<Measures>

The allocation of new shares to a third party will be carried out. As for 12-inch wafers, the company will start producing 200,000 wafers per month at Hangzhou Plant in 2022.

Parts Cleaning

The company will keep increasing production output at five footholds and seven plants in China.

The sales of services targeted at Chinese semiconductor and FPD makers, which are expected to increase production volume, is expected to grow.

<Measures>

The Tongling Plant in Anhui Province will be reorganized as the major second-tier subsidiary. The company will establish an analysis center in Shanghai, to do business in the innovative field.

(2) Electronic Device Business

| FY 3/21 | Ratio to sales | FY 3/22 Est | Ratio to sales | YoY |

Thermo-electric module | 13,036 | 75.5% | 14,586 | 68.3% | +11.9% |

Power semiconductor substrates | 3,491 | 20.2% | 5,678 | 26.6% | +62.6% |

Ferrofluid, Others | 746 | 4.3% | 1,102 | 5.2% | +47.7% |

Electronic Device Business Sales | 17,273 | 100.0% | 21,366 | 100.0% | +23.7% |

*Unit: million yen

Thermo Modules Products

The sales of automotive temperature control seats are estimated to be unchanged from the previous year. The company will seek new purposes of use of thermo modules for automobiles and proceed with commercialization.

In other industries other than the automotive, the thermo modules for telecommunication devices are estimated to sell well, as 5G infrastructure will be developed. The purposes of use of thermo modules for consumer products are expected to increase further. The sales of thermo modules, including those for medical care and PCR tests, are estimated to be healthy.

<Measures>

The sales of thermo-electric module subassembly will be promoted globally.

The development of applications for automobiles will be enhanced, with the aim of realizing mass-production in three to five years.

The company will pursue and discuss synergy with Ohizumi Mfg. (Mothers of TSE; 6618), with which the company formed a business alliance, for applying thermo modules to mainly automobiles.

4. Fundraising and Financial Management

[4-1 Fundraising and Financial Standing]

In the term ended March 2021, the company sold part of its stake in the wafer manufacturing subsidiary (30.8 billion yen) and used the proceeds to repay interest-bearing debt amounting to 40.4 billion yen.

As a result, capital adequacy ratio rose to 37.9% from 25.5% at the end of the previous fiscal year. D/E ratio declined from 1.56 to 0.61, improving the financial safety of the company.

On the other hand, in order to accelerate the speed of growth, the company plans to invest 40 billion yen in equipment for the semiconductor field, electronic device production enhancement, etc. (24 billion yen) and long-term and strategic investments in wafer recycling, etc. (16 billion yen). The Chinese subsidiary has already procured approximately 18.6 billion yen this fiscal year through a third-party allocation of new shares.

The company will continue to diversify its fund procurement methods, including IPOs, and consider appropriate procurement methods to invest in growth.

[4-2 Regarding Financial Management]

Understanding the Current Situation and the Company’s Business Policy

The semiconductor market is continuing to expand, and there are abundant business opportunities to capture the development of the Chinese market. Electronic devices are also expected to see growth in the market for automobiles and EVs.

Taking advantage of this favorable environment, the company will raise its position in the industry by investing in increased production in the semiconductor field and electronic devices, which are expected to grow. The company intends to aggressively consider long-term strategic investments and thoroughly pursue business and profit growth.

Financial Standing and Measures to be Taken

In the previous term, the company reduced its interest-bearing debt by reorganizing its semiconductor wafer manufacturing subsidiaries, improving its financial safety, and introduced Chinese external capital into the consolidated financial statements of each subsidiary, as a consolidated subsidiary or as an equity-method affiliate.

The company will continue to strengthen its finances and strive to secure an appropriate balance between business and investment opportunities and finances.

Specifically, they will use net income as a KPI and continue to manage capital investment and investment levels. Also, they will strengthen and diffuse investment return and ROIC management. ROIC is to be 5% or higher within three years.

In terms of fund procurement, the company intends to secure an appropriate balance between business and investment opportunities and finances while considering the adoption of Chinese capital.

5. New Medium-term Management Plan (FY 3/2022 - FY 3/2024)

The company has formulated and announced a three-year medium-term management plan starting this term.

[5-1 Review of the Term Ended March 2021]

Strong demand for semiconductors led to growth in each of the company’s products and services, resulting in record highs in both sales and profits.

