Bridge Report:(6890)Ferrotec fiscal year ended March 2023

President He Xian Han | Ferrotec Holdings Corporation (6890) |

|

Company Information

Exchange | TSE Standard Market |

Industry | Electric Equipment (Manufacturing) |

President | He Xian Han |

HQ Address | Nihonbashi Plaza Building, Nihonbashi 2-3-4, Chuo-ku, Tokyo |

Year-end | March |

Website |

Stock Information

Share Price | Shares Outstanding (Term end) | Market Cap. | ROE (Act.) | Trading Unit | |

¥3,535 | 47,011,067 shares | ¥166,184 million | 18.9% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥100.00 | 2.8% | ¥382.88 | 9.2x | ¥3,916.07 | 0.9x |

*Share price as of closing in June 26. Shares outstanding, ROE, DPS, EPS, BPS are based on the results of the fiscal year ending March 2023.

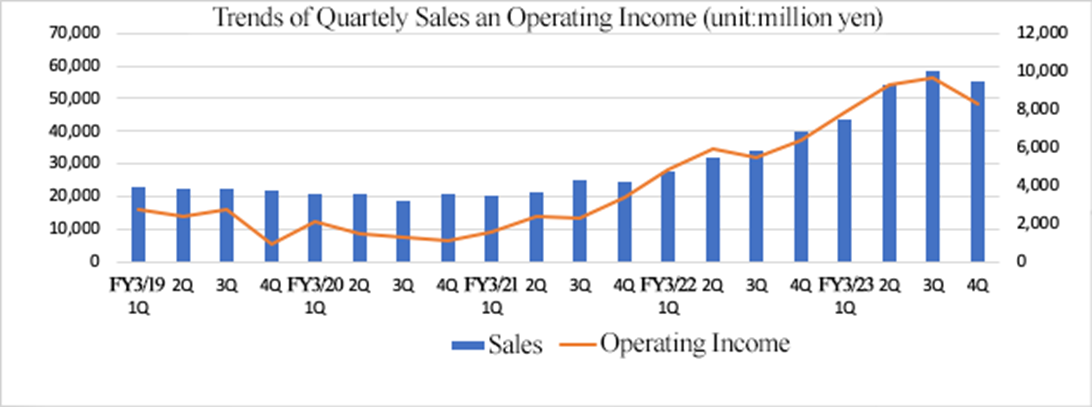

Consolidated Earnings Trends

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS (¥) | DPS (¥) |

March 2019 (Act.) | 89,478 | 8,782 | 8,060 | 2,845 | 76.90 | 24.00 |

March 2020 (Act.) | 81,613 | 6,012 | 4,263 | 1,784 | 48.12 | 24.00 |

March 2021 (Act.) | 91,312 | 9,640 | 8,227 | 8,280 | 222.93 | 30.00 |

March 2022 (Act.) | 133,821 | 22,600 | 25,994 | 26,659 | 668.06 | 50.00 |

March 2023 (Act.) | 210,810 | 35,042 | 42,448 | 29,702 | 644.81 | 105.00 |

March 2024 (Est.) | 220,000 | 32,500 | 30,000 | 18,000 | 382.81 | 100.00 |

*The forecast is from the company. Unit: million-yen, yen. DPS for FY 3/21 includes a commemorative dividend of 4.00 yen/share. The dividend forecast for the term ending March 2022 includes a special dividend of 9.00 yen/share. Net income is net income attributed to parent shareholders. The same shall apply hereafter.

This Bridge Report reviews the overview of Ferrotec’s earnings results of fiscal year ended March 2023 and earnings estimates for fiscal year ending March 2024.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended March 2023 Earnings Results

3. Fiscal Year ending March 2024 Earnings Forecasts

4. Update of the mid-term management plan

5. Summary of Q&A at the financial results briefing session

6. Conclusions

<Reference: Regarding corporate governance>

Key Points

- In the term ended March 2023, sales grew 57.5% year on year, which is almost in line with the revised forecast of the company. While the external environment surrounding the electronics industry was healthy, the demand for semiconductor manufacturing equipment was sluggish, as semiconductor devices, mainly memory, entered the inventory adjustment phase in the middle of the fiscal year. Amid such an environment, Ferrotec Holdings grew resiliently, posting record-high sales and profit.

- For the term ending March 2024, sales are expected to rise 4.4% year on year to 220 billion yen. Due to a downturn in the market, the sales of materials, etc. are projected to decline, but sales are expected to keep increasing thanks to the growth of sales of quartz crucibles and power semiconductor substrates. Operating income is forecast to drop 7.3% year on year to 32.5 billion yen. The drop in operating income is considered unavoidable, due to the decrease in sales of materials, etc. and the augmentation of depreciation. The drop in ordinary income is forecast to be more significant, as an exchange gain of 5.5 billion yen was posted as a non-operating income in the previous term, but there will be no such posting this term. The company plans to continue active capital investment. The investment amount is assumed to be 96.9 billion yen (62,661 million yen in the previous term). The company plans to pay a dividend of 100.00 yen/share (an interim dividend of 50.00 yen/share and a term-end dividend of 50.00 yen/share).

- Their stance of pursuing growth thoroughly set in the mid-term management plan is unchanged. In the term ending March 2026, sales are expected to reach 360 billion yen (CAGR during the period from FY 3/2023 to FY 3/2026: 19.5%). Regarding the forecast for each segment, it is projected that the sales of the semiconductor equipment related business will increase from 132,194 million yen to 235.6 billion yen, the sales of the electronic device business will rise from 53,024 million yen to 93,390 million yen, and the sales of the other business will grow from 25,590 million yen to 31,010 million yen. As their global production system has been enriched steadily, the company considers that if the demand in the semiconductor sector recovers, they will certainly be able to achieve the forecast sales. In the semiconductor equipment related business, the company is steadily proceeding with the enrichment, automation, etc. of the global production system, so they believe that sales will expand rapidly if demand recovers. In the electronic device business, the company is steadily increasing the output of power semiconductor substrates by establishing Sichuan Factory, and full-scale manufacturing is scheduled to be started in 2024.

- Since the end of 2021, the semiconductor market has been declining, and inventory adjustment is projected to be continued this term, too. Even under this environment, it is hard to imagine that the trend of shift to green energy will change, and it can be assumed that the semiconductor market will start growing again in the medium/long term. Under such assumption, the company continues active investment without being swayed by near-term trends. Rather than conducting speculative investment, the company procures funds when necessary while securing a good balance between investment opportunities and their financial standing and makes management decisions while considering shareholder return. We should keep an eye on such management decisions.

1. Company Overview

Ferrotec Holdings Corporation conducts business mainly on the basis of the following two segments: the semiconductor and other equipment-related Business, in which it offers parts for semiconductors and fine panel display (FPD) manufacturing equipment, consumable materials and wafers used in the process of manufacturing semiconductors, and semiconductors for equipment offering cleaning services of equipment parts, and the Electronic Device Business that focuses on the thermal element “thermo-electric modules,” with 69 companies serving as Ferrotec’s subsidiaries (56 consolidated subsidiaries and 13 non-consolidated affiliated companies accounted for by the equity method and other related companies).

Ferrotec was born as a company with highly unique technologies including thermoelectric modules with uses in thermal elements and vacuum technologies that respond to magnetic fluids that were born from the NASA space program in the 1980s. Over the course of its 42 years history of operations, the Company has developed a wide range of diverse technologies with applications in the automobile, electronics, next generation energy and other industries. As a transnational company, Ferrotec deploys its businesses in Japan, Europe, the Americas, China, and Asia, and boasts of marketing, development, manufacturing, sales, and management capabilities in various countries and regions. A holding company structure was implemented from April 2017. In April 2022, due to market reorganization, the company got listed on the Standard Market of TSE.

[Corporate Ethos and Priority Policies for Enhancing Organizational Strength and Achieving Sustainable Development]

The Ferrotec group strives to be a company that is trusted by stakeholders such as customers, shareholders, employees, business partners, and local communities, by achieving sustainable growth and complying with laws, regulations, social order, and international rules with decency in its corporate activities.

Initiatives to enhance corporate value | Promote independent management of all subsidiaries, and redistribute management resources |

Thorough awareness that puts quality first | Perfect design and product quality that pleases customers, and improvement of the quality of services inside and outside the company |

Strengthen corporate governance | Thorough internal control and management of affiliated companies, and strengthening of risk management and compliance |

【1-1.Business Segments】

Ferrotec’s operations includes semiconductor seal related products such as vacuum seal, quartz products, ceramic products, etc. used in manufacturing equipment of semiconductor, FPD, LED etc., electronic device business centering on thermo modules and business segments that are not included in the reportable segments. Other businesses, which handle silicon crystal and solar cell wafers, saw blades, machine tools, surface treatment, industrial washing machines etc.

Semiconductor and other equipment-related business

Ferrotec provides total engineering services in the Equipment Related business segment, including the manufacture and sale of Vacuum Feedthrough of equipment parts for solar power, semiconductor, FPD and LED applications, consumable products used in manufacturing of devices, quartz products, ceramic products, CVD-SiC products, quartz crucibles, silicon wafer processing and equipment cleaning services.

Its vacuum seal boasts of top market share in the world and is a functional part that insulates the interior of manufacturing equipment from gas and dust contamination while supporting rotating action of the above-mentioned equipment. These Vacuum Feedthrough use magnetic fluids (Fluids that respond to magnetic fields), which has been a core technology of Ferrotec since its founding. Because of instability in these applications arising from their link with corporate capital investments cycles, the Company focuses its marketing efforts upon expanding sales to applications for which demand is more stable, including transportation equipment, precision robots, and general industry usages. In addition, Ferrotec has also focused its efforts upon assuming consigned manufacture of vacuum chambers that use Vacuum Feedthrough and gate valves (Both use vacuum related equipment).