Capital investment was 14.2 billion yen, while the planned amount was 29.4 billion yen, but the exclusion of wafer manufacturing subsidiaries from the scope of consolidation had an impact of 5.2 billion yen. As of the end of the term ended March 2021, the company had 8.2 billion yen in equipment-related accounts payable, and the company believes it needs to invest aggressively in wafer recycling, silicon parts, etc., in addition to the highly demanded material products, cleaning, and power semiconductor substrates.

As mentioned above, financial safety has improved as interest-bearing debt has been reduced.

The company also acquired global niche companies as subsidiaries and formed alliances with leading Japanese manufacturers to expand its product lineup and strengthen its business network.

[5-2 Views on the Market Environment]

The size of the semiconductor-related market in each field, where the company operates business, is approximately $450 billion for semiconductors/ICs, $70 billion for the front-end process of semiconductor manufacturing equipment, and $50 billion for materials, consumables, assemblies, and components, and for a total is approximately $570 billion, or approximately 62 trillion yen, indicating that the market is huge.

The semiconductor market is currently recovering to a solid growth track, with a 5.1% year on year increase in 2020 and an 8.4% year on year increase in 2021, despite the negative growth of 12.0% year on year in 2019.

Among regions, the Asian market is leading the way.

The market of front-end process of equipment for semiconductors, which is closely related to the company’s business, is also expected to see growth from 2020 onward, despite a decline in 2019.

In addition, in 2020, sales of semiconductor manufacturing equipment in China grew significantly by 39% year on year to $18.72 billion, making China the world’s number one semiconductor market, surpassing Taiwan.

[5-3 Basic Policies of the New Medium-Term Management Plan]

The company has the following basic policies for each of the four areas: Business Growth, Fortification of Financial standing, Quality improvement, and Strengthening of personnel.

Business Growth | We will rigorously pursue the growth of business and profit, and continue investment for growth |

To invest for increasing production output in the promising fields of semiconductors and electronic devices, and increase our position To promote investment in electric vehicles (EVs), etc. for future growth. | |

Fortification of Financial standing | We will fortify the financial standing, and secure an appropriate balance between investment opportunities and the financial status |

To use net income as a KPI, enhance the management of return on investment and ROIC, and appropriately discuss the utilization of external capital | |

Quality improvement | Considering that “quality is vital,” we will enhance quality control |

To upgrade our production system through quality control, automation, and digitization | |

Strengthening of personnel | We will strengthen personnel and reform organizational structures |

In order to achieve sustainable growth while our corporate scale is expanding, we will recruit and train personnel, reform our organizational structure, and foster our corporate culture |

[5-4 Business Growth: Initiatives and Targets for Each Business]

(1) Semiconductor Equipment-related Segment

In addition to material products, including quartz products, silicon parts, ceramics, and CVD-SiC, which are the mainstay, the segment also offers vacuum feedthroughs, wafer cleaning and recycling services.

The strength of this product portfolio is that it includes not only products such as vacuum feedthroughs, which are highly correlated with increases and decreases in capital investment, but also material products, which are frequently used consumables that are highly correlated with the production operations of semiconductor device manufacturers. In addition, the company can capture a wide range of demand by providing services.

① Semiconductor Materials

The semiconductor market is expected to remain firm due to factors such as 5G-related factors and the expanding demand for data centers caused by the increase of remote work.

Since there is a significant demand for consumables in the field of semiconductor material products, a high percentage of the demand is linked to the production utilization rate of semiconductor manufacturers, although some of it is linked to investment.

Since the market of front-end process of semiconductor manufacturing is expected to grow positively year on year in 2021 and 2022, the company will increase the production capacity of material products as needed to meet the increased demand.

Quartz Products

Reflecting the firm demand for consumables, the sales of the quartz products are expected to grow especially steadily among the material groups.

The company has plants in Hangzhou and Changshan in Zhejiang Province and Dongtai in Jiangsu Province in China, and Yamagata City in Japan, and is continuing to increase production.

Ceramics and CVD-SiC

The company will expand its business by taking the developmental advantages of materials, processing, and coating technologies in Japan.

For machinable ceramics, the company will strengthen its laser processing (high value-added) probe card applications.

In China’s Hangzhou Plant in Zhejiang Province, the company is currently working to increase its production capacity for fine ceramics, for which demand is strong.

Silicon Parts

Until now, the company’s production base has been Yinchuan for ingot production for silicon parts and Hangzhou for processing and assembly. However, to respond to requests for significant increase of production output from customers, the company plans to increase ingot manufacturing in Yinchuan and newly establish processing and assembly processes in Yinchuan to build a large-scale integrated production system in Yinchuan.

② Semiconductor Services

Parts Cleaning

The business is specialized in the Chinese market and has been expanding steadily every year in line with the expansion of production by clients of semiconductors and FPD (organic EL and LCD).

As in the case of semiconductor material products, this is a recurring-revenue business that is linked to customers’ production operations, so stable sales can be secured.

Business expansion is expected to continue steadily in the future, and the company’s share in the Chinese domestic market is close to 60% as it continues to increase production at its five bases and seven factories. The company plans to expand them to six bases and nine factories in 2021 to directly provide meticulous services to customers.

Since the sovereign wealth fund in Tongling, Anhui Province, was also added to the list of investors, the company implemented a reorganization centered on Tongling, Anhui Province, and began preparations for listing on the Chinese domestic market.

The company is planning to increase production capacity at Tongling for Chinese clients for semiconductors and FPD.

Wafer recycling

A new service to be launched this term.

The company will utilize resources from its wafer business and knowledge from its cleaning business. The film removal process will be addressed through technical collaboration with partners.

The wafer recycling plant, which was completed in November 2020 in Tongling City, Anhui Province, is scheduled to begin trial production in April-June 2021 and mass production in October-December 2021.

The acceleration of domestic production of semiconductors in China has led to a sharp increase in demand for wafer recycling, and the company has increased its monthly production capacity from 65,000 wafers to 120,000 wafers in the first phase to meet strong customer demand, particularly for 12-inch wafers. Eventually, they expect to produce 200,000 wafers.

To raise investment funds, a third-party allocation of new shares was carried out in December 2020 and March 2021, for a total of 1.14 billion yen (710 million yuan).

As a result, the capital of the wafer recycling subsidiary, Ferrotec (Anhui) Changjiang Semiconductor Material Co .,Ltd. became 18.99 billion yen (1.21 billion yuan). In the future, several sovereign wealth funds will increase their stakes in the company, and the Ferrotec Group’s shareholding ratio will decrease from 70.0% to 41.3%.

Semiconductor Wafer (Unconsolidated Business)

Due to the transfer of shares of the semiconductor wafer manufacturing subsidiary (CCMC (formerly FTHW)) and two third-party allocations of new shares, the Ferrotec Group’s shareholding ratio will drop to the 23% level during the term ending March 2022. The company has been an equity-method affiliate since the fourth quarter of the term ended March 2021.

The demand for 6-inch wafers is currently strong. The company will maintain its monthly production capacity of 420,000 wafers in the term ending March 2022.

The company is strengthening its own direct sales structure for 8-inch products and will increase monthly production output to 350,000 wafers by the end of the term ending March 2022 in Shanghai and Hangzhou. The facilities have the capacity to produce 450,000 wafers per month.

The company plans to start with a monthly production system of 30,000 12-inch wafers and gradually build up to a system for 200,000 wafers within the term ending March 2023. Capital investment will be funded through a third-party allocation of new shares in China.

The company is currently increasing production with the goal of producing 70,000 wafers per month by the end of the term ending March 2022.

In addition to strengthening the certification of new customers for 8-inch and 12-inch wafers at the Hangzhou wafer plant, the company is expanding the scale of mass production.

SiC (Silicon Carbide) Business

In October 2020, the company established a joint venture with the Chinese Academy of Sciences, sovereign wealth fund, and private fund in Tongling, Anhui Province, to develop and manufacture SiC (silicon carbide) single crystal ingots and wafers, which are expected to grow as the most advanced semiconductors (third-generation semiconductors) in China. Completion of construction, delivery of equipment, and starting of prototype production are scheduled in 2021.

SiC (silicon carbide) single crystals have high technical difficulties in crystal growth (large diameter), substrate processing, electrical property control, and crystal defect control.

While some companies in Europe, the U.S., and Japan have already achieved mass production, China is aiming for domestic production with this strategic technology as its own demand for electric vehicles increases.

The Ferrotec Group possesses defect control technology and equipment manufacturing technology cultivated through its semiconductor Si single crystal business, as well as knowledge of SiC and a customer base through its CVD-SiC (jigs for semiconductor manufacturing equipment) business. By utilizing the intellectual property and human resources of the Chinese Academy of Sciences, as well as funds from sovereign wealth fund, private fund, and government subsidies, the company will establish development and manufacturing technology for SiC (silicon carbide) single crystal ingots and wafers.