At the same time, quartz, ceramic, and CVD-SiC products are critical elements in the process of semiconductor manufacturing. Quartz products are able to resist high temperature conditions that exist in the semiconductor manufacturing process and are a high purity silica glass product that protects semiconductors from undergoing chemical reaction by preventing it from activating with gas. The Company boasts of semiconductor manufacturing equipment manufacturers as their main clients in Japan and overseas who purchase ceramic products, which are Ferrotec’s core material and technology. At the same time, semiconductor inspection tools for machinable ceramics and fine ceramics used in semiconductor manufacturing equipment are two main products in this CVD-SiC.

CVD-SiC products are the term used to describe SiC products manufactured by "CVD method (Chemical Vapor Deposition method)" (created from compounds of silicon and carbon gas). Currently, semiconductor equipment and structural parts are provided, and research and development for products used in aeronautics and space (Turbine, mirrors), automobile (Power semiconductors), energy (Nuclear power related), information technology (Semiconductor manufacturing equipment parts) and other applications are also being conducted.

As for silicon wafer processing, the posting of sales of 12-inch (diameter) wafers started in the term ended March 2021, in addition to 6-inch and 8-inch wafers and has a leading share of more than half of the manufacturing equipment cleaning services market in China.

(From the company website)

Electronic Device Business

Thermal element “thermoelectric modules” are products that can instantly raise or lower temperatures to a highly precise degree and are a core product of this business. Thermo modules are mainly used for automotive temperature control seats and many other purposes, including wafer temperature control in semiconductor manufacturing equipment, genetic testing apparatus, optical communications, home appliances, and other application products such as power semiconductor substrates. The company has the largest share in the global market of thermo modules. By developing new products using high-performance materials and reducing costs and improving quality by adopting automated manufacturing lines, the company is stirring new demand and diversifying purposes of use of its products.

Furthermore, the company has the largest share in the global market of magnetic fluid, which is used increasingly for linear vibration motors for smartphones, speakers for 4K TV and automobiles, high-quality sound headphones, etc. In addition, the temperature sensors of Ohizumi Mfg. Co., Ltd., which became a consolidated subsidiary of Ferrotec Holdings in the second quarter of the term ended March 2023, were added to this business.

(From the company website)

Others

(From the company website)

2. Fiscal Year ended March 2023 Earnings Results

【2-1.Consolidated Earnings】

| FY 3/22 | Ratio to sales | FY 3/23 | Ratio to sales | YoY | Revised plan ratio |

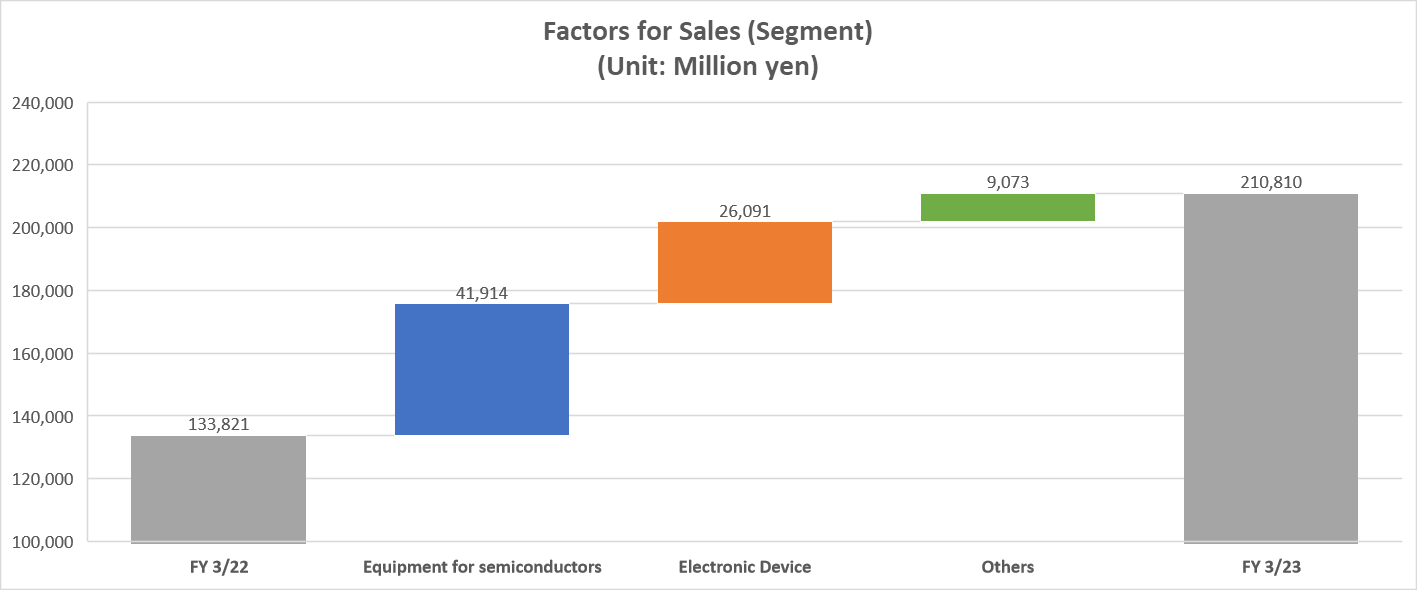

Sales | 133,821 | 100.0% | 210,810 | 100.0% | +57.5% | +5.4% |

Gross Income | 48,677 | 36.4% | 72,081 | 34.2% | +48.1% | - |

SG&A | 26,076 | 19.5% | 37,038 | 17.6% | +42.0% | - |

Operating Income | 22,600 | 16.9% | 35,042 | 16.6% | +55.1% | +3.1% |

Ordinary Income | 25,994 | 19.4% | 42,448 | 20.1% | +63.3% | +6.1% |

Net Income | 26,659 | 19.9% | 29,702 | 14.1% | +11.4% | +18.8% |

*Unit: million yen. Revised plan ratio is increase and decrease to the forecast announced in February, 2023.

Both sales and operating income hit a record high.

In the term ended March 2023, sales grew 57.5% year on year to 210,810 million yen, up 5.4% from the revised forecast announced in February 2023. The external environment surrounding the electronics industry was favorable, as the demand for data centers and telecommunications was significant thanks to the diffusion of remote work and online meetings. On the other hand, the demand for semiconductor manufacturing equipment declined, as semiconductor devices, mainly memory, entered the inventory adjustment phase in the middle of the fiscal year. As the U.S. announced its measure of tightening regulations on the export of semiconductor technologies to China in mid-October 2022, the sale of semiconductor manufacturing equipment was affected. Amid this environment, the company sustained its strong growth, as the sales of the semiconductor equipment related business and the electronic device business grew significantly, hitting a record high.

Operating income grew 55.1% year on year to 35,042 million yen. Operating income margin declined 0.3 points year on year to 16.6%. Thanks to the sales growth, operating income, too, hit a record high. Ordinary income margin pushed up 0.7 points year on year, as an exchange gain of 5,495 million yen (2,542 million yen in the previous term) and a revenue from subsidies of 2,626 million yen (1,266 million yen in the previous term) were posted as non-operating incomes. Net income grew only 11.4% year on year, as a gain from changes in equity of 9,327 million yen (due to the allocation of new shares to third parties by the wafer company in China) was posted in the previous term, but there was no such posting in FY 2023, and the gain from non-controlling shareholders’ equity increased.

【2-2.Business Segment Trends】

Business Segment Sales and Profits

| FY 3/22 | Ratio to sales Profit margin | FY 3/23 | Ratio to sales Profit margin | YoY |

Semiconductor and other equipment -related | 90,280 | 67.3% | 132,194 | 62.7% | +46.4% |

Electronic Device | 27,023 | 20.2% | 53,024 | 25.2% | +96.2% |

Others | 16,517 | 12.3% | 25,590 | 12.1% | +54.9% |

Consolidated Sales | 133,821 | 100.0% | 210,810 | 100.0% | +57.5% |

Semiconductor and other equipment -related | 15,804 | 17.5% | 24,090 | 18.2% | +52.4% |

Electronic Device | 6,689 | 24.8% | 11,178 | 21.1% | +67.1% |

Others | 398 | 2.4% | 597 | 32.3% | +50.0% |

Adjustments | -291 |

| -824 |

| - |

Consolidated Operating Income | 22,600 | 16.9% | 35,042 | 16.6% | +55.1% |

*Unit: million yen. Beginning with the first quarter of the fiscal year ending March 2023, the contract manufacturing business, and the deposition equipment business of the U.S. subsidiary, which were previously included in the "Others" segment, are now included in the "Semiconductor and other equipment-related business" segment due to a review of business management classifications. Figures for the fiscal year ending March 2022 are the classification after the change.

*Produced by Investment Bridge Co., Ltd. with reference to disclosed material.

(1) Semiconductor and other equipment-related business

In the semiconductor and other equipment-related business, sales grew 46.4% year on year to 132,194 million yen, and operating income grew 52.4% year on year to 24,090 million yen. Profit margin grew 0.7 points to 18.2%.

Each product sold well. The sales from vacuum sealing and metal processing increased, as the company met the demand for processing of metallic parts and the operation of Changshan Plant started. The materials used for manufacturing semiconductors (such as quartz, ceramics, and silicon parts) sold well, thanks to the strong demand for semiconductor manufacturing equipment. The enhancement of production capacity, including the start of operation of Changshan and Dongtai Plants for quartz, the improvement in output of Yinchuan Plant for silicon parts, the enhancement of production capacity of Hangzhou for ceramics, and the increases in production capacity and output of Okayama Plant for CVC-SiC, led to the sales growth. The sales of recycled wafers, too, increased, as the operation of the wafer recycling factory in Tongling started gradually.

Furthermore, the sales of semiconductor wafers, quartz crucibles, which are used for manufacturing solar cells, and the service of cleaning components of semiconductor manufacturing equipment grew steadily, as the company appropriately responded to the growth of demand in China.

Detail of Sales by Product

| FY 3/22 | Ratio to sales | FY 3/23 | Ratio to sales | Progress ratio |

Vacuum Feedthroughs / Metal Processing | 18,858 | 20.9% | 27,976 | 21.2% | +48.4% |

Quartz | 21,217 | 23.5% | 28,837 | 21.8% | +35.9% |

Silicon parts | 8,565 | 9.5% | 17,542 | 13.3% | +104.8% |

Ceramics | 18,816 | 20.8% | 27,194 | 20.6% | +44.5% |

CVD-SiC | 2,975 | 3.3% | 4,812 | 3.6% | +61.7% |

EB-Gun, LED | 7,921 | 8.8% | 8,036 | 6.1% | +1.5% |

Wafer processing | 59 | 0.1% | 236 | 0.2% | +300.0% |

Recycled wafers | 98 | 0.1% | 1,501 | 1.1% | +1431.6% |

Equipment parts cleaning | 9,672 | 10.7% | 12,170 | 9.2% | +25.8% |

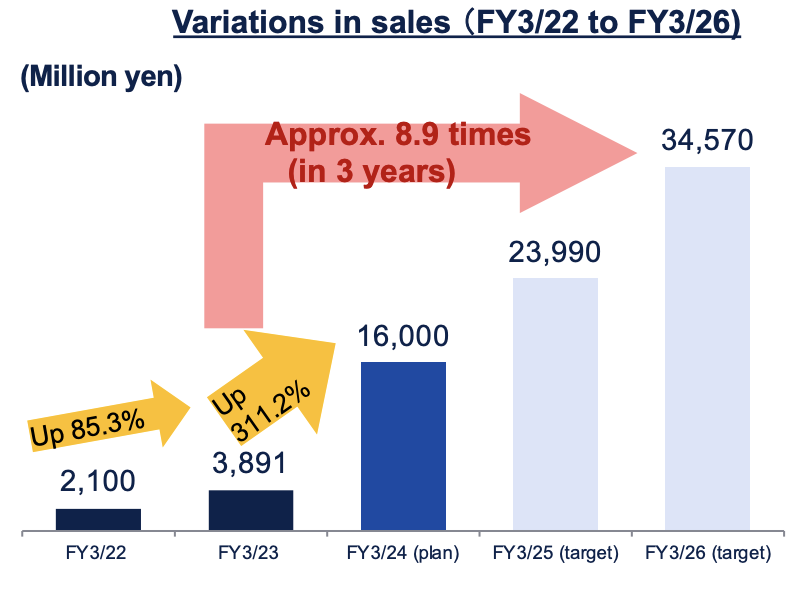

Quartz crucibles | 2,100 | 2.3% | 3,891 | 2.9% | +85.3% |

Sales of Semiconductor and other equipment-related business | 90,280 | 100.0% | 132,194 | 100.0% | +46.4% |

*Unit: million yen.

(2) Electronic Device Business

In the electronic device business, sales grew 96.2% year on year to 53,024 million yen and operating income grew 67.1% year on year to 11,178 million yen. Profit margin declined 3.7 points to 21.1%.

Power semiconductor substrates served as a growth driver. The production system centered around Dongtai Plant was enriched, and the shipment of AMB substrates for automobiles and EVs in China got on track, contributing to the good performance. The sales and profit of sensors of Ohizumi Mfg., which was included in the scope of consolidation in the second quarter (July to September), were posted in this segment.

Detail of Sales by Product

| FY 3/22 | Ratio to sales | FY 3/23 | Ratio to sales | YoY |

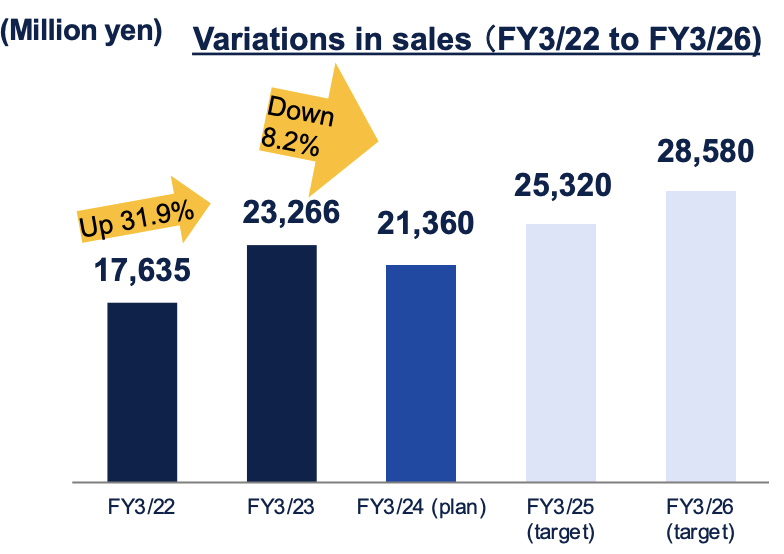

Thermo-electric module | 17,635 | 65.3% | 23,266 | 43.9% | +31.9% |

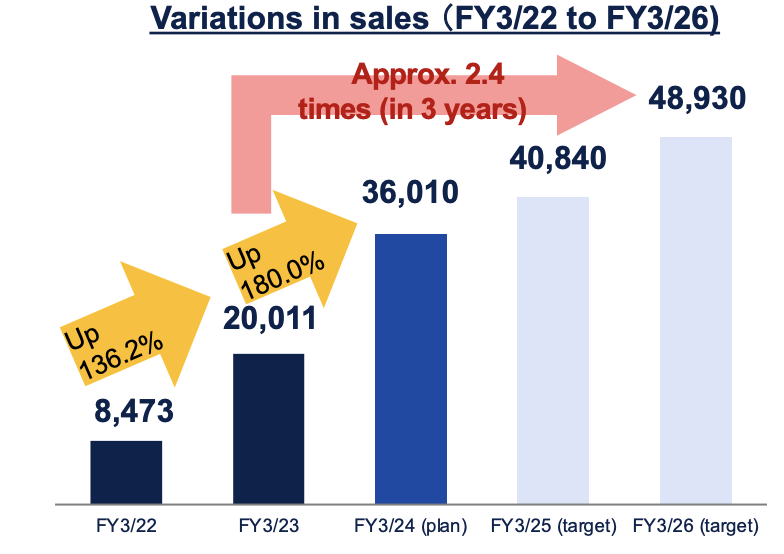

Power semiconductor substrates | 8,473 | 31.4% | 20,011 | 37.7% | +136.2% |

Ferrofluid, Others | 916 | 3.4% | 936 | 1.8% | +2.2% |

Sensors(Ohizumi Mfg) | - | - | 8,811 | 16.6% | - |

Sales of Electronic Device Business | 27,023 | 100.0% | 53,024 | 100.0% | +96.2% |

*Unit: million yen.

(3)Others

In the other business (including the production of saw blades, machine tools, and silicon parts for solar cells), sales grew 54.9% year on year to 25,590 million yen and operating income increased 50.0% year on year to 597 million yen. Profit margin grew 1.0 points to 3.4%. The sales and profit of Toyo Knife, which was included in the scope of consolidation in the second quarter (July to September), were posted in this segment.

【2-3.Financial Condition and Cash Flow】

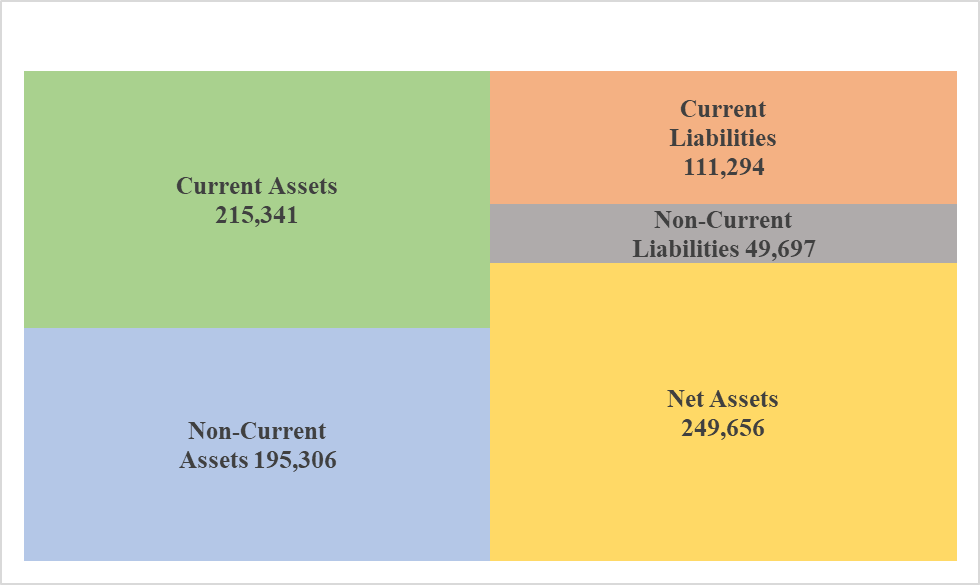

◎Balance Sheet Summary

| Mar, 22 | Mar, 23 | Increase Decrease |

| Mar, 22 | Mar, 23 | Increase Decrease |

Current Assets | 133,414 | 215,341 | +81,927 | Current liabilities | 68,800 | 111,294 | +42,494 |

Cash | 52,579 | 103,115 | +50,536 | Payable | 30,140 | 43,896 | +13,126 |

Receivable | 41,797 | 53,276 | +11,479 | ST Interest-Bearing | 14,825 | 36,203 | +21,378 |

Inventory | 28,436 | 49,177 | +20,741 | Noncurrent liabilities | 35,014 | 49,697 | +14,683 |

Noncurrent Assets | 131,358 | 195,306 | +63,948 | LT Interest-Bearing | 22,736 | 30,515 | +7,779 |

Tangible Asses | 84,083 | 139,610 | +55,527 | Total Liabilities | 103,814 | 160,991 | +57,177 |

Intangible Assets | 1,996 | 6,949 | +4,953 | Net Assets | 160,957 | 249,656 | +88,699 |

Investments and Other assets | 45,277 | 48,745 | +3,468 | Retained earnings | 43,317 | 69,656 | +26,339 |

Total Asset | 264,772 | 410,648 | +145,876 | Total Assets | 264,772 | 410,648 | +145,876 |

*Unit: million yen.