(2) Electronic Devices Segment

Thermo-electric Modules

Applications for 5G communication devices are expanding. The number of base stations for 5G in China is to increase to 640,000 in 2020, 770,000 in 2021, and 730,000 in 2022.

In addition, biotechnology applications, such as PCR testing, are expanding, and applications and demand for consumer products (wearables), IoT, and home appliances are expected to grow further in line with the digitization of society.

With the aim of further expanding its business domain and applications, the company will utilize the acquisition of Russia’s RMT Ltd. as a subsidiary and the formation of an alliance with Cado Co., Ltd. in the previous term to acquire high-value-added module technologies in the communications field, etc., and will also consider launching consumer products (temperature control for underwear and jackets) that utilize temperature control technologies.

Power Semiconductor Substrates

In the term ended March 2021, COVID-19 caused a decline in demand for industrial equipment and in-vehicle applications, but full-year sales rose 23.0% year on year.

Taking advantage of the global trend to reduce power consumption, demand is growing steadily, and the power semiconductor market is expected to grow to a scale of 4.2 trillion yen by 2030.

The number of certifications obtained from Chinese domestic and global manufacturers is also on the rise.

Currently, the company is increasing the production output of DCB substrates for home appliances and industrial equipment and AMB substrates for automobiles, etc.

The power semiconductor substrate plant in Dongtai, Jiangsu Province, is expanding its production capacity and is expected to increase sales in the next term and beyond.

The monthly production capacity is to increase from 600,000 to 1,000,000 DCB substrates and from 100,000 to 200,000 AMB substrates at the Shanghai and Dongtai Plants within 2021.

In addition, the company plans to release high heat-resistant and high-strength DPC substrates to strengthen the development of optical communications and power LED products, and is also considering listing its subsidiary in Dongtai, Jiangsu Province, on the Chinese market in the future.

[5-5 Growth Investment and Strengthening of Financial Standing]

The total investment amount is to be a total of 95 billion yen in three years.

The company will make investments (55 billion yen) to increase production output to take advantage of the expansion of markets of semiconductors, electronic devices, etc., and will actively consider strategic investments (40 billion yen) for long-term growth, including expansion of the product lineup in the semiconductor field, investments related to EVs and new energy vehicles, and investments in new core businesses.

For long-term investments, the company will consider investment projects with the goal of achieving an ROIC of 5% or higher in three years.

To fund this investment plan of 95 billion yen, operating cash flow (net income + depreciation and amortization) is to be 65 billion yen, with net income as a KPI, which will be built up through increased profits. It will also strengthen the management of investment levels, investment return, and ROIC management.

The company will consider adopting Chinese capital for strategic and long-term investments and new businesses in the Chinese market such as the wafer recycling business.

For parts cleaning, power semiconductor substrates, silicon parts, and quartz crucibles, the company intends to procure funds through IPO and new share issuance.

In any case, the company will continue to strengthen its finances and strive to secure an appropriate balance between business opportunities, growth investments and finances.

[5-6 Enhancing Quality and Developing Human Resources]

To achieve further expansion of business performance and sustainable development, the company will consider quality improvement and strengthening of personnel as priority management items and promote them through management leadership.

Regarding enhancing quality, the company believes that quality is everything, and aims to foster actions, business operations, and a culture that puts quality first, while promoting automation and digitalization to strengthen the production system.

In terms of human resources development, the company will achieve a fundamental strengthening of its human resources and organization as sales and corporate scale expand. The company will recruit and utilize high-skilled human resources as well as develop and integrate the current human resources. To achieve growth, the company will foster and instill the corporate culture.

[5-7 Numerical Targets and KPIs]

Against the backdrop of immediate growth in the semiconductor market, the company is targeting sales of 150 billion yen in the final year of the three-year medium-term management plan, the term ending March 2024.

The company will also work to establish an optimal business portfolio and raise operating income margin to 16.7%.