*Produced by Investment Bridge Co., Ltd. with reference to disclosed material.

Total assets increased 145,876 million yen to 410,648 million yen, mainly due to the increases in cash & deposits and tangible fixed assets. The increase in cash & deposits is attributable to the allocation of new shares to third parties by a Chinese subsidiary. As the company actively invested for increasing production output in each business, tangible fixed assets increased (capital investment amount in FY 3/2023: 62,661 million yen). The increase in intangible fixed assets is attributable to the increase in goodwill through the TOB targeted at Ohizumi Mfg. and the acquisition of Toyo Knife as a subsidiary.

Total liabilities augmented 57,177 million yen to 160,991 million yen. Although convertible corporate bonds with share acquisition rights decreased 2.1 billion yen, accounts payable grew 13,126 million yen, short-term debt increased 21,378 million yen, and long-term debt grew 7,779 million yen. Net assets increased 88,699 million yen from the previous term to 249,656 million yen, because retained earnings grew 26,339 million yen and the allocation of new shares to third parties by a Chinese subsidiary increased capital surplus and non-controlling shareholders’ equity.

The ratio of shareholders’ equity dropped 4.8 points from the end of the previous term to 44.7%.

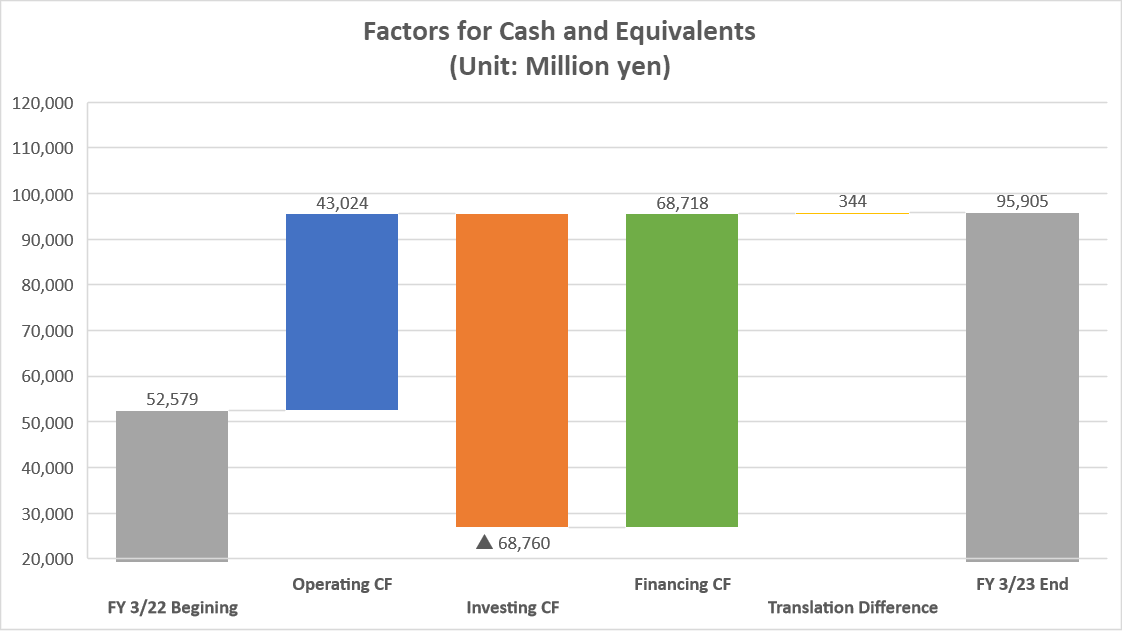

◎Cash Flow

| FY 3/22 | FY 3/23 | Increase Decrease |

Operating cash flow (A) | +17,833 | +43,024 | +25,191 |

Investing cash flow (B) | -29,399 | -68,760 | -39,361 |

Free Cash Flow (A + B) | -11,566 | -25,736 | -14,170 |

Financing cash flow | +30,601 | +68,718 | +38,117 |

Cash and Equivalents at the end of term | 52,579 | 95,905 | +43,326 |

*Unit: million yen

*Produced by Investment Bridge Co., Ltd. with reference to disclosed material.

Since the company actively carried out capital investment in FY 3/2023, free cash flow turned negative, but the term-end balance stood at 95,905 million yen, up 43,326 million yen from the previous term, due to the augmentation of interest-bearing liabilities and the revenue from payment by non-controlling shareholders (FTNC, FLH, and FTSVA).

【2-4 Topics】

(1) In response to the growth of the EV market, the company plans to increase sales of in-vehicle devices.

Due to the growth of demand for EVs, etc., the sales of power semiconductor substrates and temperature sensors increased. The consolidated sales of in-vehicle devices grew from 4,857 million yen in FY 3/2022 to 17,024 million yen in FY 3/2023. The company assumes that sales will reach 34,910 million yen in FY 3/2026. Accordingly, the company plans to actively invest for enhancing its capacity with the aim of expanding global business inside and outside Japan.

(2) Improvement in the business portfoli business expansion in the non-semiconductor manufacturing equipment field

In the electronic devices business, in addition to "thermo-modules," which are temperature control devices that have been increasingly adopted in multiple industries, "power semiconductor insulating substrates," such as DCB substrates in the industrial equipment and home appliance fields and AMB substrates for EVs and rolling stock, are growing as major business pillars in line with the global trend toward energy conservation. izumi Mfg and Toyo Knife, which are now consolidated subsidiaries, aim to expand business in the non-semiconductor production equipment field over the medium term.

3. Fiscal Year ending March 2024 Earnings Forecasts

【3-1.Full Year Consolidated Earnings】

| FY 3/23 | Ratio to sales | FY 3/24 Est | Ratio to sales | YoY |

Sales | 210,810 | 100.0% | 220,000 | 100.0% | +4.4% |

Operating Income | 35,042 | 16.6% | 32,500 | 14.8% | -7.3% |

Ordinary Income | 42,448 | 20.1% | 30,000 | 13.6% | -29.3% |

Net Income | 29,702 | 14.1% | 18,000 | 8.2% | -39.4% |

*Unit: million yen

Assuming lower sales of semiconductor material products, etc.

In the term ended March 2024, sales are expected to rise 4.4% year on year to 220 billion yen. Due to a downturn in the market, the sales of materials, etc. are projected to decline, but sales are expected to keep increasing thanks to the growth of sales of quartz crucibles and power semiconductor substrates. Operating income is forecast to drop 7.3% year on year to 32.5 billion yen. The drop in operating income is considered unavoidable, due to the decrease in sales of materials, etc. and the augmentation of depreciation. The drop in ordinary income is forecast to be more significant, as an exchange gain of 5.5 billion yen was posted as a non-operating income in the previous term, but there will be no such posting this term. It is assumed that depreciation will increase from 12,618 million yen in the previous term to 17.4 billion yen. The assumed exchange rates are 1 US dollar = 130 yen (132.08 yen in the previous term) and 1 yuan = 19.00 yen (19.50 yen in the previous term). The company plans to continue active capital investment. The investment amount is assumed to be 96.9 billion yen (62,661 million yen in the previous term).

The company plans to pay a dividend of 100.00 yen/share (an interim dividend of 50.00 yen/share and a term-end dividend of 50.00 yen/share).

【3-2 Business Segment Earnings Trends】

| FY 3/23 | Ratio to sales | FY 3/24Est | Ratio to sales | YoY |

Semiconductor and other equipment -related | 132,194 | 62.7% | 125,060 | 56.8% | -5.4% |

Electronic Device | 53,024 | 25.2% | 70,720 | 32.1% | +33.4% |

Others | 25,590 | 12.1% | 24,220 | 11.0% | -5.4% |

Total Sales | 210,810 | 100.0% | 220,000 | 100.0% | +4.4% |

*Unit: million yen.

(1) Semiconductor and other equipment-related business

| FY 3/23 | Ratio to sales | FY 3/24Est | Ratio to sales | YoY |

Vacuum Feedthroughs / Metal Processing | 27,976 | 21.2% | 22,250 | 20.2% | -9.7% |

Quartz | 28,837 | 21.8% | 22,420 | 17.9% | -22.3% |

Silicon parts | 17,542 | 13.3% | 14,840 | 11.9% | -15.4% |

Ceramics | 27,194 | 20.6% | 20,680 | 16.5% | -24.0% |

CVD-SiC | 4,812 | 3.6% | 6,450 | 5.2% | +34.0% |

EB-Gun, LED | 8,036 | 6.1% | 6,080 | 4.9% | -24.3% |

Wafer processing | 236 | 0.2% | 160 | 0.1% | -32.2% |

Recycled wafers | 1,501 | 1.1% | 1,620 | 1.3% | +7.9% |

Equipment parts cleaning | 12,170 | 9.2% | 11,560 | 9.2% | -5.0% |

Quartz crucibles | 3,891 | 2.9% | 16,000 | 12.8% | +311.2% |

Sales of Semiconductor and other equipment-related business | 132,194 | 100.0% | 125,060 | 100.0% | -5.4% |

*Unit: million yen.

Considering the impact of clients’ inventory adjustment, etc. in the wake of the market downturn, the company assumes the decline in sales of vacuum sealing, metal processing, and semiconductor materials, such as quartz crucibles, silicon parts, and ceramics. The sales of quartz crucibles are expected to grow considerably, because the production system for large-diameter crucibles will be upgraded and the demand for products for PV is projected to expand.

(2) Electronic Device Business

| FY 3/23 | Ratio to sales | FY 3/24 Est | Ratio to sales | YoY |

Thermo-electric module | 23,266 | 43.9% | 21,360 | 30.2% | -8.2% |

Power semiconductor substrates | 20,011 | 37.7% | 36,010 | 50.9% | +80.0% |

Ferrofluid, Others | 936 | 1.8% | 1,030 | 1.5% | +10.0% |

Sensors(Ohizumi Mfg) | 8,811 | 16.6% | 12,320 | 17.4% | +39.8% |

Sales of Electronic Device Business | 53,024 | 100.0% | 70,720 | 100.0% | +33.4% |

*Unit: million yen.

Regarding power semiconductor substrates, it is forecast that DCB substrates will sell well, the sales of AMB substrates for automobiles and EVs will keep growing, and the demand for thermo-modules for telecommunications and medical care will decline. Sensors of Ohizumi Mfg. will contribute throughout the year.

【3-3 Recognition of the semiconductor market】

The demand for semiconductors is projected to be healthy in the medium/long term, but it is assumed that the demand will be stagnant in 2023 due to inventory adjustment. According to the data announced by Japan Council of WSTS, the scale of the global market is projected to decline 4.1% year on year to 556.6 million US dollars in 2023. The company expects that the market of Wafer Fab Equipment (WFE) will bottom out in 2023 and get back on a recovery track.

【3-4 Investment policy】

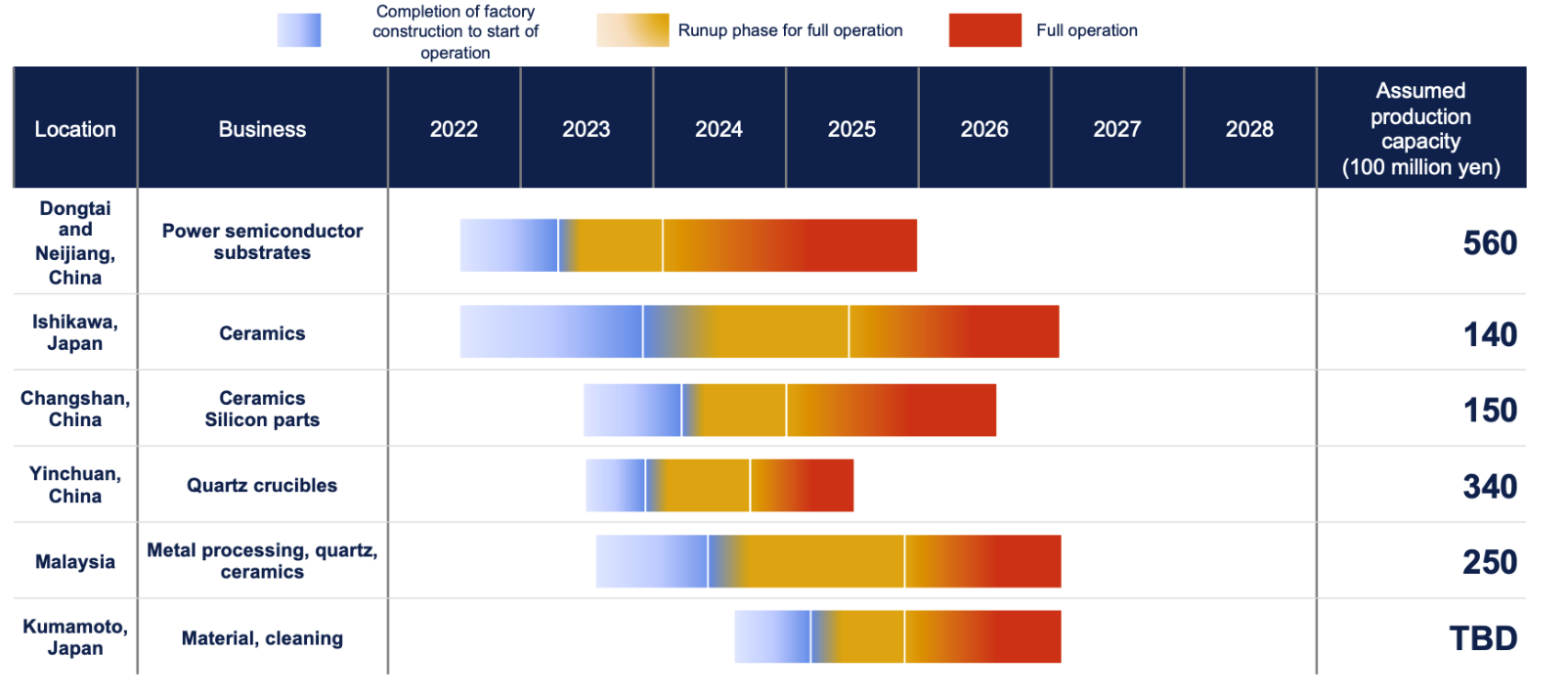

For strengthening the global production system, the company increased the investment amount from the initial plan (180 billion yen for the period from FY 3/2022 to FY 3/2024) to 195 billion yen. The company invested 35.4 billion yen in FY 3/2022 and 62.7 billion yen in FY 3/2023 for a total of 98.1 billion yen. In FY 3/2024, the company plans to invest 81.9 billion yen. Concretely, the company has increased the investment in response to the growth of demand for semiconductor materials and power semiconductor substrates, established Malaysia Plant and a new factory in Ishikawa, commenced the construction of Kumamoto Plant, acquired Toyo Knife as a 100% subsidiary, and included Ohizumi Mfg. in the scope of consolidation (capital contribution rati 51%).

For corporate growth, the company will accelerate the strengthening of the global production system, continue active investment in power semiconductors, etc. in the automobile segment, and keep discussing M&A while considering business linkage, growth potential, etc. The company has the stance of procuring funds for investment when necessary, while securing an appropriate balance between investment opportunities and their financial standing. The company raised 19.3 billion yen through the capital increase in March 2021 and 69.5 billion yen through the capital increase at a Chinese subsidiary for a total of 88.8 billion yen, and operating cash flow in the 3 years is projected to amount to 99 billion yen.

On June 7 after the disclosure of these financial results, the company resolved to issue Euro-denominated convertible corporate bonds with share acquisition rights that are worth 25 billion yen and will mature in 2028. Accordingly, the company is expected to procure funds required during the mid-term plan. The purposes of use of procured funds are as follows. (1) About 15.1 billion yen will be allocated by March 2024 as funds for construction of a factory of a Malaysian subsidiary and capital investment for robot assembly, processing of quartz products, ceramics, metal, etc. (2) About 4 billion yen will be allocated by March 2025 as funds for construction of the third factory in Ishikawa in parallel with the relocation and enlargement of Kansai Plant of Ferrotec Material Technologies and as funds for capital investment for ceramics. (3) About 2 billion yen will be allocated by March 2024 as funds for construction of a new factory in Kumamoto for manufacturing semiconductor materials and offering related services. (4) About 850 million yen will be allocated by March 2024 as funds for construction of a factory exclusively for blades in the information industry and capital investment at Toyo Knife. (5) The remaining amount after subtracting the sum of (1) to (4) will be allocated as funds for repaying corporate bonds and long-term debt by March 2024.

4.Update of the mid-term management plan

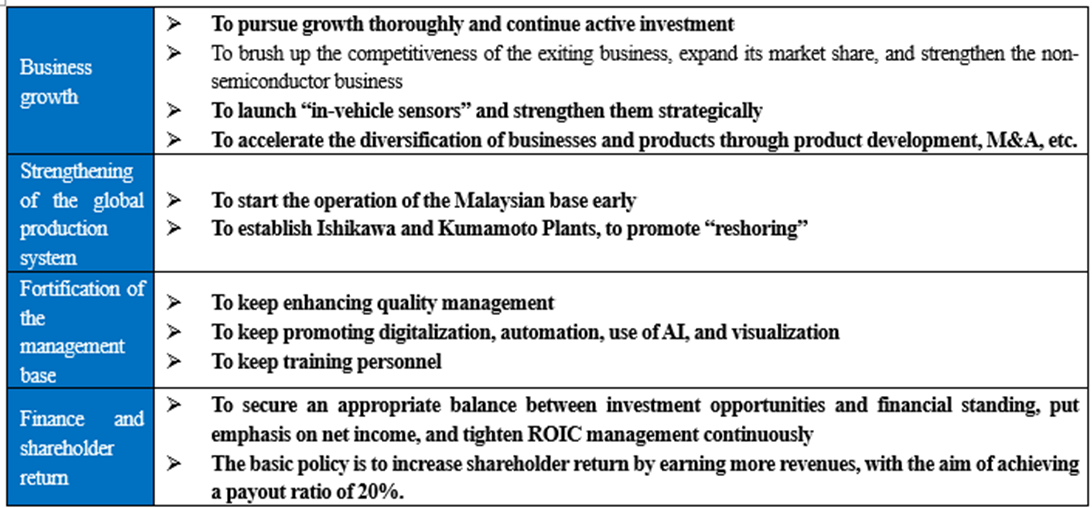

【4-1 Basic policy for the mid-term management plan】

The basic policy of pursuing corporate growth thoroughly is unchanged.

*Produced by Investment Bridge Co., Ltd. with reference to disclosed material.