(1) the whole company

| FY 3/21 | FY 3/22 Est | FY 3/23 Est | FY 3/24 Est | CAGR |

Sales | 91,312 | 105,000 | 125,000 | 150,000 | +18.0% |

Semiconductor Equipment-related | 60,669 | 66,274 | 74,434 | 89,605 | +13.9% |

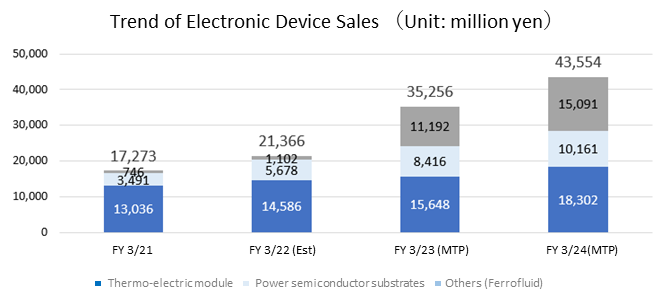

Electronic Devices | 17,273 | 21,366 | 35,256 | 43,554 | +36.1% |

Others | 13,370 | 17,360 | 15,310 | 16,841 | +8.0% |

Operating Income | 9,640 | 15,000 | 19,000 | 25,000 | +37.4% |

Operating profit margin | 10.6% | 14.3% | 15.2% | 16.7% | - |

Net Income | 8,280 | 7,800 | 11,000 | 15,000 | +21.9% |

Net Income margin | 9.1% | 7.4% | 8.8% | 10.0% | - |

ROE | 14.3% | - | - | 15.0% | - |

ROIC | 7.2% | - | - | 8.0% | - |

Capital to asset ratio | 37.9% | - | - | Over 40.0% | - |

equipment investment | 14,297 | 40,000 | 29,000 | 26,000 | - |

*Unit: million yen. CAGR is the average annual growth rate between FY 3/21 and FY 3/24. It was calculated by Investment Bridge based on the reference material of the company.

(2) Segments and Products

The company will implement measures steadily, and concentrate on the expansion of businesses and products related to semiconductor materials, thermo modules, parts cleaning, power semiconductor substrates, and wafers recycling.

①Semiconductor Equipment-related Segment

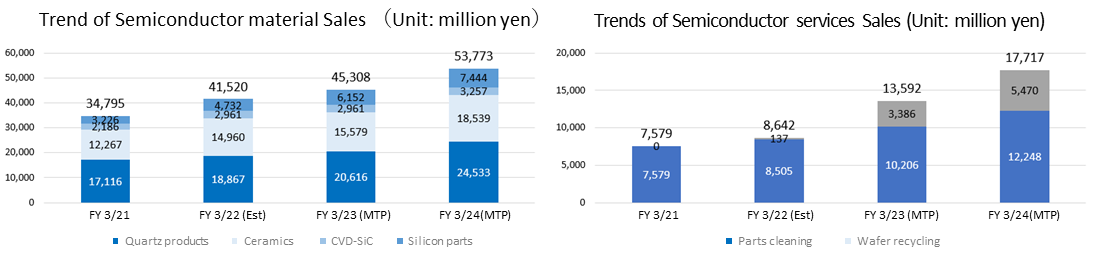

| FY 3/21 | FY 3/22 Est | FY 3/23 Est | FY 3/24 Est | CAGR |

Semiconductor material | 34,795 | 41,520 | 45,308 | 53,773 | +15.6% |

Quartz products | 17,116 | 18,867 | 20,616 | 24,533 | +12.8% |

Ceramics | 12,267 | 14,960 | 15,579 | 18,539 | +14.8% |

CVD-SiC | 2,186 | 2,961 | 2,961 | 3,257 | +14.2% |

Silicon parts | 3,226 | 4,732 | 6,152 | 7,444 | +32.1% |

Semiconductor services | 7,579 | 8,642 | 13,592 | 17,717 | +32.7% |

Parts cleaning | 7,579 | 8,505 | 10,206 | 12,248 | +17.4% |

Wafer recycling | 0 | 137 | 3,386 | 5,470 | +531.9% |

Semiconductor metals and equipment | 18,295 | 16,112 | 15,534 | 18,115 | -0.3% |

Total sales | 60,669 | 66,274 | 74,434 | 89,605 | +13.9% |

*Unit: million yen. CAGR is the average annual growth rate between FY 3/21 and FY 3/24. It was calculated by Investment Bridge based on the reference material of the company. Wafer recycling is from FY 3/22 to FY 3/24.

②Electronic Device Business

| FY 3/21 | FY 3/22 Est | FY 3/23 Est | FY 3/24 Est | CAGR |

Thermo-electric module | 13,036 | 14,586 | 15,648 | 18,302 | +12.0% |

Power semiconductor substrates | 3,491 | 5,678 | 8,416 | 10,161 | +42.8% |

Others (Ferrofluid) | 746 | 1,102 | 11,192 | 15,091 | +172.5% |

Electronic Device Business | 17,273 | 21,366 | 35,256 | 43,554 | +36.1% |

*Unit: million yen. CAGR is the average annual growth rate between FY 3/21 and FY 3/24. It was calculated by Investment Bridge based on the reference material of the company. Others was calculated by Investment Bridge based on the reference material of the company.