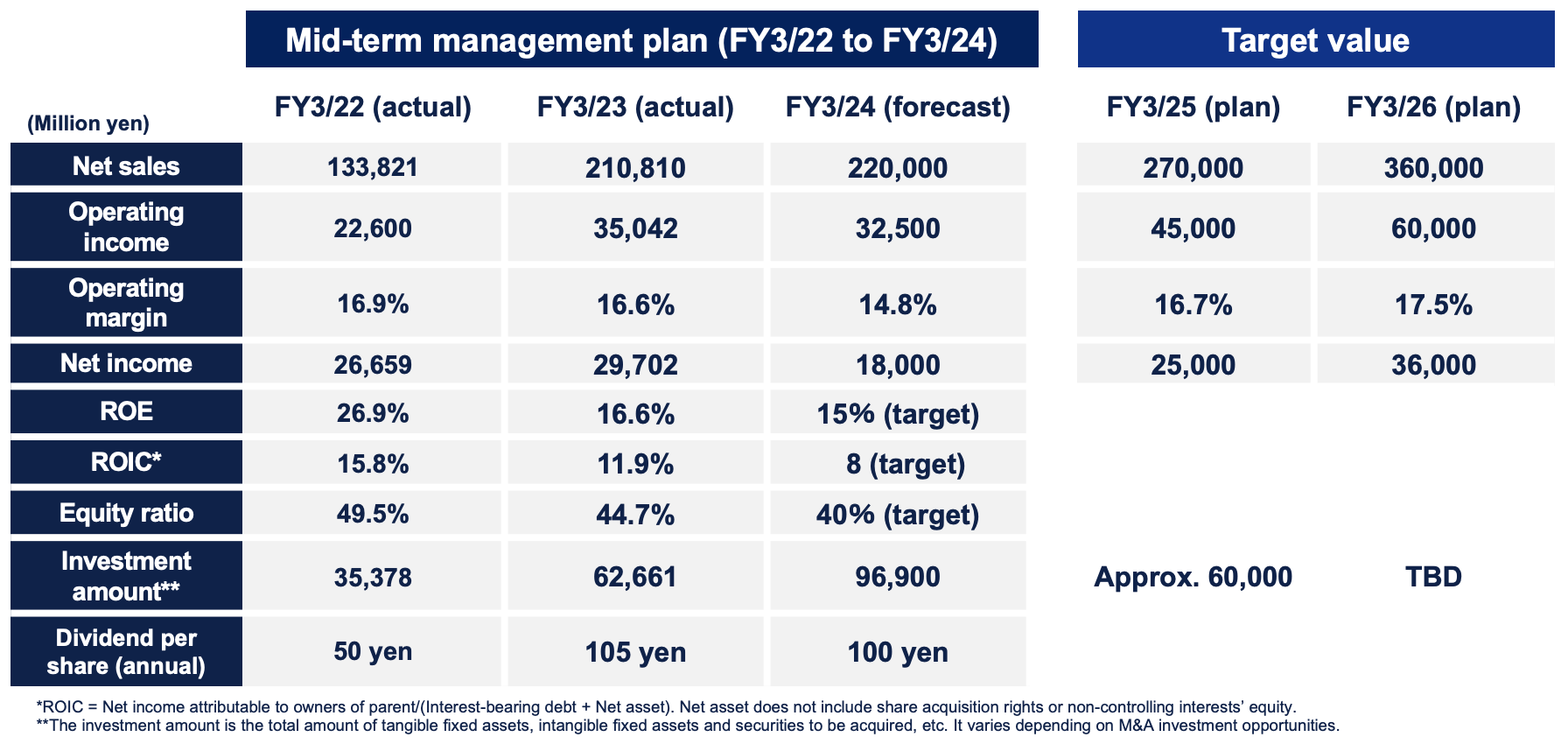

【4-2 Progress and Update of Mid-term Management Plan KPI】

(From the company’s materials)

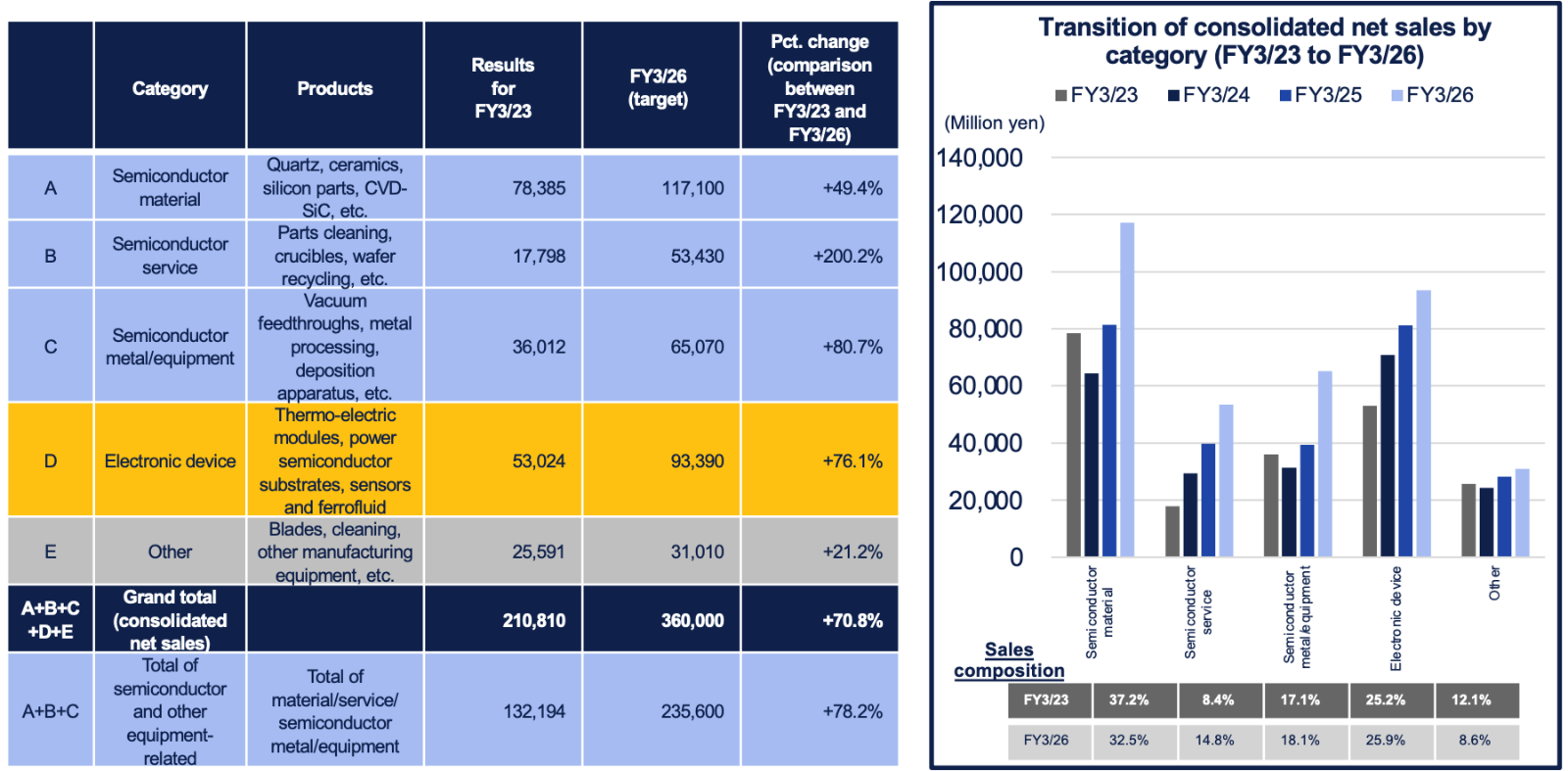

In the term ending March 2026, sales are expected to reach 360 billion yen (CAGR during the period from FY 3/2023 to FY 3/2026: 19.5%). Regarding the forecast for each segment, it is projected that the sales of the semiconductor equipment related business will increase from 132,194 million yen to 235.6 billion yen, the sales of the electronic device business will rise from 53,024 million yen to 93,390 million yen, and the sales of the other business will grow from 25,590 million yen to 31,010 million yen.

As their global production system has been enriched steadily, the company considers that if the demand in the semiconductor sector recovers, they will certainly be able to achieve the forecast sales. In the semiconductor equipment related business, the company is steadily proceeding with the enrichment, automation, etc. of the global production system, so they believe that sales will expand rapidly if demand recovers. In the electronic device business, the company is steadily increasing the output of power semiconductor substrates by establishing Sichuan Factory, and full-scale manufacturing is scheduled to be started in 2024.

【4-3 Target Sales by Category】

(From the company’s materials)

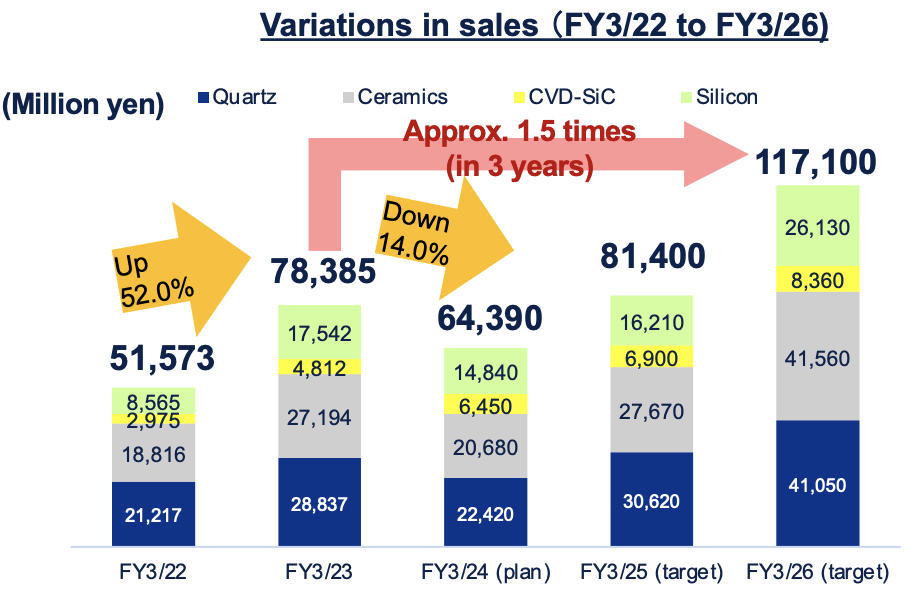

<Semiconductor material>

Sales grew 52.0% year on year in FY 3/2023 but are projected to decline 14.0% year on year in FY 3/2024.

The semiconductor market was healthy in FY 3/2023, thanks to the expansion of investment in digital technology, the demand for EVs, etc. However, most analysts forecast that the Wafer Fab Equipment (WFE) market will be stagnant in FY 3/2024, so it is assumed that the WFE market will decline in the short term. In the medium/long term, it is still expected that the market will keep growing, so the company plans to keep enhancing the production capacity for each product while predicting the market expansion from FY 3/2026. In detail, the company plans to construct new factories in Malaysia and Kumamoto for quartz, build new factories in Malaysia and Ishikawa for ceramics, upgrade the equipment in Okayama and Changshan for CVD-SiC, and upgrade the equipment in Changshan for silicon parts.

(From the company’s materials)

<Quartz crucibles>

Sales grew 85.3% year on year in FY 3/2023 and are expected to increase significantly by 4.1 times year on year in FY 3/2024. As quartz crucibles are increasingly adopted in the solar cell market and there is a remarkable trend of the increase in diameter of quartz crucibles in response to the enlargement of wafers, the company is investing for enhancing the production capacity of Yinchuan Plant.

(From the company’s materials)

<Thermo-modules>

Sales grew 31.9% year on year in FY 3/2023 but are projected to decline 8.2% year on year in FY 3/2024.

It is assumed that the sales of thermos-modules for 5G telecommunication devices, bio devices, such as PCR, and semiconductors will peak out in FY 3/2024. However, the sales are expected to grow again in FY 3/2025.

The company plans to develop multiple models of chillers, including the thermos-module (peltier) type and the compressor type, and promote sales in the fields of semiconductors, machine tools, and medical apparatus.

(From the company’s materials)

<Insulated substrates for power semiconductors>

Sales grew 2.4 times year on year in FY 3/2023 and are expected to rise 80.0% year on year in FY 3/2024.

Sales are projected to keep growing, due to the completion of a new factory in Neijiang, Sichuan, China in June 2023, and the enhancement of production capacity of Dongtai Plant. The company plans to expand the monthly output at Dongtai Plant in Shanghai from 1.1 million substrates to 1.6 million substrates for DCB substrates and from 0.2 million substrates to 0.45 million substrates for AMB substrates. As there is a global trend of curtailing power consumption, the company predicts that the demand for DCB substrates will grow further.

(From the company’s materials)

【4-4 Situation of construction of major factories and enhancement of production capacity】

(From the company’s materials)

◎Shareholder Return

The company's basic policy of increasing shareholder returns through sustained earnings growth remains unchanged, but the dividend policy is based on a dividend payout ratio of 20%, which is determined by balancing financial and investment opportunities. Under this policy, the company decided to pay a dividend of 105 yen/share (payout rati 16.3%) for FY 3/2023. The company plans to pay a dividend of 100 yen/share (payout rati 26.1%) for FY 3/2024. They mentioned that they would like to raise payout ratio to 30% in the medium term.

◎ Long-term goals

The company has not revised its numerical goals set in the long-term vision, that is, sales of 500 billion yen and a net income of 50 billion yen in FY 3/2031.

5. Summary of Q&A at the financial results briefing session

The following is a summary of the Q&A session at the financial results briefing for analysts and institutional investors held online from 16:00 on June 1, 2023 (compiled by the company's IR Office and PR Department).

(Q1) In your ambitious medium-term management plan, which business fields do you think will grow profit in the future, especially in terms of profitability? Sales of power semiconductors are also extremely well, and sales of quartz crucibles are also expected to grow at an astonishing speed. Could you list other businesses that contribute significantly to your company's profits and shareholder returns?

(A1) The metal processing and assembly field is likely to grow in the future. In the business of manufacturing units and supplying them to equipment manufacturers, the metal processing that was previously carried out in Hangzhou will be expanded to Changshan and Malaysia. I think we can expect considerable growth in this field. The CVD-SiC products are starting to have various uses. Okayama Plant will sell as much as it produces, and I think sales for this fiscal year will be around 6 billion yen to 7 billion yen. We would like to aim for around 10 billion yen in the next fiscal year. Our company also plans to launch a CVD-SiC factory in China this year. The use of CVD-SiC products has increased considerably in China as well. There is also demand for CVD-SiC in places that make polycrystals and materials and hot zones (of pulling equipment). Most of the equipment manufacturers in China are our customers, so we can expect considerable growth. Our company has worked in various fields, and I think we have finally reached a point where we can flourish.

(Q2) Regarding the demand for power semiconductors, it seems that demand in China is increasing. How many requests have you received? China produces about 30 million vehicles a year, and I think that the procurement of EVs (electric vehicles) from Chinese manufacturers to European and Japanese companies is accelerating. How much demand will there be in a few years? Give us an overview from the perspective of a five-year span.

(A2) Europe is the largest market for power semiconductor substrates, and European companies involved in power semiconductors are growing rapidly. In the Chinese market as well, about 9 million EVs will be sold this year, and one in three cars will be an EV; therefore, they will use IGBTs. In addition to EVs, it is also used extensively in Shinkansen (bullet trains), aviation, and medical equipment. The briefing materials stated that the sales target is 35 billion yen in the fiscal year ending March 2026, which is conservative. In the future, we will also possess the ability to manufacture IGBTs from substrates (raw materials), and we have our own research institute. Based on our current outlook, we believe that the scale of the power semiconductor substrate business will reach around 100 billion yen in 2030.

(Q2-2) What will the operating income of the power semiconductor substrate business when it reaches 100 billion yen be?

(A2-2:) Currently, our profit margin is around 15%, but we would like to bring it up to around 20%.

(Q3) Regarding capital investment funds, there is an explanation of the fund procurement results in the document, and most of the investment amount is covered by the total operating cash flow for the three years and the funds raised. The difference is small, and since investments are assumed to be around 60 billion yen in the next fiscal year as well, could you tell us about your thoughts on fund procurement? I would like to confirm them as stock price fell two years ago due to a public offering.

(A3) Our approach to fund procurement has always been to ensure an appropriate balance between investment opportunities and financial conditions, and this has not changed. In the past, there was a time when the reliance on interest-bearing debt was high, but now our operations are balanced. We plan to invest more proactively through our current medium-term management plan, and our target is 195 billion yen in investments. This is because we were able to procure capital at a relatively good valuation through a capital increase in a subsidiary, and we intend to procure funds while maintaining our balance in this way.

(Q3-2) There has been share dilution in the past, but do you think that Ferrotec Holdings shareholders will not be affected by dilution in the future? I'm trying to say that there has been some wariness of another dilution happening like the public offering at the end of 2021. The company has a tremendous growth scenario, and even if you consider the expansion of production capacity for power semiconductor substrates and semiconductor materials and the size of commercialization, the company is likely to grow significantly in terms of sales and profits. The company earnings are safe, but from the shareholders' point of view, there is much anxiety. If stock price drops by 20% in a month due to dilution through the capital increase, operational managers may lose their jobs, so it is difficult for long-term investors to consider investing in your company. I would like to hear your thoughts on this matter.

(A3-2) I will avoid talking about the future. We are currently actively investing, maintaining our financial position, and conducting our operations while balancing several factors. We will continue to manage our financial affairs while paying attention to maintaining an appropriate balance.

(Q4) I would like you to summarize and explain your approach to payout ratio.

(A4) We strongly intend to actively invest and continuously increase earnings. This is our basic policy, along with strengthening shareholder returns. Our recognition of the importance of enhancing shareholder returns is evident through the briefing materials, which show our comprehensive decision to set dividend payout ratio at the 20% level. We did not mechanically calculate the dividend for FY 3/2023 and FY 3/2024 at 20% of net income. Dividend payout ratio will be 26% in FY 3/2024. We made a comprehensive decision, taking into consideration factors such as the prospect of significant growth in the next fiscal year ending March 2025.

(Q5) You are actively investing in quartz crucibles for solar cells, and it is said that the business scale will reach 60 billion yen; how much profit will you make when it reaches that scale? As for solar cells, you have experienced some bad results in the past, so please explain your thoughts on this project.

(A5) Regarding solar cells, as you mentioned, in 2011, the bubble burst in the solar cell market, and we were hit hard. We are well aware of it, but the situation is completely different now than it was in 2011. If we want to be CO2-free, we will not be able to achieve these goals by 2050 unless we produce more and more green energy sources such as solar power, hydroelectric power, and wind power. In general, Chinese companies tend to go too far, but this time we are a little cautious about our approach to the solar panel business. For one, investment in quartz crucibles is small compared to sales. The reason is that there is a large technical barrier. In the case of high-quality quartz crucibles, firstly, they can be used for a long time. Conventionally, it had a life span of 200 hours, and now 300 hours is the standard, but we can manufacture quartz crucibles that can be used for up to 500 hours. Secondly, bubbles related to ingot quality do not emerge even after long-term use. Thirdly, single crystallization can be smoothly performed when the ingot is pulled. In addition, there are various technical elements such as oxygen concentration and resistance value, but our company has maintained very high quality in these aspects as well. We believe that sales of 60 billion yen are possible this time, even if the price does not stay at the current level and there is a gradual decline in it. In the PV wafer business, we only deal with n-type OEMs. This does not mean that we will make our own products and aggressively enter the market. We will limit our partners to two major global companies. From time to time, a Chinese company asks us for n-type wafers. The size of the wafers was 160 mm at first and 180 mm now, and we will make 210-mm wafers and intend to increase the size to 230 mm and 260 mm in the future. We work closely with our OEM partners and ask them to ensure that our products generate sales. Therefore, we do not plan to actively enter the market for PV wafers. Now (compared to the past), the scale is completely different. When our company was engaged in the business, 1 GW was considered a large capacity, but now 20 GW is normal, and the large size is 50 GW, so we cannot compete.

(Q6) In the semiconductor equipment-related segment, I understand that earnings will grow from next year due to the market recovery and your company enhancing production bases and increasing your share among customers. As you mentioned earlier about metal processing, is it correct to understand that income per unit delivered will increase? Also, please tell us about the status of your work with local equipment manufacturers in China.

(A6) This fiscal year will be the toughest for the semiconductor equipment-related business, and we are working hard to overcome this year. As for what the market will look like in the first half of next year, there are various views about this, but it depends on the trends of US policy and strategies. There is an assumption that the global semiconductor market will grow significantly, but if we exclude Chinese semiconductors from the global market, it seems difficult to realize such a significant growth. In that sense, we believe that the development of the Chinese semiconductor market will affect our semiconductor business. The metal processing and assembly business I mentioned earlier supplies products to equipment manufacturers. Still, if we start our business in Malaysia, it will be easy to export products to the two major US companies and three Japanese companies, and tariffs will be low. Local equipment manufacturers in China are currently rushing to develop new products, and their business is growing considerably. It is considered that they will overcome the current situation in three to five years. However, China has a shortage of resources, and we believe that it will take some time to resolve this issue. If local Chinese equipment manufacturers grow, our business will also expand. We believe that local sales in China will account for about 30% to 40% of the segment.