[5-8 Long-term Vision]

After the mid-term management plan, the company has a long-term vision of achieving sales of 300 billion yen and a net income of 30 billion yen by the term ending March 2031.

(From the company website)

6.Conclusions

Like in the previous term, profit is expected to grow considerably this term. Its share price skyrocketed, because its performance made a favorable impression on investors. The share price exceeded the high price in January 2018 and is now at the 3,000-yen level. When the share price marked the high price of 2,900 yen in January 2018 in the monthly chart, PER was 23, while EPS was estimated to be 126.67 yen in the term ended March 2018 (source: the brief report on financial results for the third quarter of the term ended March 2018), and the current PER is lower than that. As the distribution of 5G has finally started, 6G is increasingly discussed. The purposes of use of semiconductors, such as CASE, IoT, and robotics, have diversified and such semiconductors are used abundantly than in 2018. The demand-supply balance will settle eventually, but the business environment is expected to remain favorable for the foreseeable future.

We would like to pay attention to the progress of plans and the trends of new burgeoning products, such as recycled wafers and power semiconductor substrates, as well as the current core products, which are semiconductor materials whose sales are expected to grow steadily.

Reference: Regarding Corporate Governance

◎ Organization type, and the composition of directors and auditors

Organization type | Company with board of auditors |

Directors | 8 directors, including outside ones 2 |

Auditors | 3 directors, including outside ones 2 |

◎ Corporate Governance Report(Updated on August 18, 2020)

Basic policy

The company considers that it is important to improve its corporate value, emphasize the soundness of its business administration to become an enterprise that will be trusted and supported by stakeholders, including shareholders, customers, business partners, and local communities, and also establish a managerial system responding the rapid changes to the business environment swiftly and accurately.

The organizational chart of the corporate governance of our company as of the submission date is included in “V. Others, 2. Other items regarding the corporate governance structure, etc.”

Our company’s board of directors is chaired by the representative director and president He Xian Han. The other 8 members (including 2 outside directors) are the representative director and chairman Akira Yamamura the representative director and vice-president Takeru Yamamura, the director Hiroo Wakaki, the director Takanori Suzuki, the director Eiji Miyanaga, the outside director Kyuzo Nakamura, and the outside director Kuniaki Yanagisawa. In addition to monthly meetings of the board of directors, we hold an extraordinary meeting of the board of directors flexibly, when there is an important matter to be discussed. The board of directors determines important items in accordance with the regulations for the board of directors in addition to laws and the articles of incorporation and oversees the business operation of each director. All auditors attend meetings of the board of directors, to oversee the business operation of directors. The term of directors is one year, so that we can respond to changes in the management environment swiftly.

Our company adopted a system of the board of auditors, which is composed of the full-time outside auditor Takamasa Higuchi, the outside auditor Go Fujimoto, and the auditor Masaru Yoshida, that is one full-time auditor and two part-time auditors, including 2 outside auditors. It is stipulated that a meeting of the board of auditors is held 8 or more times per year, once per month in principle, and extraordinarily when necessary. Full-time auditors attend meetings of the board of directors and other important meetings, such as meetings of the board of executive officers, and express their opinions when necessary, so as to oversee the business operation of directors. They also exchange information and opinions with the internal audit division and comptrollers, and hold regular meetings, to cement cooperation and improve the auditing function.

For business operation, 9 executive officers (composed of 8 male officers and 1 female officer, including 4 male directors) serve as chiefs of respective sections, so that their roles for business operation are clarified. Monthly meetings of the board of executive officers are held, to deliberate important items, including the items to be discussed at a meeting of the board of directors.

The company receives advice about legal affairs from Goto Law Office when this is necessary for business, in accordance with a legal consultancy contract. The comptroller Ernst & Young ShinNihon LLC audits our accounting in accordance with the audit contract, and provides us with their reports, including their comments during and after audit, and tries to disclose information without delay as a company listed in the standard section of the JASDAQ market of Tokyo Stock Exchange, if an event specified in the provisions regarding disclosure occurs.

This report is intended solely for information purposes and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |

To view back numbers of Bridge Reports on Ferrotec Holdings Corporation (6890) and other companies, or IR related seminars of Bridge Salon, please go to our website at the following URL.

URL:https://www.bridge-salon.jp/