(Q6-2) What is the situation of local device makers in China?

(A6-2) Regarding device makers, the U.S. has said that it will impose sanctions on all companies that manufacture devices of 14 nm or less. Some companies are suffering, some had the sanctions relaxed, and some companies are not subject to sanctions. We are starting to view the situation a little optimistically and think it is nice having a market size where products with dimensions over 14 nm account for 80%, even if we do not manufacture products of 14 nm or less (currently subject to U.S. sanctions).

(Q6-3) So, do you think products over 14 nm will be more commercially viable?

(A6-3) That's how I see it.

(Q7) Regarding quartz crucibles, it is said that major solar panel manufacturers in China have recently reduced prices by about 30%. How will this affect your business performance?

(A7) There are companies that can manufacture quartz crucibles, but there are two barriers. One is the technical barrier. It is not technically easy to make a good quality quartz crucible. Another one is the procurement of the powder, which is not easily acquired, making it a barrier to entry for general companies. We do not intend to maintain the current price. Even if the price drops a little, we are confident that we can handle it because we have been in the quartz crucible business for a long time and have continued to make efforts such as automation, visualization, and streamlining.

(Q8) I would like to confirm the accounting for depreciation and subsidies. At the previous briefing session, it was said that the subsidy from China is about 20% and that there is a cash benefit. I would like to know your views on accounting and cash flow. Also, your company's depreciation costs seem small (compared to the investment). For example, is there a case where the amount of assets offsets subsidies?

(A8) Subsidies can be accounted for as non-operating income or reduced entry for equipment (offset with assets). (Supplementary note: Reduced entry can also be used as an accounting method, but in the fiscal year ending March 2023, it is mainly recorded as non-operating income or recorded as fixed liabilities.) The depreciation is on the rise due to the current aggressive investment and is expected to increase from 8 billion yen in the fiscal year ended March 2022 to 17.4 billion yen in the fiscal year ending March 2024 and exceed 30 billion yen in the fiscal year ending March 2025.

6. Conclusion

Since the end of 2021, the semiconductor market has been declining, and inventory adjustment is projected to be continued this term, too. Even under this environment, it is hard to imagine that the trend of shift to green energy will change, and it can be assumed that the semiconductor market will start growing again in the medium/long term. Under such assumption, the company continues active investment without being swayed by near-term trends. Rather than conducting speculative investment, the company procures funds when necessary while securing a good balance between investment opportunities and their financial standing and makes management decisions while considering shareholder return. We should keep an eye on such management decisions.

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with auditors |

Directors | 9 directors, including outside ones 3 |

Auditors | 4 directors, including outside ones 2 |

◎ Corporate Governance Report(Updated on July 20, 2022)

Basic policy

While pursuing our corporate principles: “Strong commitment to our customers,” “Excellence in engineering precision solutions,” and “Delivering superior quality, value and service,” our corporate group has drawn up a code of conduct as follows: From a global perspective, Ferrotec always operates in harmony with the international community and acts in good faith with unwavering corporate ethics and social decency, as well as in compliance with the laws of each country as a company that provides products and services that contribute to everyday life of the people all over the world who are related to us; Ferrotec earns customer trust and satisfies our customers by proposing high-quality products and services and providing cost-competitive products and services mainly in the new energy and electronics industries; Considering proactive eco-friendly activities to be one of our high-profile business issues, Ferrotec contributes to solving global environmental problems by adapting ourselves to the requirements of the latest environmental regulations one by one and developing materials and products that can be used in the new energy industry; and Ferrotec contributes to society through manufacturing based on our core technology, continues to be a company whose stakeholders, including customers, shareholders, employees, business partners, and local communities, are looking forward to seeing it grow, and engages in business activities based on social decency, such as laws, social order, and international rules.

Our company not only proactively promotes environmental preservation activities and our corporate group’s governance pursuant to the aforementioned corporate principles and code of conduct, but also strives to continue being a company whose stakeholders look forward to its growth. We have also formulated a quality philosophy saying that we focus on developing new materials and production technologies, such as semiconductor materials, and pursue customer satisfaction improvement by giving top priority to quality, and are moving forward with automation, digitalization, and standardization of our production processes. Our basic business policies are to increase our share in the global market and form a corporate group with a stable profit structure.

Based on the above corporate principles, code of conduct, and basic management policy, the company considers that it is important to improve its corporate value, emphasize the soundness of its business administration to become an enterprise that will be trusted and supported by stakeholders, including shareholders, customers, business partners, and local communities, and also establish a managerial system responding the rapid changes to the business environment swiftly and accurately.

<Main Reasons for Non-compliance with the Principles of the Corporate Governance Code>

<Supplementary Principle 2-4-1: Ensuring diversity in promotion to core human resources>

While our business is expanding on a global basis, our corporate group drastically strengthens our human resources and organization, and proactively employs women, foreign nationals, and mid-career workers with extensive skills and experience to raise our corporate value in the medium/long term. In addition, we actively promote women, foreign nationals, and mid-career hires to managerial positions by comprehensively considering and evaluating such factors as their skills and valuable experience cultivated in companies outside of our corporate group.

We, however, have not disclosed our medium- and long-term policies on promoting women, foreign nationals, and mid-career hires to managerial positions and ensuring diversity, policies on human resources development, policies on internal environment development, and our progress and achievement in this regard.

We will hold diligent discussion as to formulation of these policies and disclosure of our progress to contribute to medium- and long-term improvement in our corporate value according to our global business expansion.

<Supplementary Principle 3-1-3: Disclosure of initiatives on sustainability and business strategies, such as investment in human capital and intellectual property>Following our corporate principles: “Strong commitment to our customers, excellence in engineering precision solutions, and delivering superior quality, value and service,” our company has framed a basic policy on materiality and sustainability in 2021 because we consider ESG (Environment, Social, and Governance) to be extremely important for medium- and long-term improvement of our corporate value. We will build an organizational structure, enlighten our employees, and set quantitative goals for promoting ESG. Regarding investment in human capital and intellectual property, our Japanese subsidiaries proactively promote young employees to the position of executive officer and flatten their organizations. Meanwhile, our Chinese subsidiaries actively invest in intellectual property by, as necessary, founding research institutes related to semiconductors, employ a greater number of human resources who have degrees equivalent to doctor’s degrees, and granting their employees awards and rewards for superb patent applications. We will monitor quantitative goals that we set and announce our progress with them via our website, IR material, and other means.

<Supplementary Principle 4-2 (1): Objective and transparent management remuneration system>

Given that it is the mission of directors to continuously improve corporate value through corporate activities, the basic policy to establish a remuneration system for directors that can increase their incentives to improve their short-term and medium- to long-term performance was resolved by the Board of Directors held on March 22, 2021. The system consists of three types of remuneration: fixed remuneration, performance-based remuneration linked to consolidated net income (index), and restricted stock remuneration as a medium/long-term incentive. Outside directors can only receive fixed remuneration.

To ensure fairness and transparency, the company has set up a remuneration committee with outside officers as the majority of the members. Through this committee, the company has set medium/long-term remuneration percentages, such as the introduction of restricted stock remuneration as well as the target percentages for fixed remuneration and variable remuneration to achieve sustainable growth. The President and CEO, whom the Board of Directors has entrusted with determining the amount of remuneration for each director, decides the amounts of remuneration upon convening the remuneration committee, consulting with its members, and respecting the committee's recommendations.

However, the ratio of cash remuneration to treasury stock remuneration in the consolidated remuneration has not been set appropriately, and the company, centered on the compensation committee, which is dominated by outside directors, is intensively studying the matter while referring to the opinions of external remuneration consultants as appropriate.

<Main Disclosure Based on the Principles of the Corporate Governance Code>

<Principle 2-3: Issues related to sustainability, mainly social and environmental issues>

The semiconductor manufacturing process has a significant environmental load, and solving this is a challenge for the entire industry. The company sell products such as thermo-electric modules, which are CFC-free temperature control devices, and power semiconductor substrates and ferrofluids that effectively reduce power consumption. The company also rely on clean energy, using solar panels in power generation at our plants in Japan and China. Thus, our business activities contribute to reducing greenhouse gases, leading to environmental pollution reduction. Moreover, the number of university students in financial distress is increasing due to the COVID-19 crisis. Therefore, the company support the Akira Yamamura Scholarship Foundation, which provides scholarships to engineering students to develop talented human resources who can contribute to society in the future.

<Principle 2-4: Ensuring diversity, including active participation of women>

Believing that working with employees who have different experiences and senses of values within a company is an advantage in ensuring sustainable business growth especially when companies operate globally like our company, we endeavor to ensure diversity, including active participation of women, based on our policy of entrusting each of our local subsidiaries with management of their own companies.

<Supplementary Principle 4-11-1: View on the balance between the knowledge, experience, and skills of the board of directors as a whole, and on diversity and appropriate board size>

Our company’s Board of Directors believes that a board of directors needs to be composed of directors with diverse perspectives and experience, and diverse and advanced skills for supervision of business execution and important decision-making. It also thinks that our auditors need to possess diversity and superior skills like the directors because they are obliged to attend board meetings and give their opinions as required. With regard to outside executives, we believe that we need outside directors who have voting rights in board meetings, in addition to outside statutory auditors, and it is essential that both the auditors and directors are highly independent so that a double check function, which consists of supervision by the Board of Directors and audits by the auditors, can work properly.

We have posted a skill matrix, a list of such elements as the knowledge, experience, and skills of each of our directors and auditors, on our website: (https://www.ferrotec.co.jp/esg/sdgs.php)

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |